By Gerd Schwartz, Manal Fouad, Torben Hansen, and Geneviève Verdier

COVID-19 has had a profound impact on people, firms, and economies all over the world. While countries have ramped up public lifelines to individuals and firms they will face enormous challenges to recover from the pandemic, amidst low economic activity and unprecedented levels of debt.

Public infrastructure investment will play a key role in the recovery. But with resources tight, governments need to spend taxpayer money wisely on the right projects. For this, countries need good infrastructure governance—strong institutions and frameworks to plan, allocate, and implement quality public infrastructure.

Our new book addresses how countries can design good infrastructure governance. All too often, public investment results in expensive and poor-quality infrastructure with limited benefits for people and the economy. It tends to involve projects that are large, long-term, and complex—all fertile ground for corruption, delays, and cost overruns. Strong infrastructure governance is key to cutting this waste.

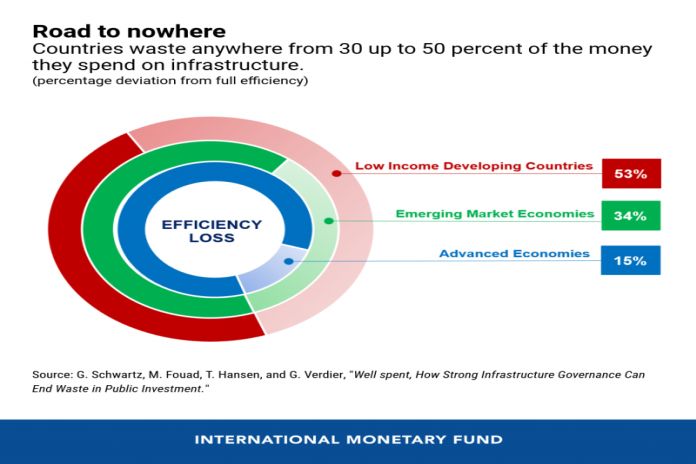

Our analysis shows that, on average, countries waste about 1/3 of their infrastructure spending due to inefficiencies. The loss can surpass a staggering 50 percent in low-income countries. Unlocking this potential should play an important role as countries recover from the pandemic. The good news is that efficiency losses and wasteful spending in infrastructure are not inevitable. Our estimates show that over half of these losses could be made up through better infrastructure governance.

A bridge to the future

The economic recovery from COVID-19 presents a unique opportunity for countries to build a bridge to the future through well-designed and well-implemented public infrastructure.

Done right, public investment to stimulate weak aggregate demand can help boost more inclusive growth, reduce inequalities, and create economic opportunities for all. Investment in health systems, digital and environmentally-conscious infrastructure can improve people’s lives, connect markets, and improve the resilience of countries to climate change and future pandemics. Countries will also need to increase public investment to attain the Sustainable Development Goals (SDGs), while advanced economies need to tackle aging infrastructure like roads, bridges, and healthcare systems.

But every dollar spent has to count, and when spending more on infrastructure, countries also need to spend better and smarter to get the most bang for the buck.

Drawing on the Fund’s analytical and capacity development work, including the Public Investment Management Assessments carried out in more than 60 countries, our book provides a roadmap for countries to move from “aspiration to action” to achieve quality infrastructure outcomes and reap the full economic and social dividends from public investment.

The book highlights the foundation of strong infrastructure governance and includes innovative practices in key areas. We give examples on how to control corruption in infrastructure projects, how to mitigate and manage fiscal risks, integrate planning and budgeting, and adopt sound practices early in the public investment cycle, as well as during project appraisal and selection, an area in which many countries tend to fall short.

Chile, for example, has developed a comprehensive infrastructure governance system that has generated cost-savings. And in Korea, a national one-stop-shop for public procurement has brought improvements in the transparency and integrity of the public procurement system.

The book also covers emerging areas in infrastructure governance such as the importance of maintaining and managing public infrastructure assets and building resilience against climate change. South Africa, for example, has established guidelines and standards for the maintenance of public infrastructure to avoid deterioration in the value of public assets like roads and bridges.

The book underscores how infrastructure governance institutions tend to look better on paper than in practice. This points to the importance of not only having well-designed frameworks but also focusing on how well they function in practice.

The overall message is simple: countries can end waste in public investment and create quality infrastructure with specific actions to improve infrastructure governance. To rebuild economies in the wake of the COVID-19 pandemic, this will be more important than ever.

The October 2020 Fiscal Monitor will include more of the IMF’s analysis and policy advice on how countries can best invest in infrastructure to build a sustainable economy and recovery.