In this two-part series, Caribbean News Global (CNG) takes a deep look at how St Lucia’s hand-to-mouth economy is reaching a boiling point; Robbing selected Peter to pay for the collective Paul; The Adventures of Robin Hood; Take Advantage of the Tax Amnesty Programme, and, Keep it!

By Caribbean News Global ![]()

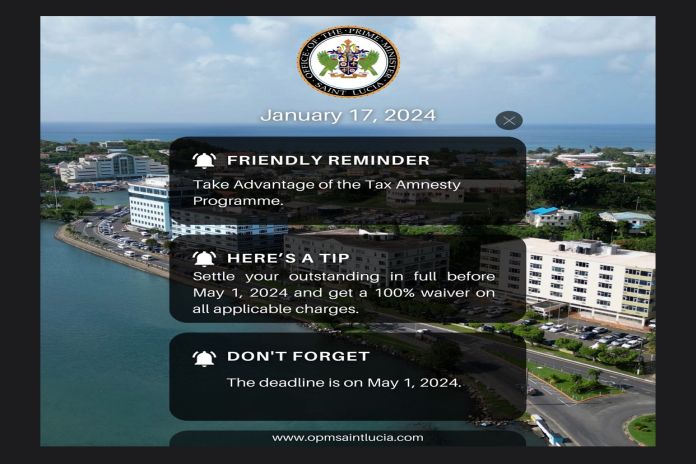

CASTRIES, St Lucia, (CNG Business) – Within 24 hours of reminding Saint Lucians to take advantage of the tax amnesty programme, the Office of the Prime Minister, (OPM) issued a statement – Keep it!

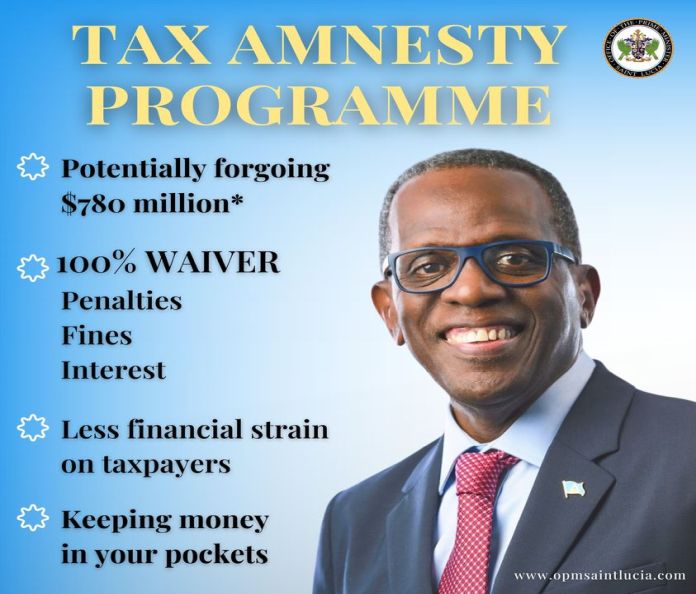

Take advantage of the tax amnesty programme

“In 2022, Prime Minister and Minister for Finance Philip J. Pierre, tabled legislation in the parliament to give legal effect to the tax amnesty programme. At the time, interest and penalty charges on outstanding taxes owed to the Inland Revenue Department (IRD) amounted to $780 million,” OPM added. “In 2023, the prime minister extended the deadline for the tax amnesty programme by one year to May 1, 2024.”

The financial reporting method from the OPM illustrated that the government is:

“Potentially forgoing $780*M in uncollected tax revenue, demonstrating the government’s understanding of the economic challenges confronting the private sector and Saint Lucian households.”

Potentially describes something that could happen or might be true.

Therefore, is the OPM prefacing imprecise figures that the “tax amnesty programme is a timely policy response crafted to alleviate economic pressures on Saint Lucian businesses and households confronted by record-high inflation and instability in the global economy.“

And is it theatrical that: “The public is reminded to take advantage of the ongoing tax amnesty programme on penalties, interest and fines before the scheduled deadline of May 1, 2024. Once outstanding taxes are settled in full before the deadline, eligible taxpayers will benefit from a 100 percent waiver on all applicable charges,” said the OPM press release, January 17, 2024, wrapping up the political playbook.

The OPM’s preoccupation with the tax collector function left the IRD little effort to release a new income tax return form to file 2023 income tax returns.

“The changes to the form include an increase in the personal tax allowance from $18,000 to $25,000 with claims (excluding medical) now capped at $30,000.

“The changes also include a $30,000 cap on all of your allowances like mortgages, claims for children, etcetera. “These changes are highlighted in the Tax Facts and Calculations booklet. The $30,000 cap does not include any medical allowances.

“Very important now is how you calculate your taxes. The tax bands in the past were four. It has been changed to three. So the band from $0 to 15,000 is at 15 percent. The band from $15, 001 to $30,000 at 20 percent, and anything above $30, 000 is at 30 percent,” the government tax department said.

In Matthew 9:9 (NIV), we read the following: “[Jesus] saw a man named Matthew sitting at the tax collector’s booth. ‘Follow me,’ he told him, and Matthew got up and followed him.”

Keep It!

In the economic philosophy to “Keep it” the OPM splashed that, in 2022, interest and penalty charges on outstanding taxes owed to IRD amounted to $780M.

Note the two methods … “potentially forgoing $780*M” – “amounted to $780M.”

The OPM further advised that it “introduced the tax amnesty programme to ease the burden on taxpayers and allow the uncollected tax revenue to stay in the pockets of everyday citizens and businesses,” adding, “the government is potentially forgoing $780M in revenue to give everyday citizens and businesses a fighting chance in the face of high inflation and escalating food prices.”

Note … “extending the deadline” for the tax amnesty programme by one year to May 1, 2024, and now, “to ease the burden on taxpayers … keeping money in your pockets.”

Here comes the exculpation:

“Cancelling the penalties, fines and interest on outstanding tax payments will alleviate the financial strain on our citizens and local businesses.”

Oh Really January 20, 2024, At 1:09 pm – writes:

“One would think the government should put programs in place to make it easier for people to pay their debt off over time. $780M over the next 10 years would make a significant dent in the country’s public debt.”

Anonymous January 20, 2024, At 1:27 pm – writes:

“Potentially Propaganda! So many ways to continue fooling people. Potentially 780M. Are we that rich to throw away money? If you match that with the hotel’s 15-year tax exemption, then you making sense, but right now, it’s pure poo-poo you talking.”

A WhatsApp commenter writes, the government is bluffing:

“Strictly speaking, the $780M is public savings managed by the GOSL … it is not the government’s money … it [still] remains the people’s money!

“What we need is debt forgiveness and cancellation. This is to allow the citizens greater fiscal space to buy more goods, and have greater spending, investment and disposable capital to grow the economy. This requires balls to frame that kind of bold policy directive.”

The OPM financial revelations above exhibit confusion around a commitment to transparency, accountability, and credible reporting that dovetails into theory. Why?.

“On August 29, 2023, the executive board of the International Monetary Fund concluded the consideration of the Article IV consultation with St Lucia. […] The authorities need more time to consider the publication of the staff report and the related press release. The last Article IV Executive Board Consultation was on August 25, 2023.

Part 2: St Lucia’s hand-to-mouth economy is reaching a boiling point. The economic theory of Peter and Paul and the adventures of Robin Hood.

St Lucia pivots ‘continued economic gains in 2024’, says OPM: The figures are indifferent