By David Jordan

In the context of Saint Lucia’s 2020/2021 estimates of revenue and expenditure, Caribbean News Global (CNG) examines Saint Lucias’ public debt and finance management with economist David Jordan, Chairman, FRIEETAD in the OECS Inc.

Q: Can you provide insight into the budgetary estimates of revenue and expenditure?

A: The estimates of revenue and expenditure as a document is divided into sections which would generally classify; a) Recurrent Expenditure; b) Capital Expenditure: c) Section which deals with Fiscal monetary policy matters – including revenue taxes non-taxes and debt: d) The fourth section deals with the classification of posts permanent establishment in the context of employees engaged to be paid under recurrent expenditure itemized in the estimates.

However, the approval of the ‘Appropriation Bill’ (the technical term) under the ‘Finance Act’ – after the parliamentary process (in the lower and upper house) provides the legitimacy to conduct the countries financial affairs for a cycle of 12 months, April 1 – March 31.

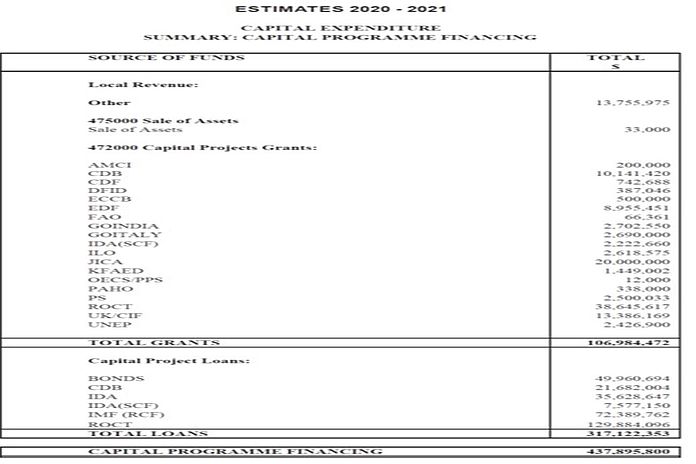

Concerning the recurrent expenditure, this section deals with salaries, wages, and administrative expenses, while the capital section relates to the element of all projects – inclusive of infrastructure, social, health, and other areas instituted by the government. Generally, these projects are financed either through local revenue, grant, loans, bonds by government, or regional and international institutions.

However, we also know that there is a strong distinction between the accounting functions of the private and public sector management. Interestingly, the estimates of revenue and expenditure provide for the transparency of the proposed government’s operations for the financial year. The document also allows for an audit on the functions of the government.

Q: Thanks for this explanation, Jordan. What is the status of the public debt, per the 20202021 estimates?

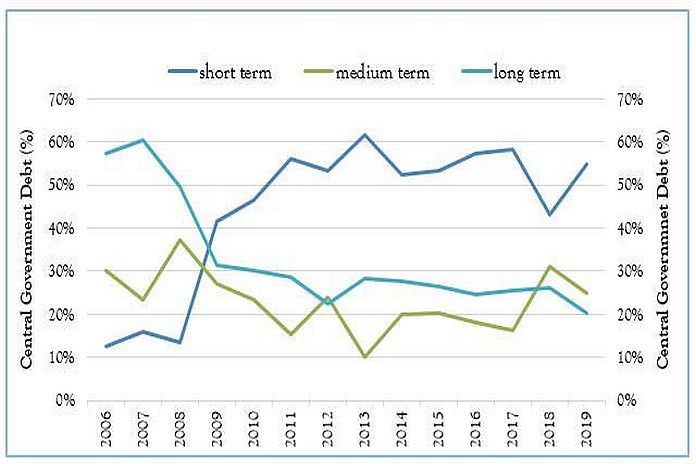

A: The Social and Economic Review 2019 affirms the current level of public debt increased by 3.4 percent in 2018; registered at 3.4167 billion. The trajectory of that debt over the last eleven years can be reflected vis a vis the GDP.

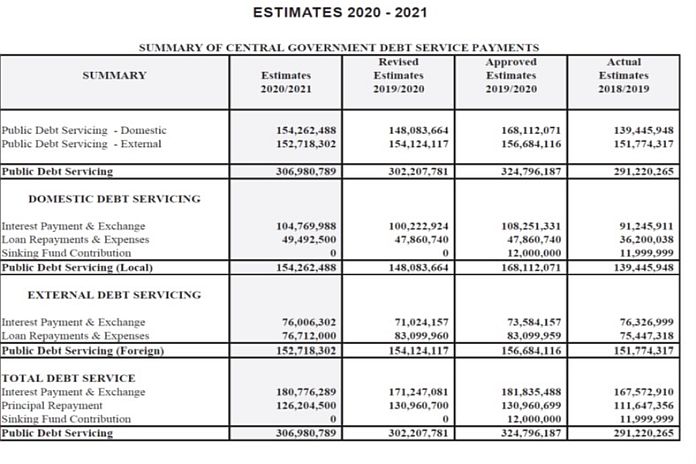

The extent of Saint Lucias’ debt is itemized in the section of the estimates which deals with the public debt inclusive of (i) internal and (ii) external. This debt arises from loans, bonds and interest payments; and from local financial institutions in the case of domestic debt, international organisations and government in the case of external debt.

Q: What’s your interpretation comparative to debt and development?

A: Of course, yes: Debt is triggered and results from borrowing and of the constant response to meet unanticipated events, poor and/or declining revenue positions to meet its financial needs/ commitments. Primarily natural disasters (climate change, hurricane, (COVID-19)) incur costs pre and post replacing infrastructure, but generally, debt extends to the weak assortment of priorities and untenable projects by governments that negatively impact the country’s public purse.

The engagement to borrow internal or external from financial institutions support economic and social budgetary classification, the major significance, however, are aspects of public debt and finance management.

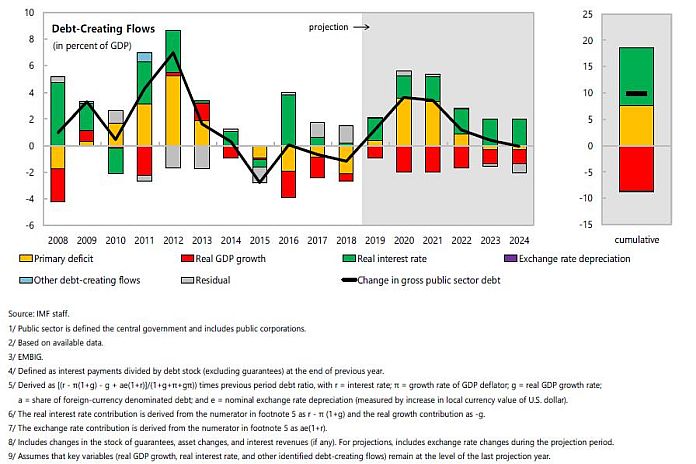

The overall historical trajectory of debt flows in Saint Lucia is delineated in the chart provided by the IMF report of February 2020, 20/54.

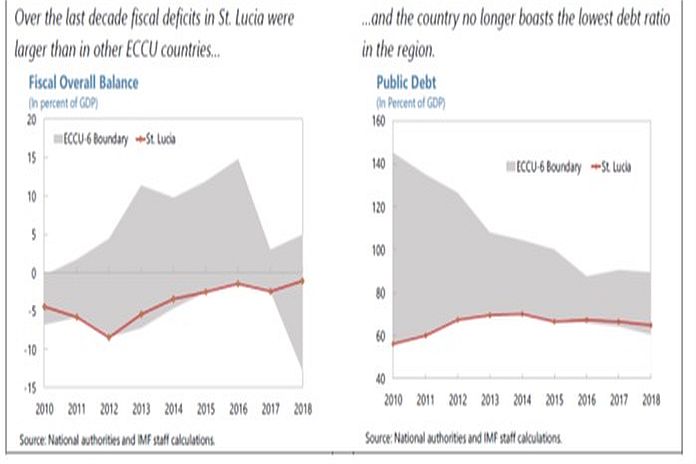

Saint Lucia during the last ten years acquired a reputation of the highest fiscal deficit and indebtedness of the Organization of Eastern Caribbean States (OECS) and member of the Eastern Caribbean Currency Union (ECCU).

Saint Lucia is grappling with the COVID-19 pandemic. This circumstance, unprecedented as it is, has a serious social and economic impact on the national debt.

The government’s revenue is severely impacted and will continue pre and post-COVID-19 (providing social and financial support for medical and personnel, infrastructure, procurement of therapeutics,etc). The final expenditure when published will certainly indicate increase expenditure and debt, though several grants have been offered.

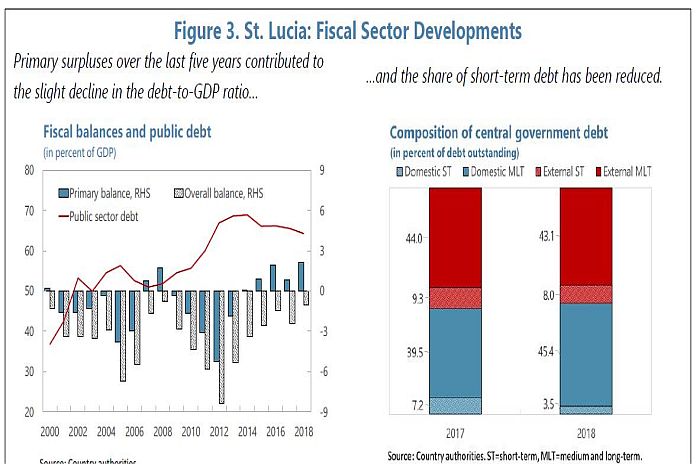

Recently, Saint Lucia enjoyed the rebasing of its Gross Domestic Product (GDP) and now adopts a new marginal status at (59.3 Debt to GDP ratio IMF 2019) in contrast to what was projected before the rebasing of the GDP in 2018. There is a very narrow window of opportunity to operate from now until 2030 unless strong socio-economic policy measures are adopted to facilitate sustainable economic growth.

Of course, there is a direct and indirect relationship between impacts on growing magnitudes of debt and economic development. Indebtedness may restrict a country’s ability to engage in further borrowing from international institutions which set quantitative restrictions on economic variables. And where exists an already high incidence of economic commitments to meet capital and interest payments on its prior borrowings.

There is a cost associated with high-levels of indebtedness. This may lead to underdevelopment, particularly when constrained to keep rigid rates of debt to GDP ratio of levels, consistent with ECCU and IMF stipulate ratios of sixty percent. The extent of debt in Saint Lucia can impede and constrained future development if it is not accompanied by appropriate supportive socio-economic policy measures. This alone would impede opportunities to promote economic growth, for example, the further expansion of GDP ( total goods and services produced within the year ) as general provision for the expansion of infrastructure requires borrowing of investment funds.

In contrast, however, lower debt levels may also influence greater latitude to borrow. But as I said earlier, I will also reiterate that borrowing will always be necessary, to enable furtherance of any monetary expansionary plans whether it is for infrastructure and other economic and social projects.

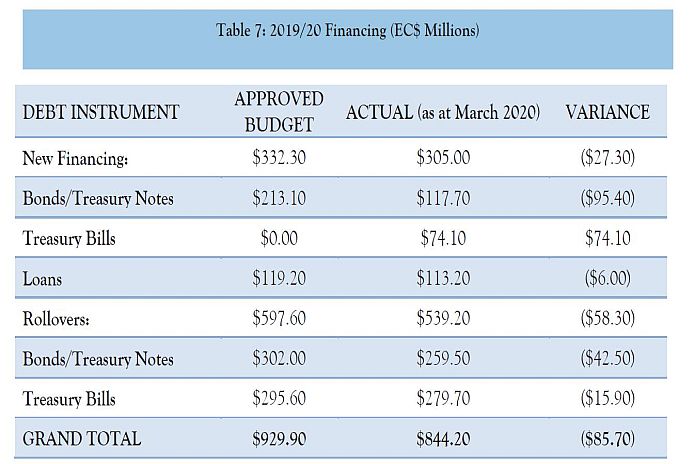

The Economic and Social Review 2019 refers to a summary financing for the period 2019/20. It highlights variances between approved actuals and approved budgets.

The 2020/2021 estimates of revenue and expenditure, however, is now reflective of the summary of the capital programme financing for the stated period.

Saint Lucia’s short-term and long term-debt items are well delineated in the context of the budgetary estimates of revenue and expenditure 2020/2021.This can be analysed against the performance full distribution of bonds issued by the government of Saint Lucia and what these bonds seek to fund. However, these repayments have to be honoured and this is under another circumstance that debt arises when a country has to meet the commitments of repayment.

A prior assessment prior reveals the status of long and short term bonds as published in the estimates of revenue and expenditure 2020/2021, that the government is committed to paying with an interest rate extending from one – seven percent.

Chairman FRIEETAD in the OECS Inc.

Very informative, great piece. St.Lucians need to understand this.

Can our Politicians/Policy makers take heed of the clear facts that Mr. Jordan has put forward. Or are we doomed into living on borrowing (don’t know how to pay back generations) to come?