Prime minister and minister for finance, corporate governance and public-private partnerships, Gaston Browne, on Thursday, January 28, 2021, presented the 2021 budget statement, amid the “overriding issue on everyone’s mind is COVID-19 – and its devastating effects”.

In this final series, the budget 2021 projections and allocations are detailed.

By Caribbean News Global contributor

ST JOHNS, Antigua – The estimates of revenue and expenditure for 2021, which support a set of policies that are consistent with the imperatives for recovery, transformation, and resilience. This budget introduces no austerity measures, nor does it cut back on social sector spending on health, education and public services. The budget also introduces no new taxes on our people.

It merely strengthens tax administration and improves tax compliance. We are also tightening up on the collection of taxes and duties that have always been payable, except that payment has been evaded or exemptions sought.

This budget provides for an overall resource requirement of $1.4 billion. This represents a decrease of 18 percent, or approximately $300 million, when compared to total estimates for 2020. This reduction is not due to the government’s reduction in service delivery, but an adoption of more efficient measures of service delivery.

The budgetary and fiscal position points to an overall deficit of 3.4 percent of GDP or $133.7 million, and a primary deficit of 0.8 percent of GDP or $30.5 million.

With the implementation of our fiscal strategy, there will be increases in revenue over the fiscal year 2020 in some of the major components of tax revenues. We also project an increase in CIP receipts in 2021 and the budget includes disbursements from the Caribbean Development Bank (CDB) and committed grants that will finance a large part of the capital programme.

Revenue

Total revenue is expected to improve gradually during this fiscal year.

Recurrent revenue is estimated at $872.5 million for 2021, which is a 17 percent increase over the $745.8 million generated in 2020.

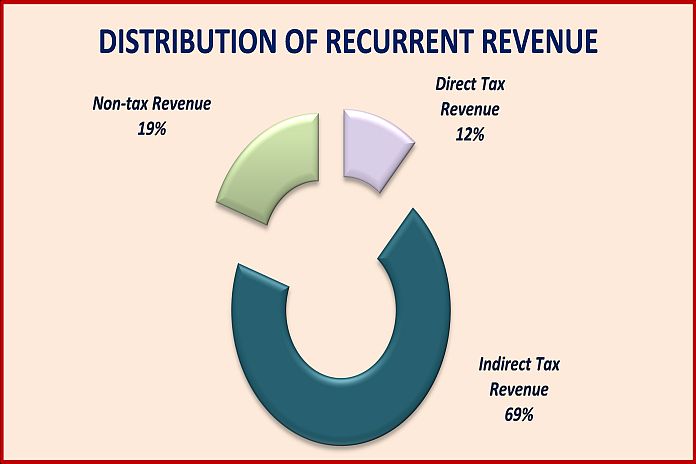

The components of recurrent revenue are:

- Indirect Tax Revenue – $604.2 million;

- Direct Tax Revenue – $98.5 million;

- Non-Tax Revenue – $169.0 million.

The Customs and Excise Division and the Inland Revenue Department are tasked with the all-important responsibility of delivering this revenue performance. The amount budgeted for capital receipts is $7 million, while grant funding for Fiscal Year 2021 is budgeted at $82.1 million.

Expenditure

Estimated recurrent expenditure, excluding principal payments, is $928.1 million. Therefore, a current account deficit of $55.6 million is projected for 2021.

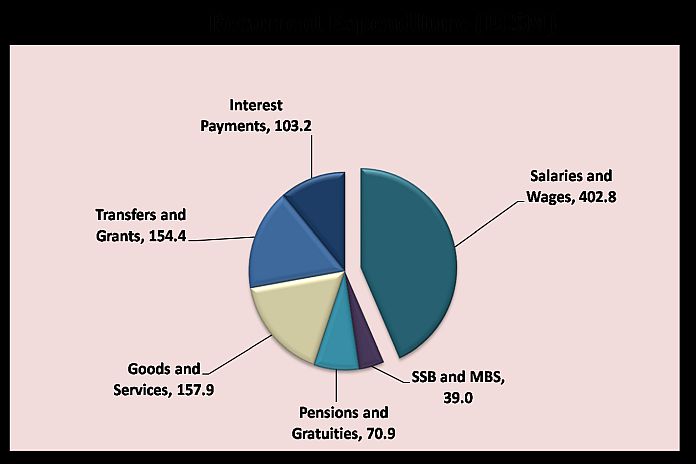

The components of recurrent expenditure are:

- Wages and Salaries – $402.8 million;

- Transfers and Grants – $154.4 million;

- Pensions and Gratuities – $70.9 million;

- Goods and Services – $157.9 million;

- Interest Payments – $103.2 million;

- Statutory Contributions – $39.0 million.

Government’s capital budget for 2021 is $167.2 million, which is a 62 percent increase over the $103.3 million spent on capital projects in 2020. This increase in capital spending is part of the government’s strategy to promote economic activity while we await a rebound in the tourism sector.

Spending on road works will amount to $31.9 million in 2021 and $43 million has been allocated for major repairs and maintenance to government buildings and to improve climate resilience of critical government infrastructure.

Ministry allocations

Parliamentary representatives with responsibility for ministries will present details of the programmes to be executed in 2021 when they contribute to the debate on this budget. However, the main allocations made in budget 2021 are as follows:

The ministry of education, science and technology has the highest budgetary allocation of $143.1 million. Included in the allocation for this ministry is $18 million, to support the UWI Five Islands Campus.

The ministry of health, wellness and the environment receives the second-largest allocation of $113.4 million.

The office of the attorney general, ministry of justice and legal affairs, public safety and labour has the third-highest allocation of $98.8 million.

The ministry of works is allocated $85.0 million to continue to manage and maintain public infrastructure.

The ministry of tourism and economic development is allocated $25.1 million.

The ministry of information, broadcasting, telecommunications and information technology is allocated $14.8 million.

The ministry of housing, lands and urban renewal is allocated $4.7 million.

The ministry of foreign affairs, international trade, and immigration is allocated $37.9 million.

The ministry of social transformation, human resource development, youth and gender affairs is allocated $22.1 million.

The ministry of agriculture, fisheries and Barbuda affairs is allocated $16.4 million.

The ministry of civil aviation, energy and transportation is to receive $8.7 million.

The ministry of sports, culture, national festivals, and the arts is allocated $22.2 million.

The 2021 budget also includes allocations for:

- Office of the Governor-General – $1.7 million

- The Legislature – $2.2 million

- The Cabinet – $3.8 million

- The Judiciary – $2.4 million

- The Service Commissions – $908,000

- Audit – $1.1 million

- Electoral Commission – $4.1 million

- Ombudsman – $634,000

- Public Debt Payments – $457.7 million

- Pensions and Gratuities – $69.1 million

I take the opportunity now to speak of the allocations and their purposes for the office of the prime minister, which is allocated $34.4 million and the ministry of finance, corporate governance and public-private partnerships, which is allocated $111.9 million.

Included in the amount budgeted for these ministries is, $16 million for the prime minister’s scholarship programme. The budget for the ministry of finance also includes an allocation of $6.5 million for the Barbuda Council.

Priorities in 2021 for these ministries include:

- Ensuring Antigua and Barbuda’s compliance with international AML/CFT standards and successful completion of the FATF Mutual Evaluation re-rating. This effort will be spearheaded by the ONDCP.

- Identifying and accessing financing for the fiscal strategy and Government’s development initiatives.

- Undertaking preparatory work for the population census which has been postponed until 2022.

- Reforming the national procurement system for improved contract management.

- Preparing the 2022-2025 Medium Term Development Strategy.

- Executing the Authorized Economic Operator/Trusted Trader Programme.

- Ensuring timely submission of Government financials to the Director of Audit

Continuing the work of the government’s wage negotiation team will also be a priority in 2021. It is anticipated that the negotiations with bargaining agents for public sector employees will be concluded by the next financial year.

Financial budget 2021

Budget 2021 has a financing requirement of $480.6 million. This will be financed by $228 million from Securities issued on the Regional Government Securities Market and loans and advances of $252.6 million.

Conclusion

This is a budget delivered in challenging times. However, notwithstanding the devastation of the COVID-19 pandemic in 2020, and the effects that will reverberate for years to come, we remain optimistic that our economy will recover. That is the goal to which we are working.

The present outlook suggests a minimum of three percent expansion in economic activity in 2021, if the impact of the pandemic dissipates, and barring any other further disasters.

We will rise to this moment. We will get through this together. This budget lays the foundations for advancement tomorrow. In 2020 circumstances changed dramatically. But the people of this nation have not. We are tough, we are resilient, and we are resourceful.

The road to recovery will be hard – but there is a plan, and, with it, a path to be pursued. Our plans laid out in this budget will keep our people safe and healthy; secure rapid economic recovery; restore and create new jobs, and return the vibrancy and dynamism that is distinctively Antiguan and uniquely Barbudan.

We will not be cowed, nor will we be paralysed by this pandemic. Together we will build back Antigua and Barbuda better, brighter and stronger than before.

Related: Part 3