- Independence is critical to winning the fight against inflation and achieving stable long-term economic growth, but policymakers risk facing pressure amid a wave of elections this year

Central bankers today face many challenges to their independence. Calls are growing for interest-rate cuts, even if premature, and are likely to intensify as half the world’s population votes this year. Risks of political interference in banks’ decision-making and personnel appointments are rising. Governments and central bankers must resist these pressures.

But why does this matter? Just consider what independent central banks have achieved in recent years. Central bankers steered effectively through the pandemic, unleashing aggressive monetary easing that helped prevent a global financial meltdown and speed recovery.

As the focus shifted to restoring price stability, central bankers appropriately tightened monetary policy – albeit on different timelines. Their response helped to keep inflation expectations anchored in most countries even as price increases reached multi-decade highs. Emerging markets were leaders in tightening early and forcefully, enhancing their credibility.

These central bank actions have brought inflation down to much more manageable levels and reduced the risks of a hard landing. While the battle isn’t yet over, their success thus far has largely been because of the independence and credibility that many central banks have built up in recent decades.

The recent success in bringing down inflation contrasts sharply to the economic instability that prevailed during the high inflation period of the 1970s. Back then, central banks didn’t have clear mandates to prioritize price stability, or clear laws protecting their autonomy. As a result, they were often pressured by politicians to lower interest rates when inflation was high.

Everyone was hurt by this high inflation, boom and bust era – especially people living on fixed incomes who saw their real incomes and savings eroded. Success in reducing inflation only came in the mid-1980s when central banks were given political support to aggressively fight inflation.

Measuring impact

Extensive research, including our own, demonstrates the critical importance of central bank independence.

One IMF study, looking at dozens of central banks from 2007 to 2021, shows that those with strong independence scores were more successful in keeping people’s inflation expectations in check, which helps keep inflation low. Independence is critical, and has become more predominant among countries at every income level.

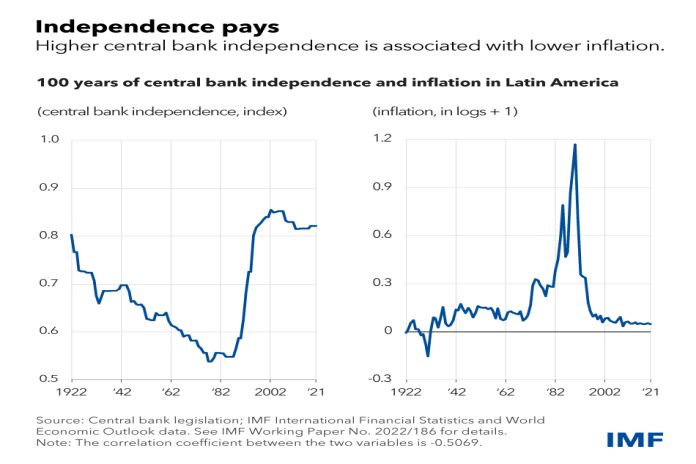

Another IMF study tracking 17 Latin American central banks over the past 100 years examines factors including decision-making independence, clarity of mandate, and whether they could be forced to lend to the government. It also found that greater independence was associated with much better inflation outcomes.

The bottom line is clear: central bank independence matters for price stability – and price stability matters for consistent long-term growth.

But to wield enormous power in democratic societies, trust is key. Central banks must earn that trust every day through strong governance, transparency, and accountability, and delivering on core responsibilities.

Strong governance helps ensure that monetary policy is predictable and based on achieving mandated long-term goals, rather than short-term political gains. It starts with a clear legislative mandate that sets price stability as the main objective.

Even if employment is put on the same pedestal as with the US Federal Reserve’s dual mandate legislators have recognized that price stability aids macroeconomic stability, which ultimately supports employment.

Strong governance and independence mean central bankers should have control of their budgets and personnel, and not be subject to easy dismissal based on their policy views or actions taken within the legal mandate.

In exchange, they must be accountable, and they should be transparent.

They should regularly explain how their actions seek to advance their legislatively mandated goals, both in detailed reports and through testimony before lawmakers. Because central bank decisions profoundly affect everyone, central banks and governments should continue working to raise economic literacy so the people can be part of the policy conversation.

And trust ultimately depends on their success in delivering price stability, and ensuring the financial system remains stable.

Respecting independence

Other branches of government have clear responsibilities in helping central bankers achieve their mandated objectives and navigate hazards ahead. This includes not only laws proclaiming independence, but also following the letter and spirit of such laws.

It also means taking into account how other policy actions impact the job of central bankers.

Enacting prudent fiscal policies that keep debt sustainable helps to reduce the risk of “fiscal dominance” – pressure on the central bank to provide low-cost financing to the government, which ultimately stokes inflation. Fiscal prudence also provides more budget space to support the economy when needed, bolstering economic stability.

Another government responsibility that is often shared with central banks:maintaining a strong and well-regulated financial system.

Financial stability benefits the whole economy and reduces the risk that the central bank becomes reluctant to raise interest rates for fear of causing a financial meltdown. Actions to strengthen financial institutions since the global financial crisis, including in emerging markets, allowed central banks to raise rates sharply without undermining the financial system. This major achievement must be preserved.

When central banks and governments each play their roles, we have seen better control of inflation, better outcomes in growth and employment, and lower financial stability risks.

The IMF is here to help policymakers face these challenges. We strongly support central bank independence, providing tailored technical assistance to members working to improve governance and legal frameworks. We make independence an explicit pillar in some Fund-supported financing programs, agreeing with members on actions to measure and achieve it.

To strengthen this work, we introduced a new way to measure independence based on which aspects of it matter most, according to our recent survey of central banks.

And to increase accountability, we have developed a transparency code that helps central banks assess and improve their practices.

By working together – central bankers and government leaders, legislatures, and the people – we can preserve and strengthen central banks to win the fight against inflation today and foster economic stability and growth for years to come.

This will benefit everyone, the retiree living on a fixed income; the small entrepreneur trying to build her business; and every society that could face unrest when inflation gets out of control.

With such high stakes, we must preserve and strengthen central bank independence.

![]()