Consumer and commercial segments responded strongly to government assistance, pushing 27% year-on-year growth for the industry

BOSTON–(BUSINESS WIRE)–As families around the world struggled to stay productive in work and school during the first wave of the COVID-19 pandemic, economic hardship was buoyed by government assistance. Consumers, commercial clients, and schools scrambled to purchase mobile productivity devices once thought to be redundant, driving 27% year-on-year growth for notebook shipments, according to Strategy Analytics’ latest report. Now up for debate is whether demand from the back-to-school and holiday seasons were pulled forward due to the pandemic or if this just the beginning of a new growth era for Notebook PCs.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Notebook PC Shipments and Market Share: Q2 2020 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-notebook-pc-shipments-and-market-share-q2-2020-results-130820

Chirag Upadhyay, Senior Research Analyst said, “The main reason for all vendors’ success in improving supply chain demand is by working closely with channel and retail partners. Most vendors started the quarter by delivering panic buy/backlog orders which were held back in March due to the lockdown imposed on majority of the countries. However, as the quarter progressed, all the vendors managed to fulfil customers’ requirements on time by working closely with channel partners (including retail) to deliver products more efficiently and in a timely manner.”

He continued, “There is definitely risk of prolonged economic hardship and a downturn in demand in countries still dealing with the first wave of infections, but this pessimism could spread quickly if more countries enter a second wave of infections like Japan, Hong Kong, Australia.”

Eric Smith, Director – Connected Computing added, “The biggest surprise of the quarter was the robust demand generated from consumers buying their own devices for work, studying, and play despite tough economic headwinds. Gaming proved to be an effective distraction in a physically isolated world. Chromebooks, in particular, experienced high demand from schools and consumers to support e-learning efforts. How these behaviors develop during and after the pandemic will be closely studied to determine the direction of the notebook market long-term.”

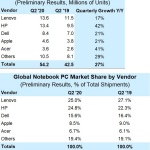

Exhibit 1: Lenovo and HP Combined to Control 50% of Notebook PC Market1

|

Global Notebook PC Shipments by Vendor (Preliminary Results, Millions of Units) |

|||||||||

|

Vendor |

Q2 ’20 |

Q2 ’19 |

Quarterly Growth Y/Y |

||||||

|

Lenovo |

13.6 |

11.5 |

17% |

||||||

|

HP |

13.4 |

9.5 |

42% |

||||||

|

Dell |

8.4 |

7.0 |

21% |

||||||

|

Apple |

4.6 |

3.8 |

21% |

||||||

|

Acer |

3.6 |

2.6 |

41% |

||||||

|

Others |

10.5 |

8.1 |

29% |

||||||

|

Totals |

54.2 |

42.5 |

27% |

||||||

|

|

|

|

|

|

|||||

|

Global Notebook PC Market Share by Vendor (Preliminary Results, % of Total Shipments) |

|||||||||

|

Vendor |

Q2 ’20 |

|

Q2 ’19 |

||||||

|

Lenovo |

25.0% |

|

27.1% |

||||||

|

HP |

24.8% |

|

22.3% |

||||||

|

Dell |

15.6% |

|

16.4% |

||||||

|

Apple |

8.5% |

|

9.0% |

||||||

|

Acer |

6.7% |

|

6.1% |

||||||

|

Others |

19.4% |

|

19.1% |

||||||

|

Totals |

100.0% |

|

100.0% |

||||||

|

Source: Strategy Analytics’ Connected Computing Devices service |

|||||||||

1 All figures are rounded

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com

For more information about Strategy Analytics

Connected Computing Devices: Click here

Contacts

US Contact: Eric Smith, +1 617 614 0752, esmith@strategyanalytics.com

UK Contact: Chirag Upadhyay, +44 1908 423 643, cupadhyay@strategyanalytics.com