SAN FRANCISCO–(BUSINESS WIRE)–Home valuation fintech pioneer HouseCanary today announced the continued review of data from the HouseCanary platform of 44 states and the District of Columbia with sufficient property listing and transaction volume. This issue of Market Pulse compares data between the week ending June 12, 2020, and the week ending March 13, 2020, detailing 22 listing-derived metrics.

Weekly new listing volume of single-family detached homes was down 17.5% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented. Additionally, new listing volume is down 8.4% this week from last week, and up 33.4% from its lowest level during the week ending April 17. Since the beginning of COVID-19, the week ending March 13, through the week ending June 12, there have been 747,781 net new listings placed on the market. For the week ending June 12, there were 57,887 net new listings placed on the market.

For the week ending June 12, the weekly volume of listings going into contract for single-family detached homes was up 28.1% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented. Weekly volume of listings going into contract is up 90.6% from its lowest level during the week ending April 10. Since the week ending March 13, a total of 851,904 properties have gone into contract across 45 states since the week ending March 13. For the week ending June 12, there were 79,258 listings that went under contract nationwide.

The weekly volume of listings removed for single-family detached homes was down 24.3% nationwide compared to the week ending March 13. Weekly volume of listing price cuts for single-family homes was down 4.5% nationwide compared to the week ending March 13. In the weeks following March 13, there was an increase in the number of listings removed from the market and a corresponding decrease in the number of price cuts to listings as would-be home sellers chose to remove their listings from the market entirely rather than keep them on the market at a discounted price. Both metrics have stabilized and have settled back into pre-COVID levels, where they have remained since mid-April.

All of this activity has culminated in a tight supply of homes listed for sale which has helped stabilize prices in many markets through the weeks following March 13. It has remained relatively constant over the entire period since that week.

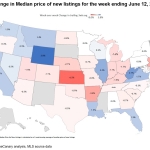

Breaking the trend of upward price trajectories seen over the past several weeks, price growth in the majority of states has started to revert. Using a 3-week moving average, we can see that for 27 out of the 45 states, median housing prices for newly listed properties fell relative to the price recorded the week prior. The majority of states, 27 out of 45, experienced a drop in the median price of newly listed properties, leaving 13 states with a rise in price and five in a steady state over the week ending June 12. The most notable week-over-week new list price declines were seen in DC, falling 8% after a 6.5% decline the week prior. Kansas and Rhode Island’s prices also retracted by nearly 6% week-over-week. In contrast, the upticks in median new list prices were smaller in magnitude, with the largest in Wyoming of 3.8%, followed by West Virginia capturing a 2.7% increase versus the week prior.

“As more states across the country enter ‘Phase Two’ of re-opening, the initial shock of COVID-19 in the housing market has worn off,” said Jeremy Sicklick, Co-Founder and CEO of HouseCanary. “Pent up demand from the spring selling season along with historically low interest rates have driven contract volume up dramatically from its lowest level in mid-April and back to pre-COVID levels.”

As a nationwide real estate broker, HouseCanary’s broad multiple listing service (MLS) participation allows us to evaluate listing data and aggregate the number of new listings as well as the number of new listings going into contract for all single-family detached homes observed in the HouseCanary database. Using this data, HouseCanary continues to track listing volume, new listings, and median list price for 45 states and 48 individual MSAs.

HouseCanary will continue to monitor these and other economic indicators for the U.S. housing market and local markets weekly and report results to the news media. HouseCanary is committed to sharing trusted, real-time information given how quickly the housing markets are evolving. For more information about the data that HouseCanary is following, please visit www.housecanary.com.

About HouseCanary:

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.

Contacts

Denise Dunckel

press@housecanary.com