By Maria Atamanchuk, Klakow Akepanidtaworn, Ezequiel Cabezon, Tigran Poghosyan and Selim Cakir

Inflation has remained stubbornly high, exceeding central banks’ targets in most Caucasus and Central Asia (CCA) countries. Inflation rates are volatile, due to the large share of food and imported products in the consumption basket. The surge in the price of these products in 2022 and currency depreciations had strong effects in some CCA countries, but even excluding energy and monetary policy can tame inflation, inflation remains high in the region. Other factors, such as persistent supply-chain bottlenecks, have also played a role.

Monetary policy impact

Central banks’ ability to secure price stability hinges in large part on the credibility and effectiveness of their monetary policy. Several CCA central banks have a mandate to achieve a specific inflation rate, under inflation-targeting regimes, supported by a flexible, market-determined exchange rate. For instance, since the mid-2000s, Armenia, Georgia, Kazakhstan, the Kyrgyz Republic, and most recently Uzbekistan have transitioned to inflation-targeting regimes.

Our analyses in the CCA show that changes in the central bank’s interest rate do have an impact on inflation: an increase in the policy rate by 1 percentage point results in a decrease in the rate of inflation by 0.5 percentage point in the first year. Changes in the exchange rate are also shown to matter for inflation. A 1 percentage point exchange rate appreciation results in a 0.3 percentage point decrease in inflation in the first year.

Although most CCA central banks have raised interest rates during this inflation episode, the region still faces persistent inflationary pressures. This is because several structural factors also hamper the effectiveness of monetary policy, limiting the impact of interest rate changes on the economy:

- Shallow financial markets in the CCA, which weaken the impact of monetary policy on interest rates, bank lending, asset prices, balance sheets, and inflation expectations.

- Continuous reliance on exchange rate management and foreign exchange interventions that may offset some of the effects of interest rate changes.

- The still elevated use of the US dollar in the economy, or dollarization – despite its gradual decline over the last decade.

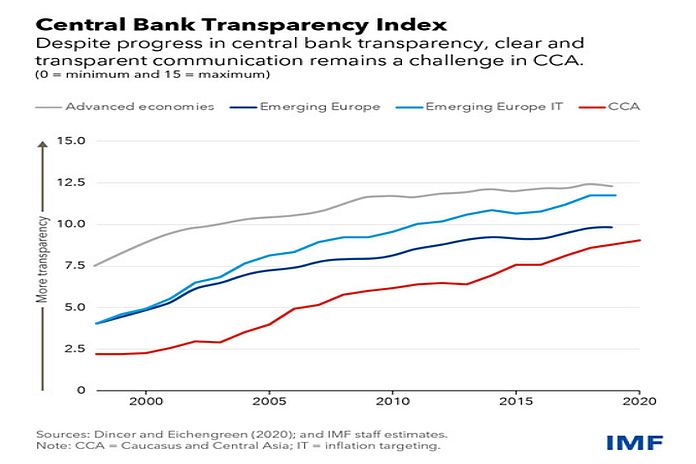

- Limited central bank credibility and communications, in environments with low trust in public institutions and low financial literacy.

Policy priorities

The paper highlights three main priorities for policymakers in the region:

- Expanding central banks’ operational independence. Government influence over central banks’ decisions and operations can make it more difficult for them to do what is needed to contain inflation. Specific priorities include ensuring that fiscal policy supports disinflation and that most central bank board members do not have executive responsibilities and eliminating subsidized lending and other off-budget government spending mandates by central banks.

- Increasing exchange rate flexibility to cushion external shocks and help focus monetary policy on domestic needs. It requires limiting foreign exchange interventions to only address excessive volatility in exchange rates and making foreign exchange purchases and sales equally balanced.

- Enhancing central bank credibility by strengthening communication and transparency. Clear communication remains challenging despite recent progress on central bank transparency. CCA central banks should pursue further efforts toward a clear and forward-looking approach in explaining how their policy decisions help achieve their policy targets.

Maria Atamanchuk is a senior economist; Klakow Akepanidtaworn and Ezequiel Cabezon are economists; and Tigran Poghosyan and Selim Cakir are resident representatives for Mongolia and Kenya respectively. The authors are in the IMF’s Departments of Middle East and Central Asia; Institute of Capacity Development; Europe; Asia and Pacific; and Africa.