By FocusEconomics Insights

ASIA – The JPMorgan Global Manufacturing PMI suggested that supplier delivery times reached a survey record high in October, which continued to spark producer price pressures as input costs rose at the highest level in 13 years and output charges rose to a fresh record high.

Global supply chains have been fractured since the start of the pandemic as closed borders, factories and warehouses left manufacturing firms struggling to source inputs. More recently, as economies have begun to reopen, a surge in shipping container costs and shortages of critical inputs such as semiconductors and skilled labor have caused further turmoil for suppliers. Consequently, supply chains are now facing a different set of complications, which will likely continue to plague manufacturers well into next year.

The rise in suppliers’ costs is having a greater impact on consumer prices. In September, the latest available data US core personal consumption expenditure inflation reached the highest level in 30 years, predominately driven by core durable goods inflation hitting one of the highest levels on record, as well as strong wage growth further stoking price pressures. Moreover, US headline inflation jumped to a 31-year high in October, which suggests some previously determined transitory price pressures may be here to stay.

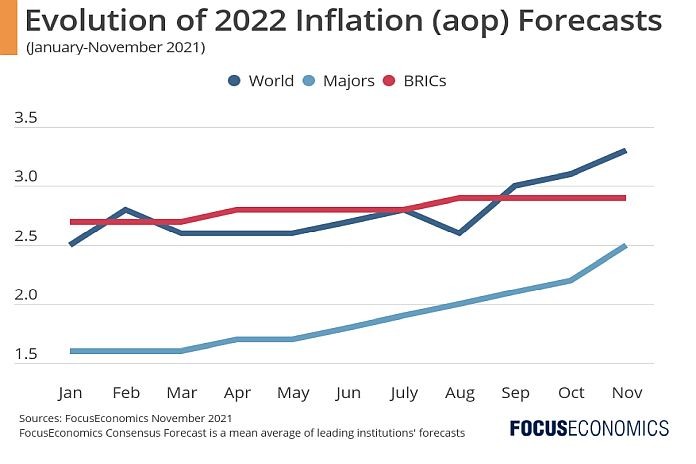

Looking ahead, our panel of analysts sees global inflation moderating from a projected 3.9 percent in 2021 to 3.3 percent in 2022, with the 2022 figure significantly up on the 2.5 percent projected at the start of the year. Price pressures are seen moderating mostly in developed economies, while inflation among the BRIC economies is expected to accelerate.

Although logistical disruptions are expected to ease next year, considerable headwinds persist given the fragility of supply chains, recent weather-related disruptions, power outages and climate policies in China, and the “energy crunch” pushing crude oil and natural gas prices up in key European markets.

Insights from Our Analyst Network

Commenting on the semiconductor shortage, analysts at Goldman Sachs, noted:

“Semiconductors have been the most important input in short supply because of their many downstream uses, especially in autos. Recovery here will come in three stages. The first stage should begin in Q4 2021 as imports of semiconductors from Asia rebound from a Q3 dip caused by Covid-related factory shutdowns, which should restore US auto production to normal levels. The second stage will come in H2 2022 as new capital investment in existing semiconductor plants begins to yield more output. But a third stage of expanding capacity further with entirely new plants is needed to keep up with rapidly rising semiconductor demand, and this will take until well into 2023.”

Furthermore, commenting on goods inflation in the short term, economists at ING, said:

“Pipeline pressures for goods inflation have mounted to historic highs and have started to translate into higher consumer prices. The extent to which this will ultimately be priced through depends not only on higher input costs, but also on whether businesses prefer to squeeze margins to maintain volumes. The latter is less of an option the longer the disruptions continue, which means that we expect goods inflation to further increase over the coming months and to remain elevated throughout the first half of the year as pipeline pressures remain fierce.”