By Evan Papageorgiou and Maria Gonzalez

After economic shocks, it’s time for this small Pacific island nation to proceed with bold reforms and policy decisions. Support from global institutions and bilateral partners will be crucial in this effort.

Vanuatu, the Pacific archipelago nation of about 350,000 people between Australia and Fiji, finds itself at a crucial crossroads.

The IMF’s recent staff report on Vanuatu reveals an economy grappling with a series of shocks: two destructive tropical cyclones last year; the fallout from the effective bankruptcy of its national airline, Air Vanuatu; and the challenges brought about by declining proceeds from its Economic Citizenship Program, or ECP, the nation’s citizenship-by-investment plan.

The current headwinds are not new, but rather, long-term adverse risks that finally have materialized. Air Vanuatu’s financial and operational weaknesses preceded the pandemic and culminated with the company’s bankruptcy in May 2024 – a blow to the island’s connectivity and tourism industry, as well as its domestic and international labor mobility and cargo networks.

Likewise, the severe challenges to financial integrity and dependence on unsustainable proceeds created by the ECP have long been in the making amid governance deficiencies and have now resulted in a significant decline of fiscal revenue (to 5 percent of GDP in 2023 from 14 percent in 2020). This year, annual real GDP growth for Vanuatu is expected to be only around 1 percent, and its current account deficit will likely widen to about 7.5 percent of GDP, although there is significant uncertainty to these forecasts.

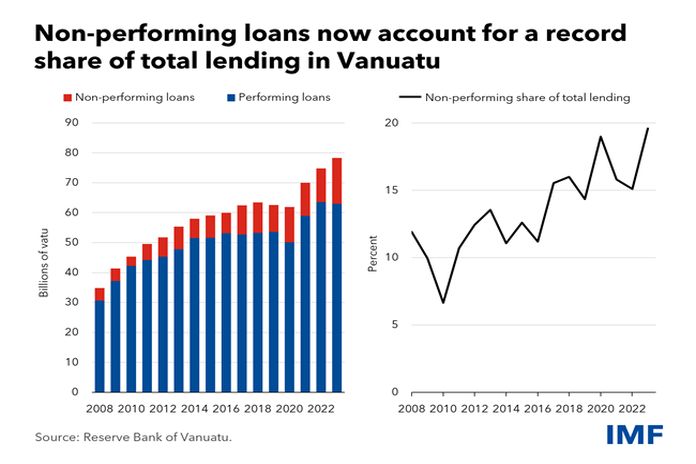

These shocks have crystallized in Vanuatu amid other brewing risks, and debt sustainability has deteriorated, leaving public and externally held debt at a high risk of distress. Moreover, despite solid bank profitability and capital levels, one in five bank loans are deemed by their lenders to be in trouble.

Evan Papageorgiou is the IMF’s mission chief to Vanuatu, and Maria Gonzalez is an assistant director in the Asia-Pacific Department.