PARIS, France – At the end of 2023, the total volume of sovereign and corporate bond debt stood at almost USD 100 trillion, similar in size to global GDP, says a new OECD report.

The first OECD Global Debt Report 2024: Bond Markets in a High-Debt Environment released today shows the low-interest rate environment post-2008 opened bond markets to a wider range of issuers, including lower-rated governments and companies, expanding the riskier market segments and contributing to the rapid growth of the sustainable bond market – a market segment focused on bonds that finance or re-finance green and social projects.

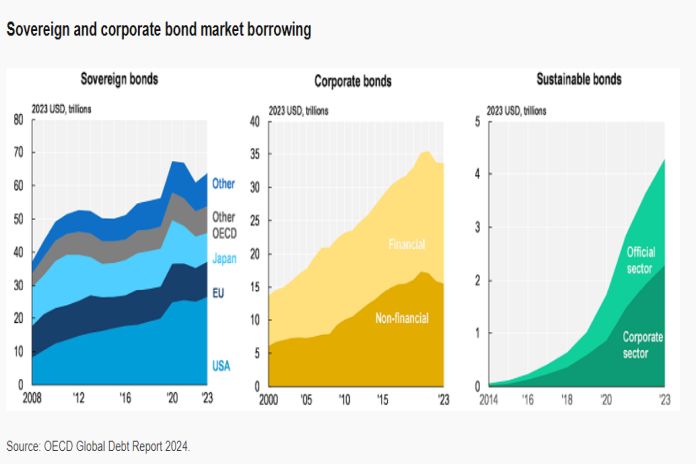

The central government debt-to-GDP ratio in OECD countries reached 83 percent at the end of 2023. This is an increase of 30 percentage points compared to 2008, even as higher inflation, which boosted nominal GDP growth, has contributed to a decrease in this ratio of more than 10 percentage points over the past two years. Total OECD government bond debt is projected to further increase to USD 56 trillion in 2024, an increase of USD 2 trillion compared to 2023 and USD 30 trillion compared to 2008. Over the same period, the global outstanding corporate bond debt has increased from USD 21 trillion to USD 34 trillion, with over 60 per cent of this increase coming from non-financial corporations.

“A new macroeconomic landscape of higher inflation and more restrictive monetary policies is transforming bond markets globally at a pace not seen in decades. This has profound implications for government spending and financial stability at a time of renewed financing needs,” OECD Secretary-General Mathias Cormann said.

“Government spending needs to be more highly targeted, with an increased focus on investments in areas that drive productivity increases and sustainable growth. Market supervisors need to monitor closely both debt sustainability in the corporate sector and overall exposures in the financial sector.”

The OECD report shows that central banks have absorbed large parts of the increases in borrowing over the last decade but are now withdrawing from bond markets through quantitative tightening. This is increasing the net supply of bonds to be absorbed by the broader market to record levels.

During the extended period of low interest rates, many governments and companies have managed to borrow at low cost, extending their maturities and increasing their share of fixed-rate issuance. Therefore, the impact of the steep increases in interest rates since early 2022 has so far remained relatively mild. Average sovereign borrowing costs in the OECD area rose from 1 percent in 2021 to 4 percent in 2023, while central government interest expenses as a share of GDP only rose from 2.3 percent to 2.9 percent in the same period.

However, this partial insulation is transitory. Even if inflation comes down to target and remains low, yields will likely remain above the low levels that prevailed at issuance in most cases. In addition, the amount of debt maturing in the next three years is considerable, adding to financing pressures, notably in emerging economies. Several highly indebted countries, including in the OECD, may potentially face a negative feedback loop of rising interest rates, slow growth and growing deficits unless bold steps to enhance fiscal resilience are taken.

The OECD Global Debt Report shows that key risks are currently concentrated in some segments of global debt markets, including some advanced economies with elevated debt-to-GDP ratios, lower-rated low-income countries, and highly leveraged corporate issuers in some sectors, notably real estate.

Risk-taking has increased substantially in all parts of the non-financial corporate sector. At the end of 2023, 53 percent of all investment grade issuance by non-financial companies was rated BBB, the lowest investment grade rating, more than twice the share in 2000. Simultaneously, the share of BBB-rated bonds with debt-to-EBITDA ratios over 4 – an indicator of high leverage – was 42 percent in 2023, up from 11 percent in 2008. Given the decreasing quality of investment-grade bonds and the limited capacity of the market to absorb a large increase in non-investment grade supply, the implications of potential downgrades merit consideration.

The sustainable bond market has grown rapidly. At the end of 2023, the outstanding global amount of sustainable corporate and official-sector bonds totalled USD 4.3 trillion, up from USD 641 billion just five years ago. This has made it a key source of funding for both governments and companies to accelerate their transition to a low-carbon economy. The growth of the sustainable bond market calls for a detailed assessment of its functioning. Sustainable bonds typically allow for the refinancing of concluded eligible projects, rather than new ones, and issuers are not penalised for failing to use all proceeds to finance eligible projects.