- On August 29, 2023, the executive board of the International Monetary Fund (IMF) concluded the consideration of the Article IV consultation with Saint Lucia. The authorities need more time to consider the publication of the staff report and the related press release. The last Article IV executive board consultation was on August 25, 2023.

By Caribbean News Global contributor

CASTRIES, St Lucia – In an inexplicable roundabout, the Office of the Prime Minister (OPM), issued two press releases on November 7, 2023, stating that “tax amnesty is working.” And instructively, the revised press release redacted “financial data.”

Original OPM press release, November 7, 2023:

“The private sector response to prime minister Pierre’s tax amnesty has been favourable. Eliminating tax arrears has improved the ability of local businesses to meet their obligations to the government of Saint Lucia:

1. “The government of Saint Lucia received $15.8 million in outstanding taxes from the private sector in 2022/23.

2. “$11.2 million was paid to the government between April and September 2023.”

Revised, OPM press release, November 7, 2023:

“Government urges the private sector to take advantage of the tax amnesty to reduce it’s debt to the government. The response to prime minister Pierre’s tax amnesty has been favourable. Eliminating tax arrears has improved the ability of local businesses to meet their obligations to the government of Saint Lucia.”

What has changed from 2017-2023?

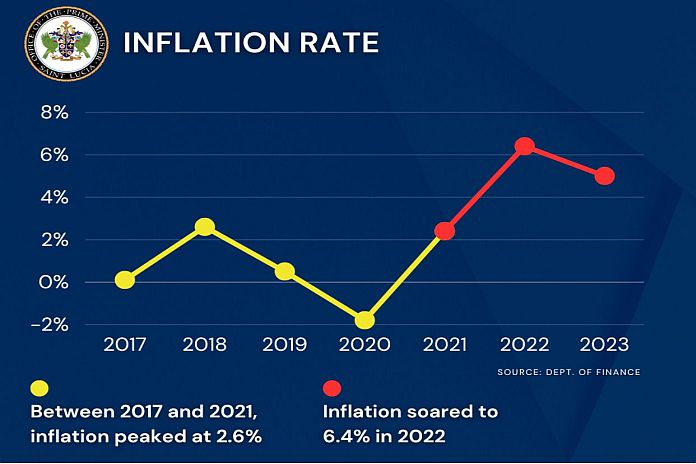

“High inflation causes consumer prices to spike. When prices go up, consumers tend to buy less. When people buy and consume less, businesses lose out on revenue. Declining revenues discourage growth and hiring in the private sector,” said the OPM.” For nearly six years, from 2017 to 2021, inflation remained below 3 percent. In 2018, inflation peaked at just 2.6 percent. Inflation more than doubled shortly after prime minister Philip J. Pierre came to office in July 2021, soaring to 6.4 percent in 2022.”

‘Soaring to 6.4 percent in 2022’ and presently, summarise the elephant in the room considering “Saint Lucia’s 2.5 percent health and security levy is an investment,” says OPM.

In this case, presented by the OPM, inflation in Saint Lucia has practically increased by 3.8 percent with no end in sight. The situation can be termed walking inflation and harmful to the economy.

‘Inflation as measured by the consumer price index reflects the annual percentage change in the cost to the average consumer of acquiring a basket of goods and services that may be fixed or changed at specified intervals, such as yearly. The Laspeyres formula is generally used.’

(There is also the announcement from the department of finance to forecast a real GDP growth rate of 3.2 percent for 2023.)

The actualities are higher prices, and in some cases increased revenue for governments (fiscal policy, as reported in increased fuel taxes, 2.5% health and security levy, and redirected in the cost of goods and services) the request for credit increases (personal and commercial) and higher interest rates.

In most cases the benefactors are lenders and on the flip side, inflation knockouts low-income households in particular categories such as food, gas, transportation, rent and labour issues – (wages, pension plans and benefits).

Related: LUCELEC responds to NWU notice of strike action in St Lucia

Earlier this month, the cabinet of Saint Lucia approved barrel concessions for the 2023 Christmas season, effective November 1, 2023, to February 28, 2024.

The barrel concession program (policy of government) is apparent to assist Saint Lucians during the Christmas season, especially the needy, and underprivileged.

In light of underlying domestic problems facing Saint Lucia, it is everyone’s business to reflect, as republish –St Lucia’s quadratic equation, choking up the thinking.

It remains relevant in part, that in Saint Lucia’s quadratic equation, the variable is random, unpredictable and dynamic to conditions, consistent with the chaos theory.

Talking Turkey –Talking Kweyol

On a point of reference, the press release from the Office of the Prime Minister (OPM) on Friday, October 27, 2023, said:

“When businesses grow, so does the economy, the department of finance forecasts a real GDP growth rate of 3.2 percent for 2023 and projects 5.2 percent real GDP growth for 2024.”

The CNG article noted that the projected 5.2 percent GDP is not supported by indicators, stating:

“An annual GDP growth rate of 2.3 percent is considered normal, measured in terms of the increase in aggregated market value of additional goods and services produced, in capital goods, labor force, technology, and human capital. GDP is formulated as consumer spending, business investment, government spending and net exports.”

IMF board discussions on St Lucia

On August 29, 2023, the executive board of the International Monetary Fund (IMF) concluded the consideration of the Article IV consultation with Saint Lucia.

The authorities need more time to consider the publication of the staff report and the related press release. The last Article IV executive board consultation was on August 25, 2023.

Recently the OPM also referenced:

“The Business Performance Survey conducted by the Chamber of Commerce, Industry and Agriculture in June 2023 confirms that 65 percent of respondents forecast increased business profitability over the next 12 months. Seventy-four percent of respondents attempted to recruit additional workers between January and March 2023. More than half of the respondents say 2023 is better than 2022.”

The OPM continues to advise that prime minister Pierre leads a cabinet of ministers that understands when businesses do well, so does the Saint Lucian economy, expounding, “the decisions made in the cabinet deliver timely relief, advance the development of our people and move our nation forward.”

Related: St Lucia’s 2.5 percent health and security levy is an investment, says OPM

“We have remained true to the principles that have shaped us, who we are and what we stand for. Principles of inclusiveness, accountability, equity and the rule of law. This government will remain focused and continue providing sound policies that aim to create the enabling environment that fosters growth for all.” ~ #PhilipCares

The bottom line to contractionary policy is the general trend of increased prices, as purchasing power decreases to buy fewer goods or services.

While investors at the very least need a return on their investment, equivalent to inflation or else their investment is losing money – despite projected gains – so must individuals and their salaries increase. Subject to that it is a practical equation of making less money – predisposed on the concept that ‘tax amnesty is working’ is a revolving barrenness.

Tax collection of VAT, 2.5 levy, and/or other taxes on behalf of the government is mandated by law and MUST be remitted as prescribed. The fascination to allude ‘tax amnesty is working’ is the facilitation of a regressive revolving door.