By Sharon Austin

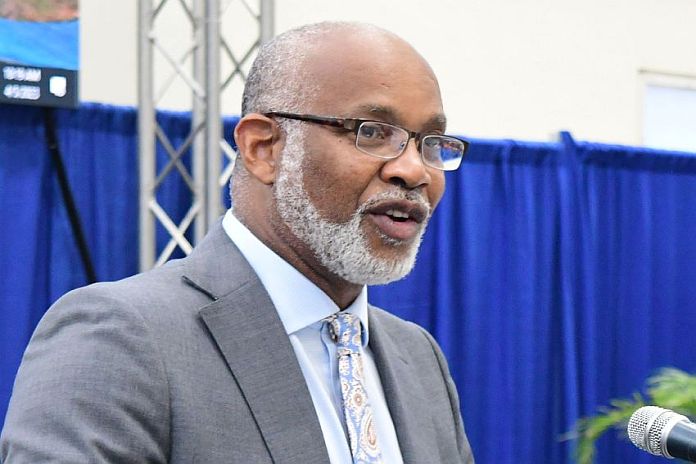

BRIDGETOWN, Barbados – The government of Barbados is working assiduously to get off the Financial Action Task Force’s (FATF) Enhanced Monitoring List, says attorney-general Dale Marshall as he participated in a panel discussion at the Regional Hybrid Anti-Money Laundering and Cybercrime Conference, at The UWI Cave Hill Campus, Cave Hill, St Michael.

“We are working night and day to make sure that we get off this list…. We have had to make a lot of changes; we are almost at the final point; it took a lot of work but in January of 2024, we will be making that final step … Marshall told the audience. “In January we are going to be having a face-to-face; we submitted report after report…trying to prove effectiveness…and we have satisfied all of those criteria, but now a multi-country team is coming to Barbados in January to meet with all of our regulators.”

The attorney-general said that once Barbados satisfies the FATF team, the island will get off the grey list and “then we anticipate getting off the EU’s blacklist.”

Stressing the importance of coming off these lists, he explained:

“This is vital for our national interest. We run the risk of losing companies but there is the point also in which we may run the risk of not being able to send money to pay for medication; you may not be able to transfer money to the US to pay for your child’s education.”

The presence of Barbados on the FATF Enhanced Monitoring List triggered Barbados being placed on the European Union AML Blacklist, and both have had a deleterious effect on doing business in – and from this country. Having had an on-site visit approved by the FATF, Barbados is one step away from being delisted and this will then confirm to correspondent banks, as well as existing and prospective investors, that the island remains a safe and reputable jurisdiction to continue to do business at the domestic level, as well as internationally.

Attorne-General Marshall told the gathering that government has had to make available significant resources to deal with the money laundering issue.

“We have very modern legislation on money laundering; we have spent a lot of money training our police officers, so that they can properly investigate money laundering cases. We have [also] spent a lot of money training our police prosecutors and our magistrates…. We have put a lot of energy, effort, and national resources…to deal with money laundering issues,” he stressed.

The one-day conference was hosted by CariSec Global, in collaboration with the Barbados Coalition of Service Industries and Sagicor Cave Hill School of Business and Management.