By Farah Hussain and Abhishek Joseph

The need for sustainable finance in emerging markets

Emerging market economies require USD 6.9 trillion to USD 7.6 trillion between 2023 and 2030 in order to achieve the Sustainable Development Goals. Additionally, intergovernmental organizations and research institutes worldwide estimate that global investments up to USD 275 trillion will be required between 2020 and 2050 to reduce greenhouse gas (GHG) emissions to net zero by 2050.

Sovereigns in emerging markets are recognizing the need for additional finance and exploring a myriad of options, including borrowing from the capital markets through dedicated sustainable financing instruments that earmark proceeds for specific types of projects. Since 2016, twenty-six emerging market (EM) sovereigns have issued green, social, and sustainability (GSS) bonds amounting to USD 125 billion, as of 30 June 2024. A key aspect of these labeled bonds is that issuers need to report the use of proceeds and the social and environmental impacts of projects and activities supported.

The necessity for allocation and impact reporting

The allocation and impact report provides investors with insights on how bond proceeds are being used by issuers and how they are contributing to the sustainability agenda the investor is interested in. It helps alleviate their concerns about sustainability and reputational risk. Inadequate disclosures can discourage investors and hurt the integrity of the market.

Given the pivotal role reporting plays in enabling the integrity and growth of the labeled bond market, the World Bank Treasury’s ESG and Sustainable Finance Advisory Services Program undertook a comprehensive analysis of allocation and impact reports published by EM sovereigns. The study, combined with surveys of sovereign issuers (public debt management offices) and investors who are active in the space, aimed to identify transparency gaps and opportunities to improve reporting practices as part of the Program’s work to promote the development of sustainable capital markets.

Types of eligible green and social projects

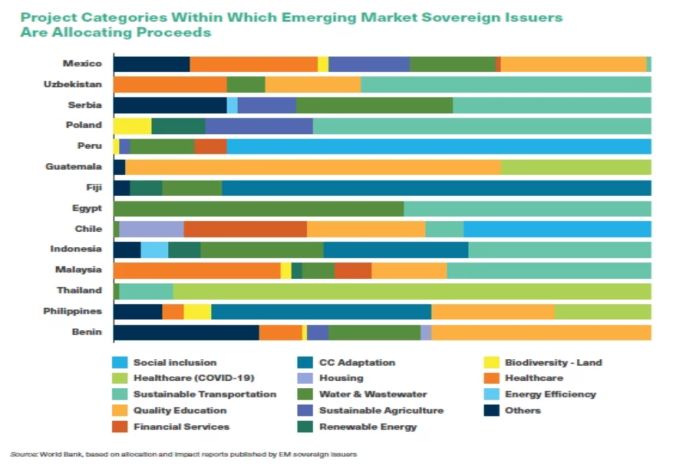

The proceeds from these bonds support specific eligible environmental or social projects that contribute towards the achievement of Sustainable Development Goals and climate challenges. During the period studied, EM sovereigns reported the allocation of USD 65.2 billion, 68 percent of which went to projects aimed at achieving social impact. The rest (32%) was allocated to green project categories. The following types of activities dominated the social categories: social inclusion measures for the disadvantaged (20%), healthcare response to COVID-19 (16%), quality education and training (13%), and enabling access to financial services (10%).

For example, Chile and Peru were the only EM sovereigns which allocated 35 and 80 percent of all of their sustainable bond proceeds to social inclusion measures for the disadvantaged, respectively. Guatemala, the Philippines, and Thailand meanwhile were the only emerging market sovereigns to allocate proceeds to the healthcare response to COVID-19 (18%, 89%, and 28% of the total use of proceeds of the issuers, respectively). Among the green categories, sustainable water and wastewater management is the most common use of proceeds, followed by sustainable transportation and sustainable management of living and natural resources.

Challenges with measuring impact performance

On average, sovereigns report on two or more impact metrics per project category. However, issuers are largely reporting outputs, rather than outcomes. In addition, only 30 percent of these indicators are aligned with the core indicators recommended by the International Capital Markets Association (ICMA)’s harmonized framework, which was developed with support from the World Bank, EBRD, KfW, and the Nordic Investment Bank to standardize reporting metrics and enable investors to easily compare impact across project categories. Moreover, only six issuers are reporting on GHG emissions or avoidance on relevant green projects and only two – Egypt and Serbia – linked the impact metrics to overall country climate targets.

The way forward

The growth and resilience of the GSS bond market lies in the transparency it offers to investors through post-issuance reporting. The majority of investors consider publication of post-issuance reports as a critical criterion. The most cited factors that influence investment decisions are gaps between the current situation and achievement of the Sustainable Development Goals (SDGs), the ambitiousness of those goals, and progress toward the goals; environmental, social, and governance (ESG) ratings; Nationally Determined Contributions (NDCs); and ambitious GHG reduction targets.

The majority of investors prefer projects that can help a sovereign close the gaps in its SDGs, particularly climate targets within the subset of environmental categories. Issuers therefore must take due consideration when allocating proceeds towards project categories and demonstrate how the expected impact of the project is enabling the achievement of the country’s climate goal and reduced the gaps in its SDGs.

Transparency and good quality reporting through post issuance allocation and impact reports provide investors with greater conviction not just on the GSS bonds, but also at the issuer level when they are investing in plain vanilla bonds. With the GSS bond market expected to grow and further diversify with innovative sustainability products, the report recommends that EM sovereign issuers and their financial partners ensure that allocation and impact reporting for these bonds adheres to market standards and recommendations of disclosure and transparency, providing investors with easily accessible, interpretable information.

Read more about the findings of the study and the surveys in the report ‘Trends in Allocation and Impact Reporting.’

Sustainable finance and ESG advisory program

The World Bank Treasury Sustainable Finance and ESG Advisory Services Program works with policy makers, ministries of finance, regulators, central banks, supervisors, and World Bank project teams to develop sustainable financial systems by:

- Advising on green financing strategies and action plans;

- Helping borrowers consider sustainable financial instruments;

- Facilitating issuance of GSS bonds;

- Building the capacity of borrowers to engage with investors who incorporate ESG considerations into investment decisions;

- Publishing knowledge products to share good practices and guidelines.

The program has support emerging market issuers through various mediums: providing e-learning on sustainable finance solutions, guidance on investor engagements, guidebook on green bond proceeds management and reporting, and advisory on developing a national green taxonomy.

![]()