- The Maduro administration has looked to tackle a devaluation of the national currency that has endangered recent low inflation.

By Ricardo Vaz

CARACAS, (venezuelanalysis.com) – The Venezuelan government has issued several debt instruments as part of its efforts to stem an ongoing currency devaluation via reduced liquidity.

In the November 13 Official Gazette #6,853, the Nicolás Maduro administration announced the issuance of IOUs (“Pagarés”) up to a total of 20 billion bolívars, the equivalent of US $440 million at the present official exchange rate, as part of its “internal and external fiscal management.”

The finance ministry will decide whether to assign the IOUs directly, via private offerings or other mechanisms. They can be set in Venezuelan bolívars as well as US dollars, euros, yuans or any other reserve currency. The foreign currency ones may be repaid in bolívars at the exchange rate set by the Venezuelan Central Bank. Financial authorities will determine interest rates whereas maturities will be agreed to with interested parties.

Besides the IOUs, Caracas is likewise creating new public debt bonds, to be offered through auctions, public tenders, direct adjudication or other methods. The instruments will pay interest every three or six months, and the Venezuelan state retains the option of buying them back before maturity.

The bonds have several variants, in bolívars and foreign currencies, as well as mixed-capital ones.

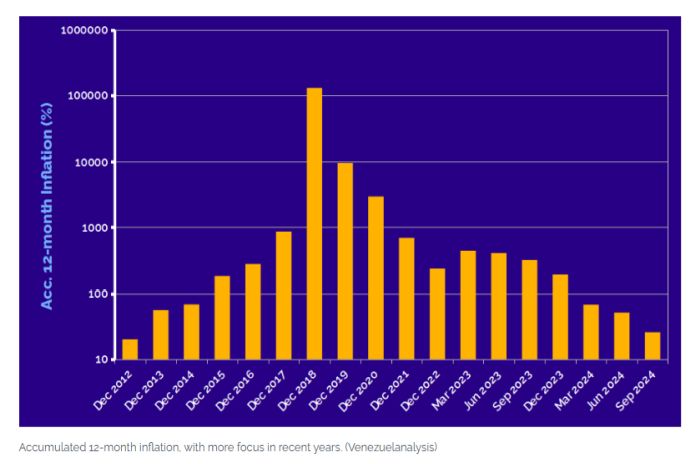

The Venezuelan Central Bank (BCV) has focused most of its recent efforts and resources on preserving low inflation. Venezuela registered 12-month accumulated inflation at 26 percent through September, the lowest such figure since early 2013. However, the stability has been impacted by a recent currency devaluation, which has historically correlated with inflation.

An unofficial, parallel USD-bolívar exchange rate has risen constantly over the past four months. In response, the BCV has let the official marker slide after months of stability while also injecting hundreds of millions of dollars into “exchange tables” run by banks.

Venezuelan economist Juan Carlos Valdez told Venezuelanalysis that the central bank continues to “asphyxiate the economy” by constraining liquidity.

“The bond issuance is another measure to absorb bolívars and remove them from circulation,” he said. According to official figures, the BCV has “sterilized” around half of the bolívars received in forex operations this year.

The financial entity has provided $4.8 billion so far this year, 16 percent more than the corresponding period of 2023, as reported by Banca y Negocios. The BCV offered $265 million this week. Despite the official exchange rate rising by more than 24 percent since the start of October, it remains 20 percent below the parallel marker.

Valdez stressed that the central bank is employing a misguided approach to tackle a “blatantly speculative” issue and that the solution is more “state control and regulation.” He argued that present economic data undermines the thesis that high demand and foreign currency shortages are pushing up the exchange rate.

“The big economic actors in Venezuela are the main recipients of state-offered dollars, and they are the ones who abuse their ability to set prices downstream,” he explained, adding that authorities could investigate distribution chains and punish actors guilty of speculation.

With wide-reaching US-led economic sanctions targeting the vital oil industry and other sectors, the Maduro government adopted a liberalizing approach in a bid to tame inflation and jumpstart growth. Policies included the abolition of forex controls, with the BCV surrendering operations to the banks, as well as frozen wages, tax breaks and various incentives for private capital. The measures successfully brought inflation down to double digits, while GDP is expected to grow for the fourth consecutive year.

Business sectors have also benefitted by gaining increased ownership or control of state-owned companies. Luigi Pisella, president of the Conindustria guild, announced recently that 350 public firms will be transferred to the private sector.

He mentioned talks with newly-appointed industry minister Alex Saab and that while some enterprises might be wholly sold, others could become “mixed” or fall under a “strategic alliance.” The last option involves a long fixed-term concession without changes to the shareholding structure.

Pisella added that the takeover of state firms would follow the “Chevron model,” mirroring the US giant’s control of operations and sales despite owning minority stakes in joint oil ventures with Venezuela’s PDVSA.