By Caribbean News Global contributor

CASTRIES, St Lucia, (CNG Business) – The Office of Prime Minister Philip J. Pierre, on Monday, January, 22, 2024, issued a statement that claims the concept of proper disclosure, ‘Historic tax amnesty, millions in tax exemption for all St Lucians,’ but according to the science, these tax amnesty gimmicks are trading tax schemes.

For “clarity” and “style” this would mean ALL 180K Saint Lucians. But this is not the case. And really, these amnesty schemes don’t work.

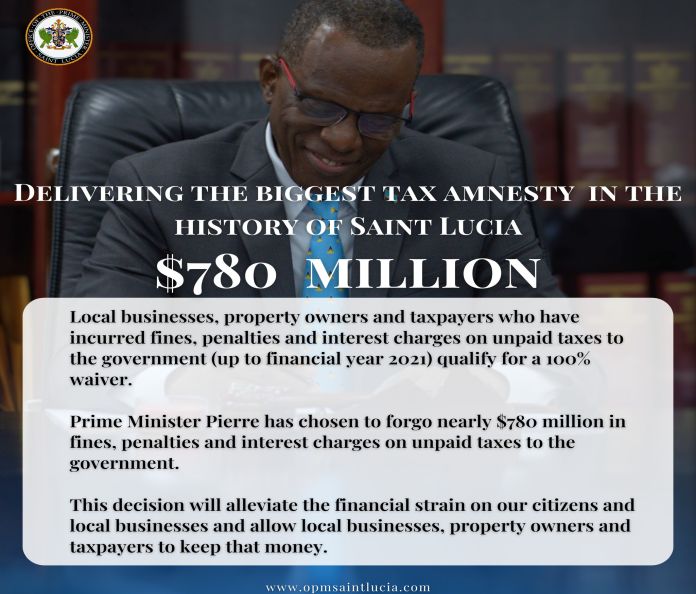

“Prime Minister Philip J. Pierre has initiated the biggest tax amnesty programme in the history of Saint Lucia,” the OPM said. “Local businesses, property owners and taxpayers who have incurred fines, penalties and interest charges on unpaid taxes to the government (up to financial year 2021) qualify for a 100 percent waiver.”

At present, there are disparities and disadvantages to law-abiding citizens who have paid their fair share of taxes, while some have simply defaulted, and others just cannot pay for economic reasons.

Saint Lucia’s tax policy must be made clear and firm in law enforcement.

The current policy of the government on taxes is heading in the wrong direction, picking winners and losers, who can now say: Why pay taxes, if the government is soft on applying the law, and if luck is on [my] side, that [my] government is in power, why bother?

The phenomenon is not unique. History can account for plenty of stories, while a secondary proposition is reasonable.

Owing to the ineffective and inadequacy of tax collection and reporting in Saint Lucia, others can simply lobby for another amnesty to solve the problem, considering, Saint Lucia’s forgiving government: One who gives and takes back more: Part 1.

St Lucia’s forgiving government: One who gives and takes back more: Part 1

But wait, there’s another. Prime Minister Pierre, recently distanced himself from the ‘Draft Tax Administration and Procedure Act’ without giving recourse on the next step.

St Lucia PM distances himself from ‘Draft Tax Administration and Procedure Act’

That said, one can speculate Saint Lucia must have discovered minerals and economic prosperity as per the OPM, Monday, January 15, 2024 statement that “point to continued economic gains for Saint Lucia in 2024” and that “They all project positive GDP growth.”

St Lucia pivots ‘continued economic gains in 2024’, says OPM: The figures are indifferent

The OPM’s stance on the economy in calculating giveaways and pardons appears to be philanthropic. This supports the case that the economy is not performing and validates the premise to be published in Saint Lucia’s forgiving government: One who gives and takes back more: Part 2.

Dividing the country along tax lines is crafted to claim outright political garble intended to not give answers without a magnifying glass to comprehend economic, social, and everyday issues that stifle the country.

The OPM statement continued: “Prime Minister Pierre has chosen to forgo nearly $780 million in fines, penalties and interest charges on unpaid taxes to the government. This decision will alleviate the financial strain on our citizens and local businesses and allow local businesses, property owners and taxpayers to keep that money.”

With a keen eye on social and law enforcement deterioration, related violence and tensions, Caribbean News Global (CNG) published the articles ‘Castries should be designated an ‘escalated crime area’ and ‘St Lucia needs to crack down on economic crimes and record homicides’. Saint Lucia has recorded seven homicides as of January 21, 2024, in Castries and the northern section of the island.

Given this tax amnesty scheme, economic hardships, the effects of inflation in Saint Lucia, and declining job prospects, taxpayers’ behaviour is not likely to change. Increasing the size of the economy is also not practical. The size and influence of the underground/criminal enterprise will expand.

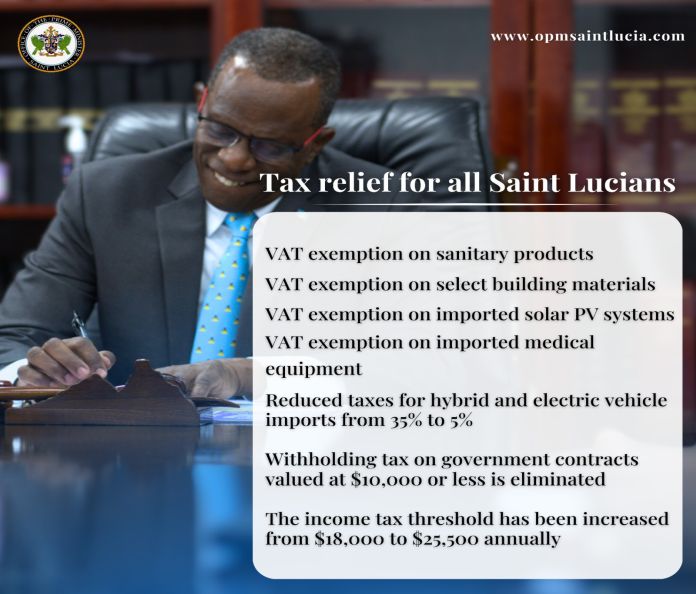

Among several attempts to revitalize the economy, Prime Minister Pierre has “activated several tax exemption programmes to give everyday Saint Lucians a fighting chance against inflation,” listed the OPM:

- VAT exemption on sanitary products (price-controlled)

- VAT exemption on select building materials

- VAT exemption on imported solar PV systems

- VAT exemption on imported medical equipment

- Reduced the taxes on hybrid and electric vehicle imports from 35 percent to 5 percent.

On July 11, 2023, Prime Minister Pierre, tabled a resolution in parliament, to provide additional economic relief to the public and spur economic development by the removal of Value Added Tax (VAT) on select building materials.

St Lucia legislates selective 12.5 percent VAT reduction for two years

Caribbean News Global (CNG) article, ‘St Lucia legislates selective 12.5 percent VAT reduction for two years’ explained:

First …

“Dr Kenny Anthony explained as published, Thursday, August 23, 2012: “The government of Saint Lucia is forgoing over EC$45 million in revenue to execute the construction stimulus which will bolster the economy and empower citizens to build.”

Second …

“In the ethos of “putting people first” VAT or no VAT, requires money and ‘money supply’. If salaries remain stagnant and money stock remains affected, by inflation, goods and services are likely to remain unchanged. And thus, without people and commerce, there is no economy.”

Throwing into action that life can change overnight, the OPM advised, on Monday, that “the social and economic needs of everyday Saint Lucians will always influence the policy decisions taken by Prime Minister Pierre and the cabinet of ministers.”

Setting up some important solutions to commit to an economic plan, the OPM stated: “Thanks to tax reforms introduced by the Prime Minister, low-income earners and government contractors have more breathing room.”

Focusing on the way forward, solutions and concepts as the economic forecasts remain flat calls to mind the presence of “withholding tax on government contracts valued at $10,000 or less is eliminated and the income tax threshold has been increased from $18,000 to $25,500 annually.” There needs more discernible evidence on this matter and likewise, how it relates to minimum wage and skills certification.

As Saint Lucian wages continue to shrink, loss of life through crime, violence, messy infrastructure and suffering from restrictions on movement, (propose tax law) are major impediments to employment, human rights and prosperity.

If crime, inflation, low wages, economic hardships and dubious tax laws impact collectively, the “result of Prime Minister Pierre’s intervention, approximately 14,000 Saint Lucians earning less than $25,500 a year will pay $0 income tax,” the result is a gradually squander to nothing. It is still a zero-sum game to poverty.

Further, based on social and economic realities on the doctrine that “Saint Lucians are saving millions of dollars annually from tax exemptions and amnesties introduced by the prime minister,” the “data” is lacking.

Disrupting domestic economic activity and being unable to mobilize greater economic impact has reduced Saint Lucia’s economy. The real tragedy is policymaking and economic reform, that has left the landscape barren.

It is also alarming that the landscape is increasingly gloomy, even after previous incentives and tax deferrals.

The OPM has not explained the tax amnesty gimmick to – NOT – go after individuals, parliamentarians and businesses who refuse to declare their assets.