By Jesus Gonzalez-Garcia and Yuanchen Yang

As economies now look for paths to recovery from the COVID-19 crisis, new evidence reaffirms that policies for more open and trade-integrated economies could significantly benefit domestic competition and ultimately may help lower costs for consumers in emerging and developing economies.

A recent Working Paper, building on the Regional Economic Outlook chapter on competition, competitiveness and growth in Sub-Saharan Africa, examines the effect of trade liberalization using a large firm-level dataset covering about 400,000 firms in 83 emerging and developing economies from 2000 to 2017. The study also focuses on 29 nations in sub-Saharan Africa where greater trade integration led to significantly lower markups. Markups show the ability of firms to charge consumers above their costs and are indicators of market power. The more the competition, the less the market power and the lower the markups.

Tariff reductions cause a significant decrease in markups in the manufacturing sector as it typically faces strong competition from abroad. The information and communication technology (ICT) sector also experience important reductions in markups after tariff cuts, most likely due to lower costs for imports in a sector that requires large investments. This additional effect of liberalization on markups among ICT firms could be related to the relatively high capital intensity in this sector, as opening markets to more imports of capital goods may contribute to more competition in this sector and the reduction of markups of dominant firms. Overall, sectors with more import penetration have a stronger response to tariff reductions.

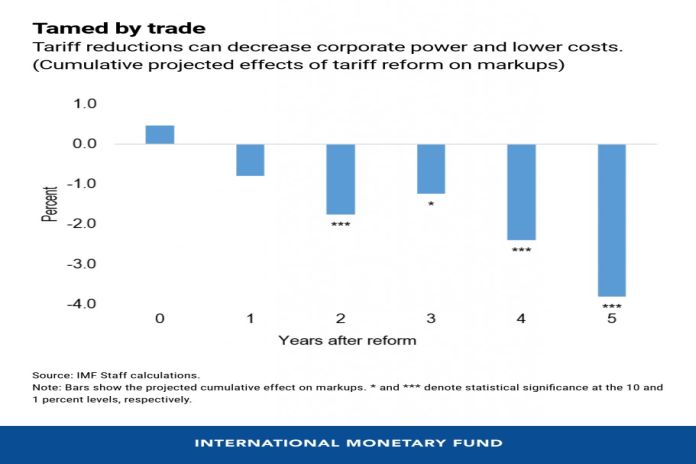

Reducing tariffs lead to significant declines in markups of about four percent in the five years after trade barriers are reduced. In sub-Saharan Africa the decrease is also significant. Using sector-specific tariff rates, it is shown that ten percent reduction in tariffs is associated with a one percent decrease in markups in the region.

This study also found that when compared to other policy actions, trade liberalization appears to be a particularly potent tool for mitigating market power and has significant synergies with real sector reforms.

The findings support efforts currently underway to increase trade integration among emerging and developing economies. The African Continental Free Trade Area, which was the subject of another Regional Economic Outlook chapter, as well as a recent IMF Staff Discussion Note, will go into operation in January and is a historic opportunity to deepen trade and economic integration. The empirical evidence presented here should further strengthen the role of trade policy as a tool to boost efficiency as economies around the globe pursue strategies for recovering from the crisis.

![]()