- Euro’s share across various indicators of international currency use remained above 19 percent

- Vigilance needed against any cracks that may appear in the international monetary system

- Deeper European economic and financial integration, together with enhancements in cross-border payment systems between the euro and other currencies pivotal to the international role of the euro

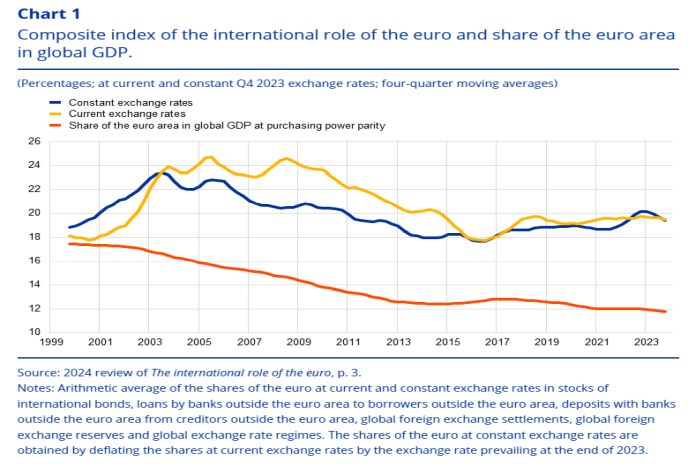

FRANKFURT, Germany – The international role of the euro remained broadly stable in 2023. The share of the euro across various indicators of international currency use remained above 19 percent, close to the average since its introduction in 1999. The euro also remained the second most important currency globally. These were some of the main findings in the annual review of the international role of the euro, published today by the European Central Bank (ECB).

Last year was marked by still elevated global inflationary pressures and tight monetary policy among major central banks. Geopolitical tensions continued to raise the risk of a more fragmented international monetary system. “Although the data so far show no evidence of substantial changes in the use of international currencies, we need to remain vigilant to any cracks that start appearing”, said ECB president Christine Lagarde.

In 2023 the share of the euro in global foreign exchange reserves decreased by one percentage point at constant exchange rates to 20 percent, a level last seen in 2020. Other indicators of the international role of the euro point to declines, albeit limited, in the position of the euro. These include the outstanding stock of international deposits, the outstanding stock of international loans, and global foreign exchange settlements. The share of the euro in outstanding international debt securities and in invoicing of goods traded between the euro area and non-euro area countries increased. At the same time, risks of potential fragmentation of global payment systems continued to emerge. Some countries increasingly sought to use units other than the major invoicing currencies for international trade as well as alternatives to traditional cross-border payment systems.

Looking ahead, the international role of the euro will be supported primarily by a deeper and more complete Economic and Monetary Union, including advancing the capital markets union, in the context of the pursuit of sound economic policies. The Eurosystem supports these policies and emphasises the need for further efforts to complete Economic and Monetary Union.

“Deeper European economic and financial integration, together with enhancements in cross-border payment systems between the euro and other currencies, will be pivotal in increasing the resilience of the international role of the euro in a potentially more fragmented world,” said president Lagarde.