By BDC

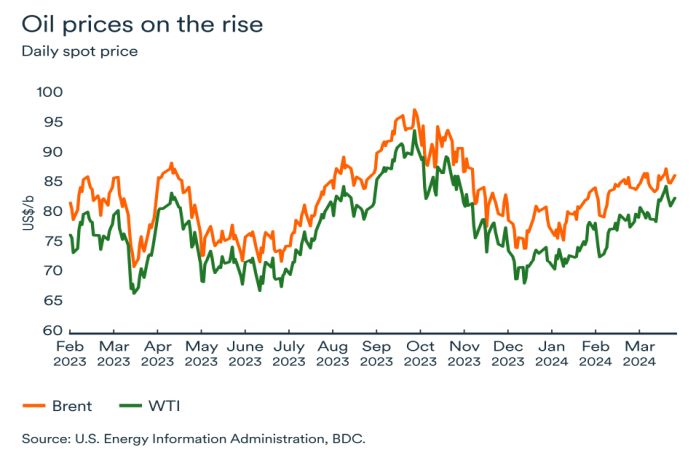

MONTREAL, Canada – Both global crude price benchmarks moved higher in March. Brent began March at US$83 a barrel and reached US$88, representing an increase of 2 percent month-over-month and a gain of almost 20 percent the same period last year.

The same was true in the United States, where West Texas Intermediate (WTI) futures closed March above US$82 a barrel, the highest level in nearly six months.

OPEC maintains restrictions

Despite efforts to cut oil production, OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) fell short of its March reduction target by around 190,000 barrels per day (bpd).

Members of the group will have the opportunity to review the voluntary cuts on June 1. Until then, the production restrictions will amplify the disruptive effects on oil market from the geopolitical conflicts raging around the world.

The market expects OPEC+ to maintain its cuts during the first half of the year. Russian production cuts following Ukrainian drone attacks on its refineries could push the price of Brent to $100 a barrel this year. Ukrainian strikes on Russian refineries may have disrupted more than 15% of Russian capacity. Russia is the third largest oil producer in the world, behind the United States and Saudi Arabia, and the largest oil exporter.

Although crude inventories are still well stocked, the market for refined products is under considerable pressure. Refining capacity is limited by the situation in the Red Sea and Russia. Therefore, petroleum products, not crude oil, are the real short-term challenge.

Renewed demand

Fears of recession around the globe are fading fast and monetary policy tightening appears to be coming to an end. As a result, the outlook for global oil demand is being revised upwards.

The resilience of energy demand has probably been underestimated and is a significant factor in explaining the recent rise in prices. Prices had remained low for months due to expectations of a decline in demand, despite OPEC’s production cuts of over two million bpd and forecasts of a slowdown in US shale growth. Now the tide is turning.

Bottom line…

OPEC+ failed to meet its production reduction targets in March but rising geopolitical tensions and stronger global demand as recession fears fade have put upward pressure on oil prices. The refined products market is particularly tight and oil prices could continue to rise in the coming months.