By Marshall Reid

In December 2020, the European Commission announced that the European Union (EU) and the People’s Republic of China (PRC) had agreed in principle on the long-awaited Comprehensive Agreement on Investment (CAI). Described as “the most ambitious agreement that China has ever concluded with a third country,” the CAI had been a key objective for both parties since its inception in 2013.

In the year and a half that has followed, however, this dynamic has changed significantly. Following a series of increasingly visible diplomatic incidents, the PRC has seen its standing amongst EU states rapidly deteriorate, to the point that discussions of the CAI were indefinitely suspended in May 2021.

While this remarkable shift should certainly raise concerns in Beijing, it could prove to be a windfall for Taiwan. Indeed, with its high-tech economy, thriving private enterprises, and unique political status, the island democracy could emerge as the greatest beneficiary of the EU-China estrangement, particularly in terms of foreign direct investment (FDI). [1]

Cooling EU-China investment ties

In the wake of the 2020 CAI announcement, many commentators were quick to frame the agreement as something of a foregone conclusion. Indeed, given long-term trends in the EU-China economic relationship, the deal had taken on an air of inevitability. Beginning in roughly 2008-2009 – when the European debt crisis left EU states desperate for foreign capital – Beijing worked to establish itself as a leading investor on the continent.

Leveraging its ascendant economy and powerful state-owned enterprises (SOEs), the PRC rapidly asserted itself as a key player in the European market, purchasing controlling stakes in a wide range of infrastructure projects, utility providers, and manufacturing firms. While these acquisitions were frequently met with significant controversy – as countless contemporary op-eds and academic reports can attest – such pushback did little to dampen EU states’ enthusiasm for Chinese capital.

While these efforts certainly included significant successes -perhaps most notably, the addition of Italy to the Belt and Road Initiative (BRI, also known as “One Belt, One Road,” 一带一路)—China’s investments in Europe have generally proven to be something of a mixed bag. As a recent report conducted by Rhodium Group and MERICS noted, Chinese investment in Europe has remained relatively limited in recent years, even as EU-China bilateral trade has steadily grown.

In fact, after an initial flurry of investments led primarily by SOEs, overall Chinese investments in the continent have followed a “multi-year downward trajectory.” While Chinese venture capital investment in Europe has increased in recent years, overall investment has grown increasingly anemic, with 2021 marking the second lowest level of overall investment in the EU since 2013, as well as the lowest level of SOE investment in two decades. Contrary to many post-CAI projections, Beijing has proven largely unable to capitalize on its position and sustain its aggressive investment strategy on the continent. Indeed, as the Rhodium-MERICS report argues, “the era of massive Chinese investment in Europe seems over for now.”

Ultimately, this decline in PRC investment in Europe is likely the result of a variety of factors. As several observers have noted, the move is in keeping with broader trends in Chinese FDI. Rattled by domestic economic slowdowns and concerns about potential Western sanctions, many Chinese firms have increasingly cut back on overseas investment.

As a result, overall Chinese FDI effectively stagnated in 2021, even as global investment surged. At the same time, European openness to Chinese investment has declined precipitously. Driven by a growing distrust of the PRC and rising awareness of the risks of foreign investment, EU states have increasingly sought to strengthen their investment screening mechanisms. As the Rhodium-MERICS report makes clear, these regulations “could impact market access for Chinese companies in Europe and diminish appetite for investment.”

Europe as a new frontier for Taiwanese investment

Despite its recent, well-publicized diplomatic victories in Europe, Taiwan remains something of an outsider on the continent. Other than the Holy See, no European nation currently recognizes Taiwan as a sovereign country. Without any formal European partners, Taipei has long struggled to forge substantive partnerships with EU capitals. However, rising European skepticism toward China – coupled with a growing European appreciation for Taiwan and its tenuous international position – could present Taiwan with unprecedented opportunities to strengthen its ties with Europe, particularly as it pertains to FDI.

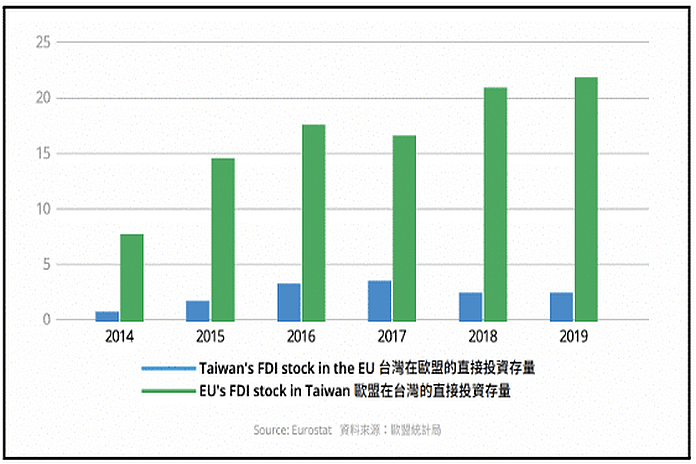

While Europe and Taiwan have a wealth of similar interests, the investment relationship between the two has become decidedly lopsided in recent years. Led by the Netherlands – historically the largest single source of FDI in Taiwan – the EU has become the foremost investor in Taiwan, accounting for 38.8 percent of total FDI in Taiwan in 2020.

By contrast, the EU “plays a minor role” in Taiwan’s overall foreign investment strategy. According to figures released by the European External Action Service (EEAS), Taiwan’s investment in the EU accounted for only 2.1 percent of its global FDI in 2020. Notably, this number lags far behind Taiwanese investment in the PRC, which accounted for a whopping 55 percent of its total investments in 2020. Furthermore, as the chart below illustrates, Taiwan’s investment in the EU has remained relatively stagnant in recent years, even as EU investment in Taiwan has steadily increased. For Taiwan -a nation sorely in need of investment partners – such meager investment in the EU represents a missed opportunity.

Wary of incurring China’s wrath, the majority of EU nations have historically sought to avoid high-profile, state-to-state partnerships with Taiwan, a dynamic that has thwarted past attempts to negotiate an EU-Taiwan free trade agreement (FTA). However, FDI has often proven to be something of an exception to this rule. As Ágnes Szunomár has noted, Taiwanese firms have been able to make substantial investments in states across the EU, even in those considered to be staunchly pro-Beijing. Perhaps the best illustration of this phenomenon can be found in Hungary.

Despite Hungarian prime minister Viktor Orbán’s strong support for the PRC, his nation emerged as the second-largest recipient of Taiwanese investment in 2020, accounting for 18.8 percent of total Taiwanese FDI in the EU. This dynamic is perhaps best summarized by Szunomár, who stated that for many EU nations, “political relations do matter, but only up to a certain point.” Simply put, when faced with the prospect of economic opportunity, even the most skeptical of EU states may be willing to open their doors to Taiwanese investment.

While such openness to Taiwanese investments certainly comes with political risks for the EU, these risks pale in comparison with the potential benefits. In many regards, Taiwan is an ideal partner for the EU. Despite its small size, the island possesses a dynamic, diversified, and highly advanced economy. Its technology firms particularly industry leaders like Taiwan Semiconductor Manufacturing Company (TSMC, 台灣積體電路製造股份有限公司) and Hon Hai Technology Group (Foxconn, 鴻海精密工業股份有限公司) are critical sources for high-tech products, particularly advanced semiconductor chips.

For the EU, which has drastically increased its involvement in the high-tech supply chain in recent years, developing stronger relationships with Taiwan’s technology firms could be highly beneficial. Furthermore, investments by Taiwanese firms traditionally lack the conditionality of Chinese investments, which have frequently been criticized as tools of PRC influence. To its credit, the EU has recognized the benefits of increased engagement with Taiwan, describing the island as a “semiconductor superpower” and hosting a Trade and Investment Forum in June.

Now more than ever, an expanded EU-Taiwan investment partnership is in the interest of both sides. Recent geopolitical events most notably the Russian invasion of Ukraine and China’s ongoing military drills in response to Speaker Pelosi’s visit to Taiwan have clearly demonstrated the many threats posed by overreliance on authoritarian powers. For the EU, encouraging Taiwanese investment on the continent and continuing to increase EU investment in Taiwan could allow the grouping to secure a safer, more reliable source of high-tech products, while also providing support to a like-minded democracy. For Taiwan, meanwhile, this growing EU openness to investment could present valuable opportunities to diversify its investment portfolio, strengthen its informal diplomatic partnerships with EU states, and increase its diplomatic space.

However, Taipei cannot afford to be passive. Instead, it should proactively work to expand its investments in the EU, mobilizing private investors and firms to build relationships with European counterparts. The EU has already demonstrated its interest in investing in Taiwan. The time has come for Taiwan to return the favor.

The main point: In the wake of the failure of CAI negotiations and a broader EU backlash against China, Taiwan has an unprecedented opportunity to expand its investment portfolio in Europe. Taipei should move proactively to increase its economic presence in the region.

Marshall Reid is a program manager at the Global Taiwan Institute.