CASTRIES, St Lucia – Caribbean Information and Credit Rating Services Limited (CariCRIS) announced their revised debt update on June 29, 2021.

“CariCRIS has reaffirmed the assigned ratings of CariBBB– (Foreign Currency and Local Currency Ratings) on its regional rating scale to the several debt programmes of the Government of Saint Lucia (GOSL)”. It is important to note that in July 2020 CariCRIS downgraded Saint Lucia’s debt rating and there has been no recovery from this recent downgrade. While it is good that Saint Lucia avoided a double downgrade in less than 12 months, the debt trajectory of the current administration makes another downgrade a very real possibility particularly given the impact of COVID-19 and Hurricane Elsa.

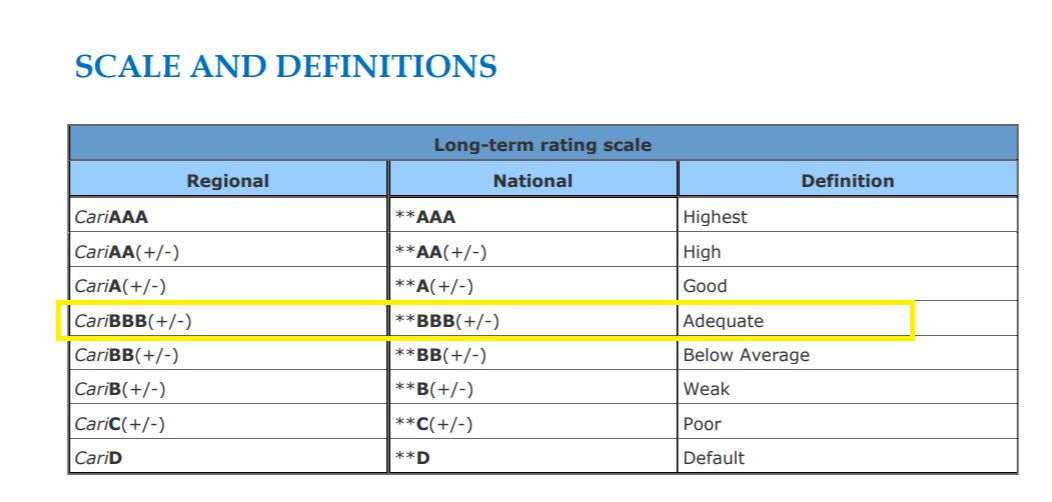

CariCRIS ratings

Saint Lucia’s current rating is “CariBBB-“ which is the bottom of the “Adequate Category”. Another downgrade would result in Saint Lucia’s debt rating falling to CariBB+ which would be categorized as “Below Average” category. A “Below Average” debt rating could significantly impact Saint Lucia’s borrowing capacity.

When this administration was elected on June 6th 2016, more than 5 years ago Saint Lucia’s CariCRIS rating was higher at CariBBB. This administration will enter the 2021 election with a lower CariCRIS rating than when they were elected more than five years ago. The prime minister argues that a lack of 2nd CariCRIS downgrade in less than 12 months implies that CariCRIS is affirming the current government policies. He failed to mention that Saint Lucia’s debt rating is lower in 2021 than in 2016 and CariCRIS did not increase Saint Lucia’s rating back to CariBBB during this most recent report because the current management of debt by his administration.

The downgrade from July 2020 of Saint Lucia’s debt rating also had knock-down effects such as a downgrade of Lucelec’s rating by 1 notch to “CariBBB-“ in January 2021 “Additionally, COVID-19 is expected to lead to a worsening fiscal deficit and a rise in public debt. The pandemic has also resulted in reduced electricity consumption in Saint Lucia, leading to a decline in LUCELEC’s core operating revenue and profitability. Further, increasing receivables outstanding from the Government of Saint Lucia (GOSL) and other segments of the economy constrains LUCELEC’s operating cash flow, leading to a reduction in the Company’s debt service metrics.”

Rating sensitivity factors

Factors that could, individually or collectively, lead to an improvement in the ratings and/or outlook include:

- Substantial changes in the debt levels leading to a debt to GDP ratio below 65 percent;

- Achievement of a balanced budget over the medium term;

- Sustained GDP growth of the order of 3 percent per annum or more (above pre-COVID- 19 level).

Factors that could, individually or collectively, lead to a lowering of the ratings and/or outlook include:

- Significant changes in the fiscal position leading to a deficit larger than 15 percent of GDP;

- Substantial changes in the debt levels leading to a sustained debt to GDP in excess of 90 percent alongside a decline in debt servicing to 2 times.

Sovereign debt rating impact

Sovereign credit rating is an independent assessment of the creditworthiness of a country and is directly correlated to the cost of borrowing. It has been estimated that a single notch sovereign debt rating downgrade can increase financing costs for countries issuing bonds by as much as 25 percent. Sovereign credit ratings are also important because these assessments affect the ratings assigned to borrowers including other corporations of the same nationality (eg. the LUCELEC rating downgrade).

Conclusion

The escalating debt for Saint Lucia continues to remain a major concern. While Saint Lucia avoided a double downgrade to “below average”, we are still precariously positioned despite the supporters of this administration considering this “good news”. From the Saint Lucia 2021 Bond Prospectus “In June 2020, CariCRIS lowered the assigned ratings of several debt programmes of the Government of Saint Lucia (GOSL) by one notch to CariBBB- (Foreign Currency and Local Currency Ratings)”.

There has also been no clear plan and strategy or timeline presented on when and how Saint Lucia’s debt rating would be improved particularly given the upcoming challenges as a result of hurricane Elsa. The next administration will need to ensure that debt management is a top priority.

Source: The St Lucian Analyzer