TORONTO, Canada – The Caribbean is vulnerable to natural disasters, earthquakes, floods, and hurricanes each year. COVID-19 pandemic has the Caribbean economy facing a new health and economic setback, inconstancy with the global economy.

Curtailed by the pandemic, are commodities exporters agriculture, manufactured goods and services, travel restrictions hitting the Caribbean’s tourism sector, the main source of income for many small island states. And while output remains highly uncertain, this poses a challenge on remittances and the region’s economies of (hand to mouth – under the table) informal economies.

Financial markets assume economic activity and its effects will be a far deeper recession than the global financial crisis in 2008 – 2009 and the 1980s debt crisis – through to a recovery of 2.8 percent in 2021.

“The outlook for the ECCU in 2020 had changed profoundly due to the COVID-19 pandemic. Real GDP for the Eastern Caribbean Currency Union (ECCU) is projected to decline within a range of 10.0 percent to 20.0 percent this year, a stark contrast to pre-COVID anticipated growth of 3.3 percent.”

Under this scenario, there are challenges of fiscal space for development. What’s more, high levels of an informal economy combined with a sharp decrease in funds, tax deferrals and wage subsidies due to COVID-19, are inadequate policy response that suppresses economic recovery.

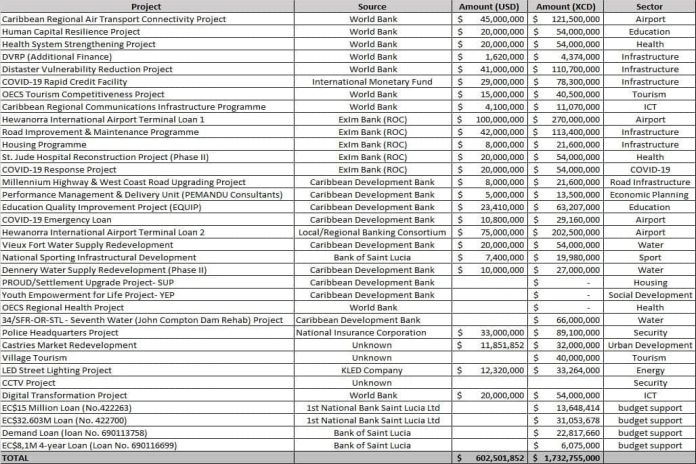

Regional economies are now faced with accelerated emergency finance, flexible credit line from IMF Rapid Credit Facility, the World Bank, Caribbean Development Bank (CDB), Eastern Caribbean Central Bank (ECCB) and domestic financial institutions, to address COVID-19 health, economic and development priorities.

The Exchange: A conversation with Kristalina Georgieva and Ian Bremmer offers some insight on the economic crisis caused by the COVID-19 pandemic is a crisis like no other as the global economy is projected to lose over $12 trillion. What is the expected impact on rising debt levels in emerging markets and low-income countries? Can worsening income inequality be avoided? How countries can lay the groundwork for a more resilient economy as they plan for the recovery?

With government revenues declining and growing budget deficits are increasingly financed, policymakers will have to be agile on how to navigate the cost of government and undertake a voluntary IMF renewal agreement for fiscal consolidation of deficit reduction.

While the government of Saint Lucia is not forthcoming on its IMF programme, it is well known that conditionalities require prioritising health and economic systems, protection of vulnerable people and vulnerable parts of the economy, and accountability.

It is also well known that Saint Lucia faces economic collapse amid extensive borrowing – “Based on the prime ministers unrealistic $1.6 billion budget, there is a financing gap of $560 million. The current deficit is $216.2 million and the recurrent deficit at $342.4 million. This means the overall deficit is $433 million,” Philip J Pierre warned. “That is the country the Saint Lucia Labour Party (SLP) will inherit when we get into government. A country that is near economic collapse.”

Objectively, Saint Lucia is not debt sustainable approaching $1.8 billion, except for perpetual debt inheritance on generations yet unborn. Absent economic and financial reforms are policy errors, signs of hyperinflation (food inflation) creeping in – a collapse of the economy is feasible.

In contrast, prime minister of Dominica, Roosevelt Skerrit, delivering his budget address for the 2020/2021 fiscal year referenced a Disaster Resilience Strategy (DRS) was recently developed with technical assistance from the IMF. “It is government’s intention to include that Strategy as an Annex to the Climate Resilience and Recovery Plan (CRRP) which was published in May 2020. The DRS is built on three pillars: Pillar I: Structural resilience • Pillar II: Financial resilience • Pillar III: Post-disaster resilience” he said.

Governance and policy reforms are needed to help countries of the region move forward from where it is today. Saint Lucia has been running large fiscal deficits to finance current consumption and spending. Consequently, this has not built up any assets – public investment or private investment.

There is the perception that the government is running a Ponzi scheme to finance central government in the use of – poor people retirement funds – commercial bank and financial institutions – borrowing from Peter to pay Paul; borrowing from one debtor to pay the other debt, as communicated in the sitting of parliament Tuesday, July 21, 2020. There are also issues on the independence of financial and capital market regulators.

There is a need for political courage and strong government to introduce reforms. However, evident by Saint Lucia’s prime minister budget address ‘a recital of unworthiness’ – and shortly thereafter an economic recovery and resilience plan, a revised hoax – the government has not prepared a rescue plan – monetary and financial reforms, fiscal reform, structural and governance reforms.

Implementing a ‘domestic solution’ is the first step at curbing inflation, through a credible sustainable macroeconomic policy, (as appose to unsustainable infrastructure projects) to reduce prevailing policy errors, investor uncertainty, and governance ineptitude.

Here are measures that would help:

- Despite the deep and multiple crises to external shocks, attempts must be made at policy formulation. Governments are faced with accelerate financial sector reforms, greater oversight and good governance, and public sector financial management (debt servicing, risk management) legislation and the rule of law;

- Under this scenario is the combined use of monetary policy, structural reform, and fiscal stimulus, and to enable a better balance between price stability, growth, and inflation in an enabling macroeconomic environment for strong investor confidence;

- The use of the instruments of capital markets, insurance and hedge funds in regional and global markets to make business development financing, capital and housing financing and equity financing accessible – as well as a clear plan to empower cooperatives and pension funds, encourage greater local savings and diaspora investment options are all that much more crucial;

- The implementation of a Centre for Policy Alternatives; and a Centre for Innovation to enhance the promotion of skills upgrade in Science, Technology, Engineering, Maths (STEM) research and development (R&D), develop enterprise in areas of skills development alongside agro-commodities markets, farm and cooperative markets and initiatives/incentives for home and garden clubs are adequate policy response many firms and households can respond to immediately.

Playing around charity economics, pandemic economics and pandemic corruption portray the unwillingness to restore investments, curtail surging bankruptcies, bring financing to Small and Medium-Sized Enterprises (SMEs) and get the economy growing again, allowing the private sector to start investing and functional.

Without these, distortions are created in the marketplace, creating new opportunities for cronyism and corruption.

“Curbing corruption requires government ownership of reforms, international cooperation, and a joint effort with civil society and the private sector. It also involves political will and the assiduous implementation of reforms over months and years.

“This crisis will sharpen our focus on governance in the years ahead because of the pandemic’s devastating effects and costs for people and economies. Countries can’t afford to lose precious resources at the best of times, and even less so during and after the pandemic. If ever there was a time for anti-corruption reforms, it is now.”

Related: Corruption and COVID-19