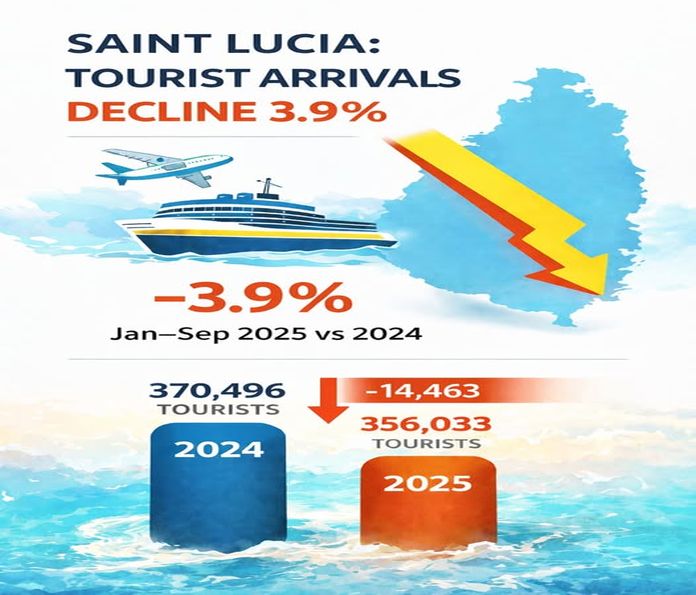

CASTRIES, St Lucia – 𝗦𝗮𝗶𝗻𝘁 𝗟𝘂𝗰𝗶𝗮’𝘀 𝘁𝗼𝘂𝗿𝗶𝘀𝗺 𝘀𝗲𝗰𝘁𝗼𝗿 𝗶𝘀 𝗳𝗮𝗹𝘁𝗲𝗿𝗶𝗻𝗴 𝗮𝘁 𝗮 𝘁𝗶𝗺𝗲 𝘄𝗵𝗲𝗻 𝗺𝘂𝗰𝗵 𝗼𝗳 𝘁𝗵𝗲 𝗖𝗮𝗿𝗶𝗯𝗯𝗲𝗮𝗻 is recovering. Data released by the Eastern Caribbean Central Bank in December 2025 show that total visitor arrivals fell by 𝟯.𝟵 percent between 𝗝𝗮𝗻𝘂𝗮𝗿𝘆 𝗮𝗻𝗱 𝗦𝗲𝗽𝘁𝗲𝗺𝗯𝗲𝗿, equivalent to 𝟭𝟰,𝟰𝟲𝟯 fewer visitors than in the same period a year earlier. The IMF has described this as a 𝗰𝗹𝗲𝗮𝗿 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗿𝗲𝗹𝗮𝘁𝗶𝘃𝗲 𝘁𝗼 𝗿𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗽𝗲𝗲𝗿𝘀, 𝗮𝘁𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗻𝗴 𝗶𝘁 𝗽𝗿𝗶𝗺𝗮𝗿𝗶𝗹𝘆 𝘁𝗼 𝗵𝗼𝘁𝗲𝗹 𝗰𝗹𝗼𝘀𝘂𝗿𝗲𝘀 𝗮𝗻𝗱 𝗿𝗲𝗱𝘂𝗰𝗲𝗱 𝗮𝗶𝗿𝗹𝗶𝗳𝘁 𝗶𝗻 𝟮𝟬𝟮𝟱. Yet the data suggest the weakness is broader and more structural in nature.

Every major tourism segment contracted. Stay-over arrivals declined by 𝟯.𝟮 percent (𝟭𝟬,𝟱𝟳𝟰 𝗳𝗲𝘄𝗲𝗿 𝘃𝗶𝘀𝗶𝘁𝗼𝗿𝘀), cruise arrivals by 𝟭𝟰.𝟰 percent (𝟲𝟵,𝟬𝟴𝟰 𝗳𝗲𝘄𝗲𝗿 𝗽𝗮𝘀𝘀𝗲𝗻𝗴𝗲𝗿𝘀), yacht arrivals by 𝟲.𝟴 percent (𝟮,𝟭𝟰𝟴 𝗳𝗲𝘄𝗲𝗿) and excursionists by 𝟭𝟳.𝟴 percent (𝟭,𝟳𝟰𝟭 𝗳𝗲𝘄𝗲𝗿). This was not a single-market shock but a system-wide slowdown affecting the island’s principal growth engine.

A look at the market composition reveals a worrying story

The stay-over market reveals where the strain lies. Arrivals from the 𝗨𝗻𝗶𝘁𝗲𝗱 𝗞𝗶𝗻𝗴𝗱𝗼𝗺 fell by 𝟭𝟴.𝟮 percent, amounting to 𝟭𝟬,𝟰𝟴𝟮 fewer visitors. Canada recorded a 𝟭𝟰.𝟯 percent decline, or 3,800 fewer arrivals, while other countries, largely continental Europe fell by 6.8 percent (1,011 fewer). These losses were only partly offset by the United States, where arrivals grew by 𝟮.𝟯 percent, adding 𝟰,𝟯𝟰𝟱 𝘃𝗶𝘀𝗶𝘁𝗼𝗿𝘀, and by a marginal increase from the Caribbean market of 𝟬.𝟵 percent, 𝗳𝗿𝗼𝗺 𝟰𝟬,𝟵𝟯𝟴 𝘁𝗼 𝟰𝟭,𝟯𝟭𝟮.

The result is a growing dependence on a single source market, whether policy-induced or imposed from outside. The United States now carries the weight of Saint Lucia’s stay-over performance, cushioning declines elsewhere but increasing exposure to external economic and geopolitical risk.

Cruise tourism: Fewer passengers despite more calls

Cruise tourism performed even worse. Passenger arrivals fell by 𝟏𝟒.𝟒 percent, 𝐢𝐧 𝐥𝐢𝐧𝐞 𝐰𝐢𝐭𝐡 𝐚 𝟐𝟕.𝟖 percent decline in cruise calls, from 292 in 2024 to 212 in 2025. Even more telling is the longer-term comparison. By 2024, cruise calls were 9% above their 2019 level, yet cruise passenger numbers remained 𝟔𝟑,𝟐𝟒𝟑 below pre-pandemic levels, suggesting smaller vessels, altered itineraries, or weaker onshore demand.

Spending declines while exaggerates impact

Visitor spending mirrored the downturn. Total visitor expenditure between January and September fell by 𝟳.𝟮 percent, 𝗼𝗿 $𝟭𝟵𝟮 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. But even when expenditure appears strong, it overstates tourism’s domestic impact. Tourism receipts recorded in the balance of payments capture gross spending, not what is retained locally. So using such an indicator might actually prove not very useful coupled with the fact that its methodological accuracy has been called into question by the IMF.

In 2024, total tourism expenditure was estimated at $𝟯.𝟲 𝗯𝗶𝗹𝗹𝗶𝗼𝗻. Yet the combined contribution of Accommodation and Food Services and Transport (land, sea and air) to GDP amounted to roughly $𝟭.𝟳 𝗯𝗶𝗹𝗹𝗶𝗼𝗻, 𝗷𝘂𝘀𝘁 𝟰𝟳 percent 𝗼𝗳 𝗵𝗲𝗮𝗱𝗹𝗶𝗻𝗲 𝘁𝗼𝘂𝗿𝗶𝘀𝗺 𝗿𝗲𝗰𝗲𝗶𝗽𝘁𝘀. The remainder leaks out; if it ever reaches Saint Lucia’s shores through imports, profit repatriation by foreign-owned hotels and airlines, international booking platforms, and prepaid travel arrangements made abroad.

Employment: The numbers don’t add up

One statistic does not fit neatly. Employment in tourism rose sharply in 2025. The sector employed 𝟭𝟳,𝟬𝟮𝟱 𝗽𝗲𝗿𝘀𝗼𝗻𝘀 𝗶𝗻 𝗤𝟯 𝟮𝟬𝟮𝟱, 𝘂𝗽 𝗳𝗿𝗼𝗺 𝟭𝟯,𝟴𝟳𝟭 𝗶𝗻 𝗤𝟯 𝟮𝟬𝟮𝟰, 𝗮𝗻 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗼𝗳 𝟯,𝟭𝟱𝟰 𝘄𝗼𝗿𝗸𝗲𝗿𝘀, even as arrivals fell by nearly 4 percent. This divergence raises questions about 𝗱𝗮𝘁𝗮 𝗰𝗼𝗻𝘀𝗶𝘀𝘁𝗲𝗻𝗰𝘆, 𝗹𝗮𝗯𝗼𝘂𝗿 𝗽𝗿𝗼𝗱𝘂𝗰𝘁𝗶𝘃𝗶𝘁𝘆, 𝗼𝗿 𝗹𝗮𝗴𝗴𝗲𝗱 𝗵𝗶𝗿𝗶𝗻𝗴 𝗱𝗲𝗰𝗶𝘀𝗶𝗼𝗻𝘀 𝘁𝗮𝗸𝗲𝗻 𝗱𝘂𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗿𝗲𝗰𝗼𝘃𝗲𝗿𝘆 𝗽𝗵𝗮𝘀𝗲.

Has tourism recovered? Only partially

By 2024, total visitor arrivals reached 𝟰𝟵𝟭,𝟱𝟳𝟯, 𝗲𝗾𝘂𝗶𝘃𝗮𝗹𝗲𝗻𝘁 𝘁𝗼 𝟵𝟴.𝟱 percent 𝗼𝗳 𝘁𝗵𝗲 𝟮𝟬𝟭𝟵 𝘁𝗼𝘁𝗮𝗹 𝗼𝗳 𝟰𝟵𝟵,𝟮𝟲𝟭. Stay-over arrivals, however, has fully recovered, rising from 𝟯𝟴𝟬,𝟳𝟵𝟭 𝗶𝗻 𝟮𝟬𝟭𝟵 𝘁𝗼 𝟰𝟯𝟱,𝟱𝟳𝟯 𝗶𝗻 𝟮𝟬𝟮𝟰. This recovery was driven almost entirely by the United States market, which surpassed its pre-pandemic level by 2022, rising from 𝟭𝟵𝟭,𝟳𝟭𝟵 𝗶𝗻 𝟮𝟬𝟭𝟵 𝘁𝗼 𝟮𝟭𝟬,𝟭𝟲𝟲.

All other markets remain below their pre-pandemic peaks: 𝗖𝗮𝗻𝗮𝗱𝗮 𝗮𝘁 𝟴𝟳 percent, 𝘁𝗵𝗲 𝗨𝗞 𝗮𝘁 𝟵𝟴 percent, 𝘁𝗵𝗲 𝗖𝗮𝗿𝗶𝗯𝗯𝗲𝗮𝗻 𝗮𝘁 𝟲𝟴 percent, 𝗮𝗻𝗱 𝗼𝘁𝗵𝗲𝗿 𝗺𝗮𝗿𝗸𝗲𝘁𝘀 𝗮𝘁 𝟳𝟯 percent. What is certain is that the recovery is narrow and uneven.

A fragile outlook

Looking ahead, risks are skewed to the downside. Heightened geopolitical tensions involving the United States, Saint Lucia’s dominant source market alongside weak growth in the UK and Europe could further suppress arrivals. Cruise tourism remains especially vulnerable to security concerns in the wider Caribbean.

What does this implies?

Saint Lucia’s post-2020 tourism performance appears to have been driven less by domestic competitiveness than by a region-wide rebound that is now fading. As neighbouring destinations such as Grenada, Dominica, St Vincent and the Grenadines, and St Kitts 𝗲𝘅𝗽𝗮𝗻𝗱 𝗮𝗶𝗿𝗹𝗶𝗳𝘁, 𝗮𝗱𝗱 𝗵𝗼𝘁𝗲𝗹 𝗰𝗮𝗽𝗮𝗰𝗶𝘁𝘆, 𝗮𝗻𝗱 𝗶𝗻 𝗦𝘁 𝗞𝗶𝘁𝘁𝘀’ 𝗰𝗮𝘀𝗲 𝗽𝘂𝘀𝗵 𝗮𝗴𝗴𝗿𝗲𝘀𝘀𝗶𝘃𝗲𝗹𝘆 𝗶𝗻𝘁𝗼 𝗵𝗼𝗺𝗲-𝗽𝗼𝗿𝘁𝗶𝗻𝗴, 𝗦𝗮𝗶𝗻𝘁 𝗟𝘂𝗰𝗶𝗮 𝗿𝗶𝘀𝗸𝘀 𝗹𝗼𝘀𝗶𝗻𝗴 𝗺𝗮𝗿𝗸𝗲𝘁 𝘀𝗵𝗮𝗿𝗲.

The data point to a deeper question: 𝘄𝗵𝗮𝘁 𝗶𝘀 𝗦𝗮𝗶𝗻𝘁 𝗟𝘂𝗰𝗶𝗮’𝘀 𝘁𝗼𝘂𝗿𝗶𝘀𝗺 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗻𝗲𝘅𝘁 𝗳𝗶𝘃𝗲 𝘆𝗲𝗮𝗿𝘀 𝗮𝗻𝗱 𝗯𝗲𝘆𝗼𝗻𝗱? Without a clear answer, the island risks remaining dependent on favourable external tides, mistaking recovery elsewhere for resilience at home.

What’s next?

A more comprehensive analysis will follow to establish whether Saint Lucia is, in fact, ceding market share to its regional peers, particularly within the OECS and Barbados. The evidence warrants closer scrutiny. Stay tuned.