By David Jordan

The following is a three-part series of an interview conducted with David Jordan on the economic paralysis that confronts Saint Lucia, in the era of COVID-19; the International Monetary Fund (IMF) and Saint Lucia’s 2020/2021 estimates of revenue and expenditure for 2020/2021.

Q: Prime minister Allen Chastanet announced ‘economic growth’. However, respondents question that discernment. What is your economic view, against the backdrop of the IMF and World Bank projections (phenomenal shrinking) of the economy for 2020 and the outlook in the era of the novel coronavirus (COVID19)?

A: First, you will be able to document my revelation to you and validate the facts, with the International Monetary Fund (IMF) 1LCAEA2020001 Saint Lucia report, published February 2020 Ref 20/54, and the clarification that you may need about its content. The second document is the Economic-and-Social-Review-2019 from which I will pick-out some areas for discussion.

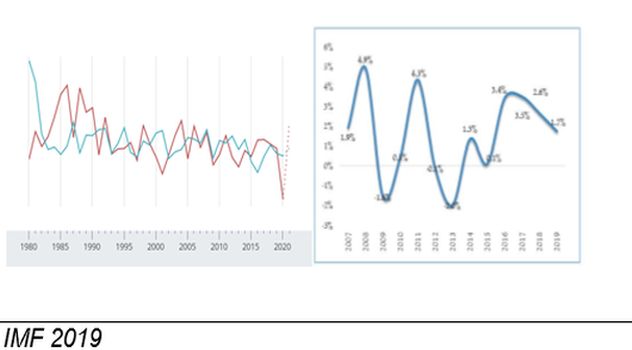

I will focus on the trajectory that depicts a continued path of growth of the Saint Lucian economy for the last 40 years and capture last year’s projection. The IMF report outlines what the projected growth pattern would be like. Further, this report states that the Gross Domestic Product (GDP) was subdued as reflected in the data supplied for the period ending 2019.

Economic and Social Review 2019

Economic and Social Review 2019

The historical trend has been as described above, also the IMF captures a trend ever since Saint Lucia was recognized by the IMF in 1979. Further, I wish to examine their summary alongside the Economic and Social Review 2019, which captures the GDP growth for the period 2007-2019 which the last rate of growth registered at 1.7 percent, (2019).

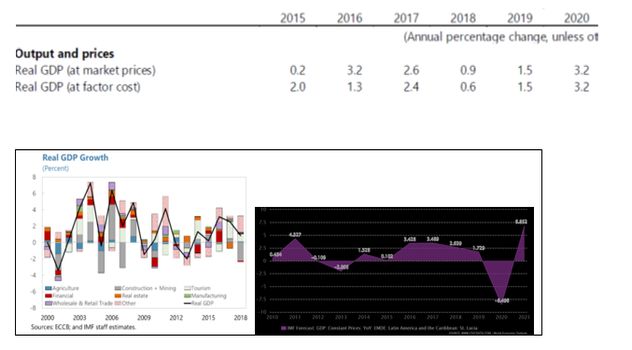

The above depicts the trajectory of the Saint Lucian economy for the period ending 2018-2020 (before the COVID-19 pandemic). Significantly, as you examine the data on Saint Lucia (ECCB, IMF chart) you will note the productive sectors that performed positively were notably tourism ( expenditure in the sector was estimated to have increased by 11.2 percent) distribution, trades and manufacturing (8.6 percent) respectively. However, the construction sector (0.3) and agriculture ( 0.8 percent) experienced contractions and were not so important in the IMF analysis you saw earlier.

Q: How and why was this change – different statements of growth: Isn’t this misleading?

A: The GDP annual production of goods and services in an economy – data experienced a rebasing exercise in 2018. GDP is used to decipher – compare an economy’s performance from year to year. The positive performance registers economic growth. Rebasing establishes a new base year. This is a modern public finance management applied theory as a contemporary approach that fits within a certain framework which deals with a country’s national accounts and statistics. This truly provides an element called “misleading image” and/or “may cloud a misrepresentation”. But, may I also introduce the international financial landscape with which we are precariously engulfed in now.

Rebasing the GDP could occur every five years to the national accounts, however, in the case of Saint Lucia, the last period of the GDP series was 2006 and ended in 2018. (Social and Economic review 2019). The year, 2017 was commissioned “a good normal year” as there were no adverse shocks. A normal year is defined without shocks ( 2018 features post the devastating hurricanes of 2017 which impacted the Eastern Caribbean Currency Union (ECCU) region, namely Dominica).

This rebasing may include other significant emergent productive sectors that recognize economic performance to broaden the GDP basket of the industry, goods and services. As an adopted instrument, this allows for the compilation of national statistics and the structural changes of the economy in comparison from 2018 onwards. This is the misgiving that appears ad hoc and not structured causing concerns. In my view, rebasing ought to be transparent. Thus, just like the census – every ten years or even 20 years to capture generational changes and potential growth of new industry.

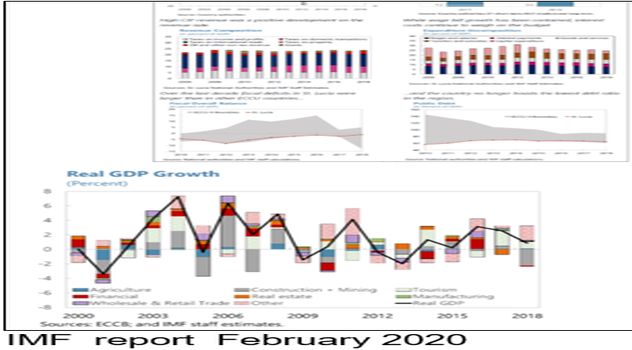

Governments that are categorized with a high level of indebtedness such as Saint Lucia are happy ex-poste when such a framework is applied, is done for a reason. However, Saint Lucia up till 2019 was categorized as having the largest fiscal deficits in the ECCU as described by the IMF report.

When you look at the historical trend and what has been categorised ex ante. This revision softens the impact and reflects a different image. Opposition parties never like this.

Q: And what about the rate of unemployment?

A: The economy performed lower than the previous period. And I am more concerned about the actual levels of employment per sector rather than debating the issues that maybe only economists know-how unemployment figures are estimated.

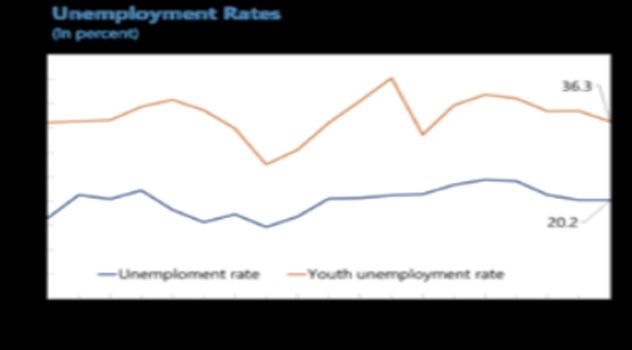

The trajectory of unemployment can be captured similarly in the Table below. The average rate of unemployment rate fell to 16.8 percent in 2019, down from 20.2 percent in 2018. Youth unemployment also decreased from an average rate of 36.3 percent in 2018 to 31.6 percent in 2019.

The fiscal health of the economy is of particular importance in this report. A much better measure to examine the performance of the economy to my mind is to assess and monitor employment figures as per productive sectors; for example the number of persons employed within each sector and the movement.

Q: The prime minister recently spoke to the issue of debt to GDP ratio moving faster than the rate of growth for the last 20 years: Can you speak to that?

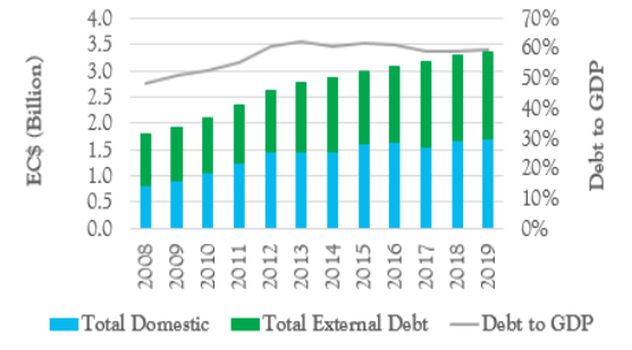

A: There are two elements to be mindful of: First, the magnitude of the debt and, secondly, the variation from the previous 2018 time period. You can also examine the trend for the last five years ( Economic and Social Review 2019) below;

The magnitude of the total actual public debt increased by 3.4 percent of 2018 and is registered as $3.4167 billion at the end of 2019. Thus, the reason you would say this is misleading is the trend before the rebasing of the GDP which is not an unusual practice. This does not mean there was a better performance as the GDP was rebased. However, this rebasing reflects that the country is now operating within the “Maastricht guidelines of the magic 60 percent and will be required until 2030”. We shall come to that later when we discuss the injection in the economy which most likely would have enabled access to the IMF facility.

Q: So we adopt the re-based position to describe indebtedness from now on: Is that your understanding?

A: Absolutely, the issue of debt is always a livid sensational issue for politicians on either side of parliament. I hope, one day the people who ultimately choose their representatives would truly hold them politicians accountable and bear the burden of the debt.

Saint Lucia’s debt as its stand, increased in 2018 – 2019 to reflect $3.4 billion and approximately 59.3 percent debt to GDP ratio rebased. Outside of the rebased trend, it would have been a historical trajectory 74 percent debt to GDP ratio for the period 2020. The 59.3 ratio allows a revised status but a very narrow window of (0.7) to operate from and to maintain IMF conditionality.

Q: Is this official?

A: This process started earlier and is already adopted and endorsed by the agreement which enabled the RCF facility and enabled the country’s access to the full IMF loan agreement. This measure will still be a major challenge as I will discuss later. It is expected that as part of the conditions Saint Lucia will need to maintain the magic 60 percent debt to GDP ratio till 2030.

Q: The prime minister proposed a measure to deal with payment to the public sector while the leader of the opposition has proposed a different option. Can you compare and contrast the different methods?

A: This is a bullet that the country has to bite and live with. While it is not only a cash flow problem and the solutions are from two different policy approaches to address a fiscal deficit scenario, facing the country at this time.

The information which was announced has the immediacy for more than EC$245 million cash injection in the economy. This was the disclosure by the minister for commerce. We have to await the full disclosure of what the actual size of short-term and long-term debt commitments are. However, we may need to examine even closer the data in the Economic and Social Review 2019 which I suspect may be closer now to EC$950 million, inclusive of payment of maturing Bonds and commitment of larger debt repayments at that are at risk of default and its implications. The novel coronavirus pandemic opened a “ large can of fiscal deficit issues” and reduced revenue for 2020, in the instance.

Q: The prime minister remarked that Saint Lucia’s economy was doing well in February 2020: What’s your analysis?

A: I did not hear him say this, but you may not have seen the document which I am privy to. Surely we will learn sooner or later, whether there is – an impending national debt crisis and difficult times ahead for the country. There is a need for full disclosure. In other words, if the “country is broke” and cannot manage its economic affairs, we need to know, since several of us don’t have access to all of the studies and data.

But there are several areas of concern that can be disclosed. I certainly have heard of policy measures and response which deals with an element of “cash and bonds” debate. This has now finally reached the public domain and should be discussed with the entire country. The methodology cannot be hidden and discussed behind closed doors, amid proposals to certain agencies to absorb the bonds. I do hope these entities do their homework.

To be continued … Part 2 (Circular flow of income in the country’s economy)