By FocusEconomics

In early December, the EU and Mercosur – a trading bloc whose members include Argentina, Bolivia, Brazil, Paraguay and Uruguay – reached a trade deal after 25 years of negotiations. With the two blocs making up over 700 million people and about 20 percent of the world’s GDP, the long-anticipated agreement has the potential to create one of the world’s largest free-trade zones. Below is a look at the implications for the world economy and our Consensus Forecasts.

Trade deal to reshape trade dynamics

The EU-Mercosur deal will eliminate over 90 percent of tariffs on goods traded between the two blocs, saving European companies an estimated EUR 4 billion in import duties per year. Moreover, the removal of non-tariff barriers to trade will facilitate trade in services, and environmental and labor safeguards aim to ensure the agreement meets EU regulatory standards. Taken together, these policy changes should boost trade between the two regions.

EU to benefit from untapped markets and cheaper imports

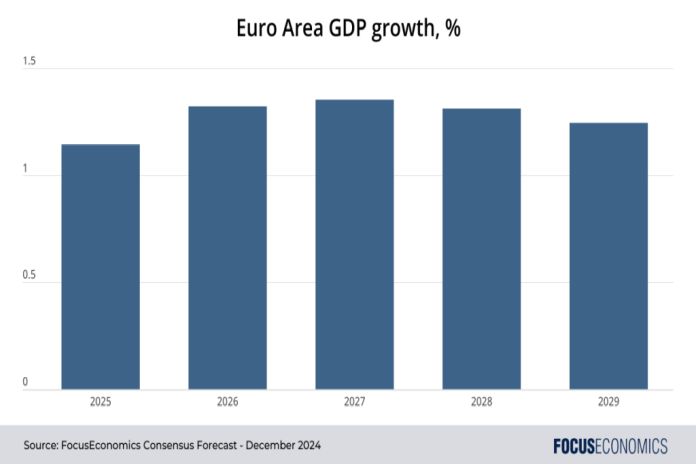

Our panelists see the Euro Area’s GDP growth remaining subdued in 2025 amid sluggish demand. Nevertheless, the deal with Mercosur could lift momentum by boosting exports of agricultural and industrial goods, automobiles and pharmaceuticals to Latin America, ameliorating the hit from higher US tariffs next year under president-elect Trump. Meanwhile, the impact of the trade pact on inflation will likely be muted, meaning our Consensus forecast for Euro area inflation to slow modestly next year is unlikely to change significantly.

Mercosur to diversify its exports markets and attract investment

So far, our analysts expect Mercosur’s GDP growth to broadly stabilize near 2025’s projection through 2029 – but wider access to the EU’s high-value market could support sharper expansions in industrial activity, investment and exports, with base metals, beef, soy and sugar exporters set to reap the greatest benefit. That said, increased export demand could fan domestic inflation, especially if supply chains struggle to keep pace. As a result, price pressures could spike further above the Latin America average, putting at risk the region’s already sluggish monetary policy easing cycle.

Critical raw materials trade to shift geopolitical dynamics

Beyond the economic sphere, the trade deal is also poised to counterbalance China’s influence in both Europe and South America. Mercosur’s abundant reserves of lithium and nickel are critical for Europe’s green transition, with EU demand for these materials set to surge in the coming years. This makes the trade deal a strategic pivot away from Chinese dominance in supply chains.

The deal’s ratification is still up in the air

Several EU countries, such as France and Poland, have opposed the deal due to fears that it would flood European markets with cheap agricultural products. Meanwhile, others, whose economies rely heavily on the automotive sector, such as Germany and Spain, have pushed for a swift ratification. As a result, the deal’s full ratification could face potential delays and modifications due to pressure from farming lobbies and environmentalists. Even so, the deal will remain a key factor to watch due to its potential to redefine global trade and reaffirm the value of economic cooperation in the era of rising protectionism.

Insight from our analysts

On the impact of the deal, ING analysts said:

“A trade deal between these two economic blocs would be welcome amid a global climate engulfed by a new era of protectionism, and would be significant step towards ongoing trade liberalisation. However, the likelihood of success remains slim – and we’re interested to see whether free trade supporters can prevail over the protectionists this time around.”

EIU analysts are more optimistic:

“The trade chapter only needs a qualified majority to be ratified, with support from at least 15 EU members representing at least 65 percent of the bloc’s population. There is still opposition from some EU member states, notably France, reflecting concerns about the impact on European farmers. But it looks increasingly unlikely that France will be able to rally enough support to block ratification of the FTA.”

On the implications for the EU economy, Fitch Solutions analysts commented:

“For EU member states, the deal helps to improve their export-oriented manufacturing sector’s competitive position vis-a-vis Mainland China, while also helping to build ties with a part of the world that is rich in critical minerals that will play a key role in the green transition. On this side of the Atlantic, agribusiness is the big winner, though in an effort to satisfy European farmers, tariff-rate quotas will still apply to a number of Mercosur agricultural exports. […] With that in mind, the overall importance of the deal itself from an economic perspective should not be overstated. While the two blocs account for about 20 percent of global GDP, trade between them totaled only around USD120bn in 2023 (or 0.1% of global GDP) and geographical issues and tariff quotas mean that any increase in trade over the coming years is likely to be gradual. That is, of course, assuming the deal itself is ratified by the Europeans.”

Our latest analysis

- The Canadian economy only managed a slight expansion in Q3.

- New Zealand’s central bank cut rates recently due to a sluggish economy.