By Kristalina Georgieva and Ceyla Pazarbasioglu

Despite significant relief measures brought on by the COVID-19 crisis, about 60 percent of low-income countries are at high risk or already in debt distress. In 2015 that number was below 30 percent.

For many of these countries, the challenges are mounting. New variants are causing further disruptions to economic activity. COVID-related initiatives such as the G20 Debt Service Suspension Initiative (DSSI) are ending. Many countries face arrears or a reduction in priority expenditures. We may see economic collapse in some countries unless G20 creditors agree to accelerate debt restructurings and suspend debt service while the restructurings are being negotiated. It is also critical that private sector creditors implement debt relief on comparable terms.

Recent experiences of Chad, Ethiopia, and Zambia show that the Common Framework for debt treatments beyond the DSSI must be improved. Quick action is needed to build confidence in the framework and provide a road map for helping other countries facing increasing debt vulnerabilities.

2022: A more challenging debt outlook

Since the start of the pandemic, low-income countries have benefited from some attenuating measures. Domestic policies, together with low-interest rates in advanced economies mitigated the financial impact of the crisis on their economies. The G20 put in place the DSSI to temporarily pause official debt payments to the poorest countries, followed by the Common Framework to help these countries restructure their debt and deal with insolvency and protracted liquidity problems. The international community also scaled-up its financial support, including record IMF emergency lending and a $650 billion allocation of special drawing rights, or SDRs—$21 billion of which was allocated directly to low-income countries. The G20 leaders committed to support low-income countries with on-lending $100 billion of their SDRs to significantly magnify this impact.

No doubt 2022 will be much more challenging with the tightening of international financial conditions on the horizon. The DSSI will expire at the end of this year forcing participating countries to resume debt service payments. Countries will need to transition to strong programs, and for low-income countries that need comprehensive debt treatment, the Common Framework will be critical to unlock IMF financing.

But the Common Framework is yet to deliver on its promise. This requires prompt action.

Implementation so far has been slow

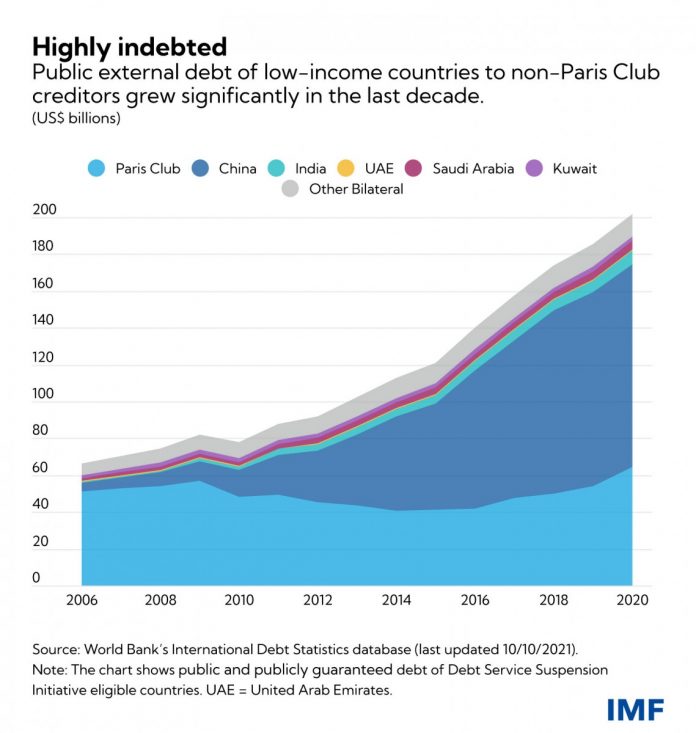

The Common Framework is intended to deal with insolvency and protracted liquidity problems, along with the implementation of an IMF-supported reform program. G20 official creditors – both traditional “Paris Club” creditors, such as France and the United States, and new creditors, such as China and India, which, as shown in the chart below, overtook the Paris Club as lenders in the last decade – agreed to coordinate to provide debt relief consistent with the debtor’s capacity to pay and maintain essential spending needs. The Common Framework requires private creditors to participate on comparable terms to overcome collective action challenges and ensure fair burden-sharing.

But so far, only three countries – Chad, Ethiopia, and Zambia -have made requests for debt relief under the Common Framework. And each case has experienced significant delays.

In part, these delays reflect the problems that motivated the creation of the Common Framework in the first place. These include coordinating Paris Club and other creditors, as well as multiple government institutions and agencies within creditor countries, which can slow down decisions. The Common Framework aims to mitigate these problems but does not eliminate them. New creditors, including relevant domestic institutions, need to gain comfort with restructuring processes that would allow all creditors to work together in providing relief and enable the IMF to lend to countries facing debt difficulties. This takes time.

But there were also delays for reasons that have nothing to do with the Common Framework. To restore debt sustainability, Chad must restructure a large, collateralized obligation held by a private company, which is partly syndicated to a large number of banks and funds. This complicates the decision-making process. Domestic challenges slowed progress in Ethiopia and Zambia.

No time to waste

With policy space tightening for highly indebted countries, the framework can and must deliver more quickly.

First, greater clarity on the different steps and timelines in the Common Framework process is vital. Alongside earlier engagement of official creditors with the debtor and with private creditors, this would help accelerate decision making.

Second, a comprehensive and sustained debt service payment standstill for the duration of the negotiation would provide relief to the debtor at a time when it is under stress, as well as incentivize faster procedures to get to the actual debt restructuring.

Third, the Common Framework should clarify further how the comparability of treatment will be effectively enforced, including as needed through implementation of the IMF arrears policies, so as to give greater comfort to creditors and debtors.

Last but not least, the Common Framework should be expanded to other highly-indebted countries that can benefit from creditor coordination. Timely and orderly debt resolution is in the interest of both debtors and creditors.

Ensuring a success in the early cases will not only benefit the countries, but foster confidence in the Common Framework. In that regard, finalizing Chad’s restructuring quickly can serve as an essential precedent for other countries. In Ethiopia, the creditor committee should continue the technical work that will allow early provision of debt relief assurances once the situation stabilizes. In Zambia, G20 creditors should expeditiously form a committee of official creditors and begin engaging with the authorities and private creditors on debt relief, while also providing a temporary debt-service suspension for the duration of the debt-restructuring discussions. Otherwise, the country would be confronted with the impossible choice of cutting priority expenditures or piling up arrears.

Debt challenges are pressing and the need for action is urgent. The recent Omicron variant is a stark reminder that the pandemic will be with us for a while. Determined multilateral action is needed now to address vaccine inequality globally and also to support timely and orderly debt resolution. For its part, the IMF is ready to work with the World Bank and all our partners to help ensure the framework delivers for the people it was put in place to help.

![]()