GENEVA, Switzerland – The soaring cost of development finance is stalling progress and deepening inequalities, UN Trade and Development (UNCTAD) secretary-general Rebeca Grynspan said on 25 November, calling for urgent action.

“Behind these macroeconomic terms and policy debates lie real people – men, women and children whose lives are profoundly affected by the decisions we make here,” Grynspan said, opening a high-level meeting in Geneva, Switzerland.

The three-day session brings together senior officials from governments, development banks, credit rating agencies and international organizations, alongside finance experts and academics to address the high costs of finance for developing countries.

‘Not just a symptom’

The meeting takes place in a challenging landscape of global growth that is too low to meet development needs, high levels of debt across the Global South, weak foreign investment, fragmented trade and geopolitical tensions.

“The high cost of finance is not just a symptom but a significant contributor to the challenges we face,” Grynspan said, describing it as a structural issue. High borrowing costs constrain growth and drain financial resources.

Developing countries are grappling with soaring debt payments, volatile currency markets and tighter global financial conditions that limit investments in infrastructure, social services and climate action.

Their external interest payments surged in 2023. Low- and lower-middle-income economies – also referred to as frontier-market economies – saw a 42 percent increase and other developing economies faced a 112 percent spike.

Between 2010 and 2023, frontier-market economies’ external interest costs rose by an average of 15.5 percent annually – double the rate of other groups.

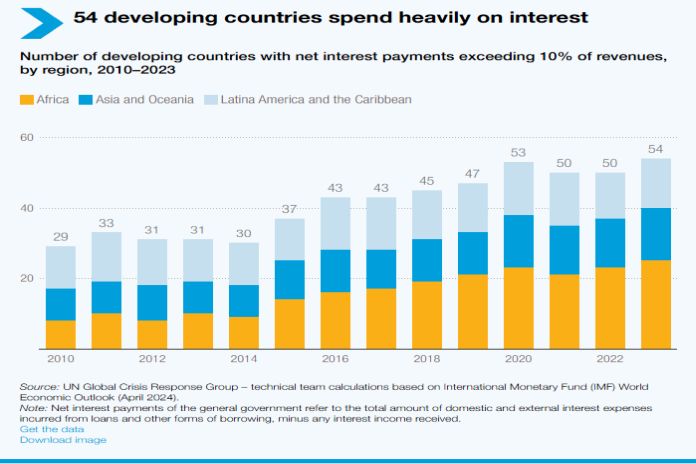

Moreover, in 2023, a record 54 developing nations dedicated a minimum of 10 percent of government funds to debt interest payments.

“In a world where 3.3 billion people live in countries that spend more on debt servicing than on either health or education, this is a particularly worrying issue,” Grynspan said.

Entrenched inequalities

High capital costs are often attributed to developing countries’ higher risk, but much of this risk stems from external factors, Grynspan explained.

Limited access to foreign currencies, conditional lending and lingering debt from past crises like the COVID-19 pandemic leave many developing nations ill-equipped to respond to shocks, driving up their borrowing costs.

“The same hurricane may hit Miami and Haiti, but the devastation will be very different,” she said, adding that high capital costs in the Global South reflect an international financial architecture that treats countries unequally and lacks a universal safety net.

This exacerbates existing inequalities. Africa faces financing costs two to four times higher than the US average and up to 12 times higher than Germany’s, according to the UN report “A world of debt”.

“If development is a race, then high capital is like wearing heavy shoes,” Grynspan said. “Those furthest behind carry the heaviest shoes and are therefore least able to catch up.”

Agenda for action

The meeting will address systemic drivers of high financing costs, including the role of foreign exchange markets and the privilege of a few major currencies.

The US dollar, for example, accounts for 70 percent of international transactions. Since most developing economies don’t issue international currencies, they’re exposed to higher volatility and risk premiums, which inflate borrowing costs.

To mitigate these risks, many developing countries hold large foreign currency reserves – a costly approach that diverts funds from vital domestic investments and channels scarce savings to wealthier nations.

Another topic on the agenda is the impact of sovereign credit ratings on the cost of borrowing.

Developing countries pay on average an estimated 200 basis points more than developed countries for comparable credit ratings.

These ratings often determine whether a country can access capital. For example, 22 African countries remain unrated by international credit agencies, limiting their access to capital markets.

Innovative tools and solutions

Discussions will explore solutions, such as how international financial institutions and development banks could improve access to affordable, long-term finance.

Projects involving multilateral development banks in public-private partnerships see capital costs drop by 40 percent, according to a UN Trade and Development report. The UN secretary-general’s SDG stimulus initiative calls for these banks to boost their annual lending capacity to at least $500 billion by 2030.

The meeting will also examine how innovative tools, such as debt-for-development swaps, blended finance and green bonds could lower financing costs in vital areas like food security, energy transition and digital infrastructure.

“There are lot of things we can do together to lower capital costs and to face these challenges collectively,” Grynspan said.

Experts will draw on their diverse expertise to propose actionable policies at national, regional and international levels to reduce developing economies’ debt burdens and mitigate their financial vulnerabilities.

A pivotal moment

The meeting comes on the heels of the 29th UN climate summit (COP29), which ended on 24 November with developed countries pledging to contribute at least $300 billion annually to help developing nations safeguard their people and economies against the impacts of climate change.

Although the pledge triples the current $100 billion goal set to expire in 2025, developing nations said it was insufficient to address the complexities of the climate crisis.

The agreement, known as the New Collective Quantified Goal on Climate Finance, ultimately aims to mobilize $1.3 trillion per year from all sources by 2035.

Ahead of COP29, UN Trade and Development released new calculations showing developing countries would need $1.1 trillion annually in climate finance by 2025, rising to $1.8 trillion by 2030.

The meeting of experts on financing for development builds on momentum from the Paris Summit for a New Global Financing Pact and helps lay the groundwork for the 4th International Conference on Financing for Development, scheduled for June 2025 in Seville, Spain.

Grynspan urged participants to engage the discussions with a sense of urgency and purpose. “The high cost of finance translates to lost opportunities, diminished livelihoods, and unrealized potential.”