By BDC

MONTREAL, Canada – It’s been a tough year for the Canadian economy. Entrepreneurs, consumers and governments have all been shaken by uncertainty caused by trade tensions.

Can we hope for better in 2026? Yes and no. The outlook remains clouded as we continue to face trade disputes and other external and internal issues. But while the year ahead will be challenging, a recession doesn’t look to be in the cards.

Key determinants of the 2026 outlook:

International tensions

Limited domestic demand

Uncertainty and geopolitics will shape the coming year

The Canadian economy should continue to grow in 2026, but at a slower pace than in 2025. Economic growth is slowing around the world, including in the Eurozone, China and the United States. As an open economy and a major producer of natural resources, Canada won’t avoid the effects of the expected international slowdown in the coming year.

What’s next for tariffs?

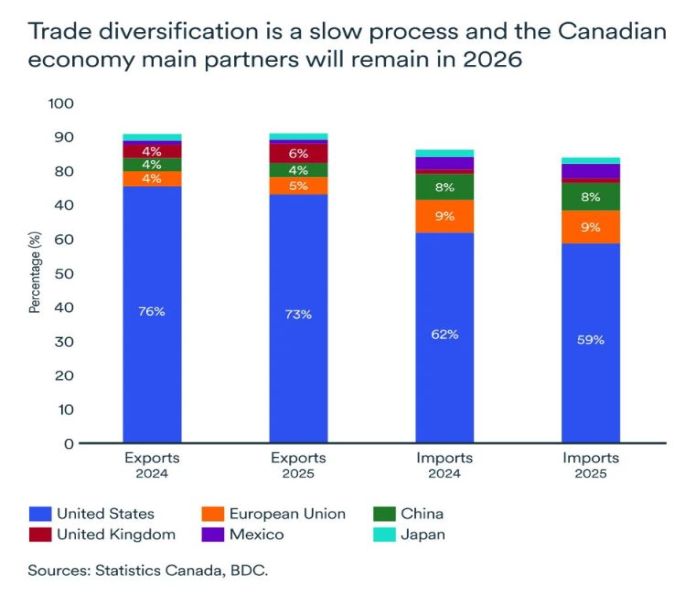

The Canadian economy is under strain from uncertainty caused by trade tension with the US and China, Canada’s most important trading partners.

Canada’s relationship with these two giants is in flux, and this will continue to hamper our export growth in the coming year.

Canada could face more tariffs. For example, US duties on upholstered wood furniture are set to increase next year from 25 to 30 percent and those on kitchen cabinets and vanity units to 50 percent .

On the other hand, there’s the possibility of a comprehensive trade agreement between Canada, the US and Mexico because the CUSMA (Canada-United States-Mexico Agreement) is up for renewal in 2026.

Canada adapts to new trade environment, but uncertainty remains

The sectors most affected by trade tensions showed signs of adjustment at the end of 2025, and other parts of the economy remained stable. A surprising 26,200 jobs were created in export-dependent sectors over the year, while the rest of the economy generated 192,000 more. Sectors that are more sensitive to international trade experienced sluggish growth (0.2%), while the others chugged along at a steady pace (1.5%).

In 2026, we expect the Canadian economy to remain resilient, producing modest growth overall.

Real GDP growth, projected to be 1.2 percent for 2025, will slow to 1 percent in 2026, according to our estimates. That’s a result that would indicate the country isn’t using its full capital and labour capacity.

This outlook is based on the current geopolitical context and could be revised upward in the event of a significant easing of trade barriers. By contrast, it could be adjusted downward if new tariffs are imposed.

The pillars of growth in 2026 will come from within the country

Canadian household spending plays a key role in economic growth. Year in, year out, household consumption accounts for about 60 percent of GDP. Household demand for goods and services are doubly important during a global slowdown because it has a strong influence on domestic business investment.

We expect consumer spending to remain a stabilising force for the Canadian economy in 2026. Supported by a relatively strong job market and inflation that remains within the Bank of Canada’s target range (close to 2%), domestic demand will continue to cushion the effects of the global slowdown.

Consumption will be constrained

However, high debt levels and prices continue to weigh on consumers. These factors, along with weak population growth and poor consumer confidence, will limit the contribution that domestic demand makes to growth.

Consumer spending will focus more on essential goods and services, while discretionary purchases and real estate investments will remain under pressure.

Fortunately, the Bank of Canada’s key interest rate of 2.25 percent is currently at the bottom of the neutral rate range—that is, at a level that encourages neither excessive debt nor savings accumulation. This should promote a balance between consumption and investment.

The bank began its easing cycle (rate cuts) in June 2024, and made four additional cuts in 2025, for a cumulative reduction of 100 basis points over the past 12 months. While the bank is expected to hold the rate steady in the near term, it takes between 18 and 24 months for the full effect of previous cuts to be felt in the economy.

Sectors that are more sensitive to interest rate changes have suffered from high uncertainty and household pessimism. The residential housing market, for example, experienced weak growth in 2025, which is likely to continue in 2026. A cautious mood among households will limit the potential for a strong recovery.

The sales outlook for businesses in 2026 is positive but modest. This is dampening Canadian business investment and prompting SMEs to focus on targeted investments aimed at improving operational efficiency, rather than growth.

Once consumer confidence improves, consumption should rebound because disposable income continues to grow. Companies that will benefit most from the recovery will be those with the ability to respond quickly and cost-effectively, i.e., the most efficient ones. (Assess whether you’re one of them).

An evolving economic picture for businesses

Fortunately, Canada entered 2025 on a solid footing, with low unemployment, inflation under control, interest rates trending downward and strong population growth. These factors largely explain the economy’s resilience despite record levels of uncertainty.

However, as the year unfolded, the foundation began to show cracks. 2026 will start of shaky ground. Here’s what we expect for 2026’s numbers:

Real GDP: 1.0 percent

Unemployment rate: 6.8 percent

Exchange rate: 74 US cents

Inflation: 2 percent

Key interest rate: 2.25 percent

SMEs are caught between a rock and a hard place: they must absorb the rising costs of certain inputs while remaining competitive on price.

Looking ahead, we expect oil prices to remain low in 2026, fluctuating between US$55 and US$63 per barrel, far below the levels of previous years, due to persistent oversupply and moderate demand.

Despite lower oil prices, the economies of oil-producing provinces will continue to outperform other parts of the country. At the same time, energy-consuming businesses and households will benefit from lower energy costs.

Meanwhile, the outlook for the Canadian dollar shows little sign of significant strengthening versus the US dollar. The loonie could appreciate slightly at the beginning of the year when the interest rate differential between the US and Canada is expected to narrow.

Despite a more flexible labour market, wage growth isn’t slowing significantly due to structural and demographic changes in the country. Wage increases are therefore expected to remain moderate but above inflation, averaging 3 percent, reflecting strong competition to attract and retain talent.

SMEs: Tight management and forward-looking investments will be key

The economic outlook for 2026 suggests that good profit margin management will remain essential to the financial health of Canadian businesses.

As the cost of doing business continues to rise and companies face more cost-conscious consumers, focusing on productivity is also a must. Investing in technology, automation, and process modernisation through artificial intelligence will not only offset cost pressures but will also improves operational efficiency.

In a volatile environment, organisations that invest to improve productivity will position themselves to seize opportunities when demand picks up again, turning uncertainty into a strategic advantage.

In short…

Uncertainty is not going away. Tariffs continue to hurt the Canadian economy, but a recession should still be avoided this year, thanks to domestic spending. Canadian businesses must continue to invest in innovation and productivity to adjust to the new economic reality and the trends that will shape our future.