By Gita Bhatt

Nearly a century ago, Joseph Schumpeter wrote, “The spirit of a people, its cultural level, its social structure…all this and more is written in its fiscal history…. The public finances are one of the best starting points for an investigation of society.”

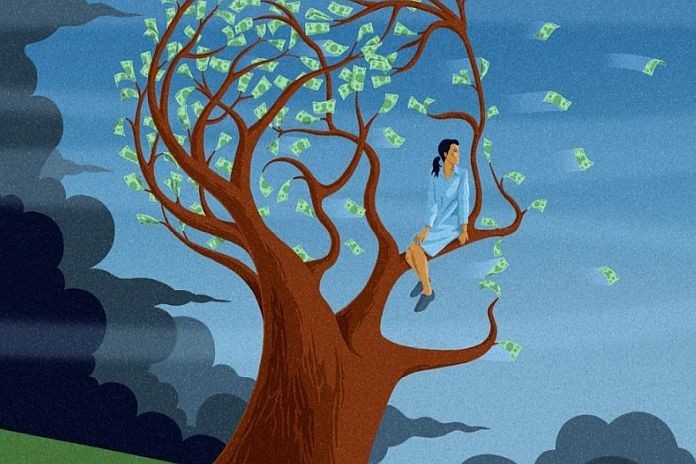

The innovative fiscal responses to the pandemic’s economic fallout bear him out. The power and agility of fiscal policy were far beyond what was previously thought possible. Governments channeled cash directly to households and businesses to save jobs and livelihoods. As the IMF’s Vitor Gaspar notes, these actions demonstrated government’s “special role in protecting the vulnerable when things go wrong.” But now, the bill is coming due. Governments face the tricky task of reducing unprecedented debt to more sustainable levels while ensuring continued support for health systems and the most vulnerable.

In this issue of Finance & Development, contributors examine how fiscal policy can be retooled for the post-pandemic world to deliver public value and a balanced economy for all.

But we still have to keep an eye on debt. “When does the level of debt become unsafe?” asks Olivier Blanchard. He rejects simple fiscal rules and says policymakers must consider tough questions on the interplay of such variables as the outlook for interest rates, economic growth, and political stability. For Arminio Fraga, the old numerical thresholds for debt and deficits only made sense in an era of unusually low interest rates that can’t be counted on to last. Still, new fiscal rules are needed, he argues. Amid the post-pandemic inflationary spurt, Ricardo Reis warns that price stability matters more than ever if debts are to stay sustainable.

Debt transparency is essential. In emerging market and developing economies, ever vulnerable to debt crises and rising interest rates, Ceyla Pazarbasioglu and Carmen M. Reinhart urge governments to make a complete accounting of hidden debts, both public and private, to sustain growth and avoid the risk of default.

Social questions matter, too. Emmanuel Saez defends the need for an expansive welfare state. Paolo Mauro argues that policymakers can muster broader support if they consider the full range of moral perspectives on public finance. Other contributors reflect on fiscal balancing acts to address inequality—including through progressive taxes and spending aimed at universal access to health and education—and support the green transition.

How are some countries using fiscal policy to meet a changing world head on? Case studies from Belize, Colombia, and Ghana showcase efforts to align fiscal policies with efforts to limit climate change, increase tax transparency, and harness digitalization for more effective revenue collection. And as our “In the Trenches” interview with Cina Lawson, minister of digital economy and transformation in West Africa’s Togo shows, even small, developing nations are surpassing advanced economies when it comes to innovative fiscal policies to help people in need.

Policymakers face myriad uncertainties, including rapid changes in the geopolitical environment, and difficult trade-offs. They must prepare to adjust priorities to create economies that are fairer, more inclusive, and sustainable. After all, how a society manages its fiscal affairs decides the fate of the nation and the well-being of its people.

![]()