– In this two-part series, a special contributor examines Part 1: The Policy-Based Loan (PBL) to the government of Saint Lucia fulfilling the prerequisites, VAT paradigm and Regional VAT rates – less the squabbles. The information flow continues in Part 2, with an understanding of policy-based lending, debt management and the (in)distinct squabbles.

By Special contributor

– Be it resolved that parliament authorizes the Minister of Finance to borrow an amount of USD42,700,000.00 from the bank’s Ordinary Capital Resources for the Recovery and Resilience-Building Policy-Based Loan.

CAP ESTATE, St Lucia – Understanding the application of the 2.5 percent levy in the context of the USD42,700 million from the Caribbean Development Bank (CDB) ordinary capital resources for the Recovery and Resilience -Building, Policy-Based Loan (PBL) to the government of Saint Lucia fulfilling the prerequisites for obtaining the loan that entailed meeting eight requisites from the CDB; the specific language revolving from parliament Tuesday, February 20, 2024, and subsequent political squabbles.

Fulfilling the political squabbles over the CDB-PBL loan is incoherent, escaping valued narratives.

The PBL squabbles, explanation and intent seem centred around, Prime Minister, Minister for Finance, Economic Development and the Youth Economy, and Minister for Justice and National Security, Philip J. Pierre, reference to prior policy action:

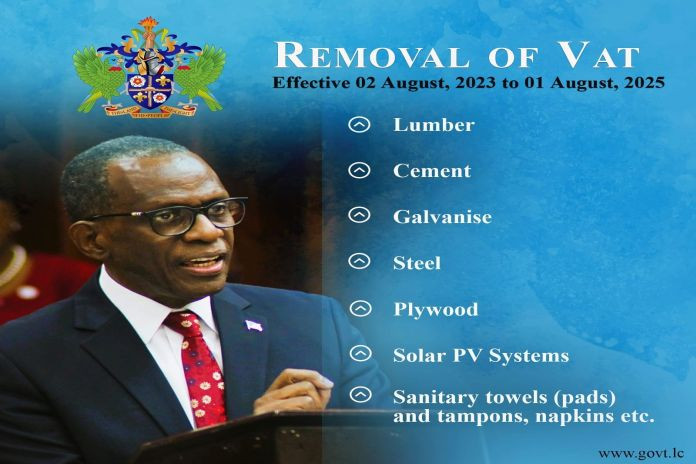

“To enhance tax revenue and support fiscal sustainability, the government has (i) introduced the Health and Security Levy at a rate of 2.5 percent on goods and services except food items, medicines, selected building materials, medical equipment, and security equipment, and (ii) increased the Excise Tax on Tobacco Products.”

At the center of the PBL is the centralized position of the government of Saint Lucia (social and economic) circumstances inherited (July 26, 2021) and at the time of negotiation. In principle, the primary fundamentals are government modernization, severely backlogged and made more acute in the digital age of Artificial Intelligence (AI).

The other is land acquisition and the bellicose compulsory land acquisition policy, also called eminent domain. The government of Saint Lucia has legal liability to land owners of approximately XCD100 million, excluding interest that extends over 15 years.

Substantive to this is the commitment of taxpayers to settle state obligations in judicious time. In normal negotiations, repayment methods and policy criteria are factors to consider, given immediate and long-term propositions.

VAT paradigm

Modernised taxes, enhancing tax undercurrents and helping lift revenue are most valuable – “until someone comes up with a better idea, taxation is the only practical means of raising the revenue to finance government spending on the goods and services that most of us demand.”

The actuary in this scenario could have raised the 12.5 percent Value Added Tax (VAT) to 17.5 percent overall, less exemption (removal of VAT ending August 2025) to acceptable regional levels, to simply catch-up on budgetary considerations and incidentals. However, the risk remains in capital expansions and development goals.

Beyond the numbers of 2.5 percent Health and Security Levy implemented fully in October 2023 to raise approximately $10.5 million at Customs & Excise and the Inland Revenue Department,” of the projected 33 million annually, a planned upgrade of the Saint Lucia Health Systems made possible through a US$9.86 million loan from the Caribbean Development Bank (CDB), financed by the European Investment Bank (EIB), will begin shortly. And, consider the Saudi Fund for Development signs US$75M loan agreement to reconstruct and rehabilitate St Jude hospital.

Published on April 6, 2023, The CDB committed US$100 million in support of The Bahamas as it charts a path to economic recovery and resilience following the back-to-back disasters of Hurricane Dorian and the COVID-19 pandemic.

As explained, “The PBL will provide support to the government of The Bahamas as it undertakes a programme of policy, legislative, and institutional reforms aimed at strengthening fiscal discipline and boosting revenue mobilisation while safeguarding the vulnerable.”

Regional VAT rates – less the squabbles

Rates across countries vary. The VAT rate in The Bahamas is 10 percent; Dominica 15 percent; Grenada and Saint Vincent and the Grenadines at 16 percent; and in Saint Kitts and Nevis 17 percent.

VAT in Trinidad and Tobago is 12.5 percent. The General Consumption Tax (GST) in Jamaica is a value-added tax (VAT), and the standard rate is currently 15 percent on standard-rated goods and services.

In Antigua and Barbuda, the ABST (sales tax) rate increased from 15 to 17 percent effective January 1, 2024.

The VAT standard rate in Barbados in 2024 is 17.5 percent, applies to supplies of goods and imports.

VAT in Saint Lucia is 12.5 percent, with a 2.5 percent health and security levy. Saint Lucia as compared to the Caribbean region, ranks in a cumulative standardized level of 15 percernt tax bracket.

In consideration of Saint Lucia’s moderate VAT rate, the level of development and borrowing required to necessitate advanced development is a prime candidate for VAT rates of 17.5 percent.

In the context of the CDB-PBL loan, the limits to external institutional demands, and setting the base for future lending and the value of government (monetary) paper it is theoretically acceptable that the country has not exceeded 17.5 percent tax bracket.

Debt management

Fiscal consultation and sustainability deserve a level of sacrifice. Saint Lucia to its credit, has not been under an International Monetary Fund (IMF) programme.

The IMF staff statement of the 2024 Article IV Mission – ECCU extracts the following on debt:

“The ECCU has recorded a strong recovery from successive pandemic and commodity price shocks. … Nevertheless, overall public debt remains elevated and generally well-above the regional 2035 debt ceiling of 60 percent of GDP.

“Amid slowing growth and elevated risks, pursuing a steady reduction in public debt in countries where it is well-above the regional ceiling is critical to maintain macro stability and safeguard the currency board against future shocks.

“Building on the success of countries with national fiscal responsibility frameworks (FRFs), ECCU-wide adoption of national FRFs, designed with well-defined country-specific operational rules and escape clauses to deliver a consistent decline in debt, would strengthen the credibility of the regional debt ceiling. The calibration should include a cushion to provide fiscal space to respond to shocks.

“Operationalizing regular ECCB Monetary Council peer reviews of member states’ policy strategies and progress toward meeting the regional debt target would help strengthen fiscal discipline. The effective implementation of the rules will require further progress in strengthening revenue administration, public investment and debt management, as well as enhancing medium-term fiscal frameworks and state-owned enterprise oversight.”

Part 2: Policy-based lending, debt management and (in)distinct squabbles.