By BDC

More and more Canadians are worried the economy will soon slip into recession. Some economists have already sounded the alarm. Our current analysis indicates the Canadian economy will experience a marked slowdown this year, but avoid a recession. Yes, there’s a difference between a slowdown and a recession.

So, what does recession actually mean? More importantly, how can you ensure the survival and continued growth of your business when the economy simply won’t cooperate?

Recessions 101

Recessions are a normal and expected part of the business cycle. A recession, in its simplest and most widespread definition, is characterized by two consecutive quarters of falling real GDP.

However, many economists, including our team at BDC, prefer a less mechanical definition. We believe widespread and significant declines in GDP and employment are more useful indicators in deciding whether a recession has occurred.

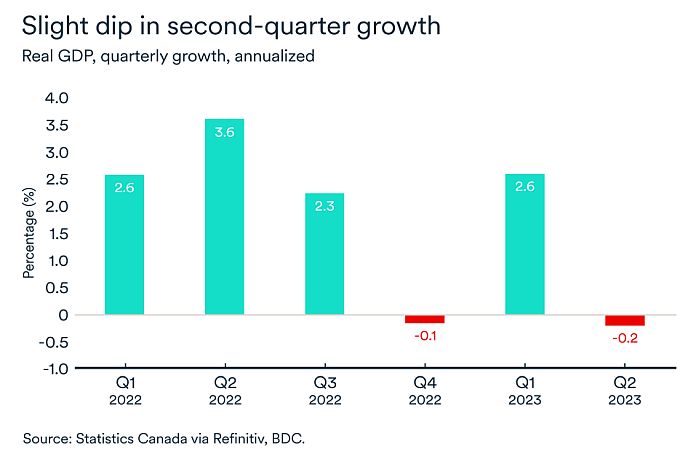

So, where are we now? Real GDP in Canada fell in the second quarter by 0.2 percent, and we expect weak growth in the third quarter, if not outright stagnation.

Therefore, it’s possible we will see two consecutive quarters of negative growth, the technical definition of a recession. Again, while this is a necessary condition of a recession, we don’t believe it’s sufficient to declare one has occurred. As proof, recall that US real GDP contracted in the first two quarters of 2022, but there was little talk back then of recession.

An economic slowdown turns into a recession when linked parts of the economy contract one after the other like falling dominos. Hence, a drop in consumer spending, retail sales, industrial production and corporate profits leads to layoffs and higher unemployment, a loss of income and finally a reduction in real GDP.

In evaluating whether we are in a recession, we must also consider how widespread the negative growth becomes. If the slowdown does not produce a sequence of reductions across the various links in the economy, we can’t say we’re in a recession.

Where are we headed?

Canada has experienced twelve recessions since 1929, including five since 1970. The most recent one, caused by COVID-19, is probably the most unusual, since it was triggered by an unforeseen and unpredictable event. It was also the shortest on record. History shows that recessions are triggered by a shock to the economy -such as an oil shock or financial imbalances (those famous bursting bubbles). The economy is not currently facing these same trends.

Recessions are often blamed on rising interest rates (the third potential trigger of recession). And rightly so, since the objective of central banks in raising rates is to slow down the economy to reduce demand and cool inflation.

This is precisely what’s happening in Canada today. A series of interest rate hikes by the Bank of Canada is slowing demand. A tightening cycle doesn’t always lead to recession, but it has in the past. What’s more, we are currently in the midst of the most rapid tightening of credit conditions in decades.

Our current analysis indicates that the Canadian economy should experience a marked slowdown this year, but avoid a recession.

How can your business continue to prosper in a slowdown?

Whether we’re talking about a recession or a slowdown, the important thing for entrepreneurs is the steps they can take now to ride out the jolts in the economy over the coming months. Here are some strategies to keep your company on track.

Before

- Your finances must be at the center of your concerns: You can’t rely on guesswork or intuition. You need hard data and a process that tells you how your results fluctuate over time if you’re to prepare adequately for a downturn. Discover the key steps to healthy finances and cash flow here.

- Focus on efficiency: When demand slows and it becomes harder to make gains on sales volume, it’s important to maximize returns while limiting unnecessary expenses. This includes reviewing and optimizing your costs.

During

- Reframe the situation: Seeing a slowing economy only as a threat can make you freeze. By contrast, seeing it as an opportunity can lead you to seek ideas, innovations and new markets that could fuel your company’s growth well into the future. What worked last year may not this year, so your company needs to be open to adapt and change with current conditions.

- Look for opportunities: Turbulent times can bring opportunities, but much depends on your sector and company characteristics. Take stock of your company’s strengths and discover the opportunities available to your business today to ensure its long-term survival.

- Stay agile but be prepared for setbacks: Proceed in small steps and adopt practices and methods that enable you to change course quickly.

- Focus on the short term first: To counterbalance the negative effects that typically accompany an economic slowdown, keep a keen eye on your finances.

- Plan for the long term: Companies that are most resilient to economic cycles are those with a long-term strategy focused on productivity gains (doing more with less) and diversification. It’s never too late to prepare for the next recession since they are an integral part of business cycles.

Read more about how to make the most of economic downturns here.