- The way central banks communicate has a profound impact on how people perceive monetary policy. But who delivers messages also matters. This ECB Blog post explains how the messenger can affect both the reach and influence of policy communication.

Monetary policy relies heavily on people’s expectations about future inflation influencing how they save or spend their money. To successfully guide those expectations, policy messages must reach and convince the public. This is why effective central bank communication is essential. This blog post summarises a recent study showing that good monetary policy communication depends not only on what is said, but also who says it.

When the messenger of policy communication and their audience share the same nationality, the information they provide receives more coverage in newspapers and on social media in their country of origin. As a result, the share of the audience in that country exposed to the message rises. As well as this, those who receive information from a messenger of the same origin are more likely to believe it. This “ingroup effect” is well documented in interpersonal settings, such as in schools or during doctors’ visits. The empirical evidence presented in the following now shows that it also extends to monetary policy communication.

Shared identity increases the visibility of messages

Let’s take a closer look at the findings. When central bankers share a national identity with their audience, their messages attract more attention locally. This means people who share the messenger’s nationality are more exposed to the same information than audiences in other parts of the euro area. This pattern is clearly visible in news data. The study analysed around eight million ECB-related tweets and more than 25,000 newspaper articles published between 2016 and 2022 across the four largest euro area countries: Germany, Spain, France and Italy.

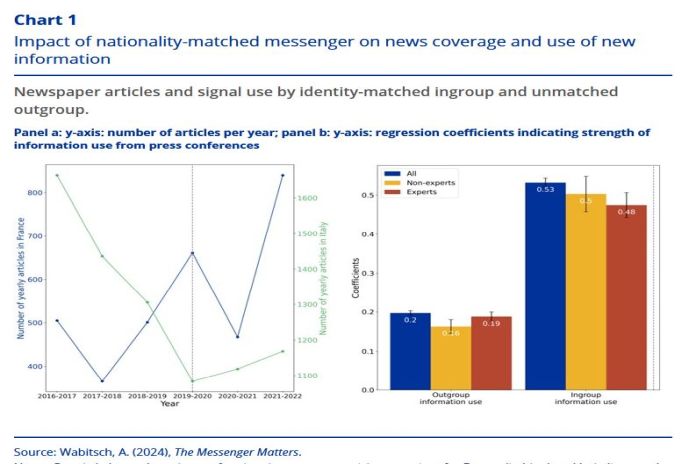

As Chart 1, panel a shows, Italian newspapers published many articles about the ECB during the presidency of the Italian ECB president, Mario Draghi. However, this coverage dropped noticeably after Christine Lagarde, who is French, took over in 2019. A similar pattern can be seen in France. Here, news coverage of the ECB increased markedly once president Lagarde took office. So, one way the choice of messenger affects monetary policy communication is by boosting the visibility of the messages for a particular audience.

Shared identity makes messages more convincing

Another way shared identity affects central bank communication is by shaping people’s beliefs. Here, the ingroup effect comes into play, which means that a message tends to have a stronger impact if it comes from a messenger that shares key characteristics with the audience. To understand whether such effects take place during monetary policy communication, the study analysed how economic sentiment expressed in tweets – that is, how positive or negative they are – changed after ECB communication. It focused on 48 monetary policy press conferences, the main communication events of the ECB.

Consistent with ingroup effects, the findings showed that social media users have stronger reactions when the ECB President shares their nationality. In other words, they are more willing than others to take on board the information communicated during press conferences. Chart 1, panel b compares how strongly ingroup users (those who share the president’s nationality) and outgroup users (those with a different nationality) react to new information from the ECB. Interestingly, the differences between the ingroup and the outgroup are remarkably similar across different user groups. They can be observed for both monetary policy experts, who often tweet about the ECB, and non-experts, who rarely do.

To confirm these findings, the study carried out a controlled experiment. A few hundred individuals in Germany, Spain, France and Italy were asked to predict historical inflation at different points in time. Before each prediction, they received a forecast from a different messenger. In some cases, the only information participants had about the messenger was either their nationality or their affiliation with a monetary institution, such as the ECB or the participant’s national central bank (e.g. the Banque de France or the Deutsche Bundesbank). In other cases, both the messenger’s nationality and their affiliation with a monetary institution were provided.

This method isolated the effect of messenger identity by keeping the content of the message consistent across various messengers. The results show that individuals adjusted their inflation expectations more when the messenger shared their nationality and less when they did not. The effect also appeared for messages delivered by ECB-affiliated messengers of different nationalities, indicating that ingroup effects persist in an institutional context. So, it matters to the public if policy messages are presented by a German, French or Italian person – despite the fact that they all represent the same central bank.

Homophily, trust and perceived ability drive the ingroup effect

But what’s behind these findings? In theory, within institutions the ingroup effect can arise through two main channels: a greater reliance on information from ingroup messengers people feel close to (so-called homophily), and a relative under-reliance on information from outgroup messengers (often referred to as heterophobia). The evidence from the experiment confirms homophily by comparing the effect of ECB messengers of ingroup nationality with neutral ECB messengers whose nationality was not disclosed. And indeed, information from ingroup ECB messengers had stronger influence on people’s inflation expectations. By contrast, forecasts from ECB messengers of an outgroup nationality had a similar influence as those from neutral ECB messengers, ruling out heterophobia. This means it’s people’s preference for messengers who are similar to themselves that seems to make the difference, not their aversion to others.

Why do we find in-group messengers more persuasive than others? To shed light on this, the study surveyed the experiment’s participants. It asked them how capable they perceived the messengers to be. Also, they were asked whether they trusted the messengers’ institutions as well as selected ECB Board and Governing Council members. Their responses indicate that both perceptions of ability and trust are key reasons for the stronger reliance on ingroup messengers. People tend to trust those who are similar to themselves. Also, they find them more capable.

The messenger matters

People do not just listen to what is said. They also care about who says it. For central bankers this provides important takeaways. The same ECB message can reach audiences more effectively and better guide public expectations when it comes from a messenger of shared identity. And thus, leveraging Europe’s diversity can help improve economic understanding across the euro area. In a world where reaching and convincing the public are essential, choosing the right messenger is not simply good communication – it’s good policy.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.