By BDC

MONTREAL, Canada – Recovery from the short but deep recession caused by the COVID-19 pandemic is proving to be more difficult than anticipated a year ago. In 2022, the question has shifted from “is this the end of the pandemic” to “are we in a recession.”

The simple answer for Canada is that we’re still not in a recession. And while the economic outlook has darkened in recent months, the economy can still avoid slipping into negative growth. The year 2023 will, however, be characterized by a slowdown and a great deal of uncertainty. A slower economy is necessary to counteract inflation but will policymakers go too far?

The legacy of a turbulent year

Before making predictions, it’s always important to know where we stand. It’s now clear that 2022 was a turning point for the global economy. The war in Ukraine, the resulting sanctions on Russia and a sharp slowdown in China all weighed on global growth as the year progressed. High inflation forced central banks to raise interest rates sharply to bring down inflation.

The European economy suffered a serious setback due to the invasion of Ukraine in late February 2022 and continues to face a major energy crisis. The US economy, meanwhile, was hurt by consumer pessimism and caution in the face of high inflation, interest rate hikes and a declining stock market. US GDP declined in the first two quarters of the year, but a rebound in the second half helped offset the earlier losses.

The Canadian economy in 2022 proved resilient despite global problems and growing uncertainty. Growth was supported by a strong recovery in the labour market, household savings, high commodity prices, increased business investment and pent-up demand for services following the end of COVID restrictions.

What can we expect in 2023?

While there is some disagreement among economists about whether we are headed for a recession, there is consensus that the economy will slow in 2023. The source of the slowdown is the Bank of Canada’s fight against inflation. Interest rate hikes are expected to continue in the new year, but there’s a lot of uncertainty about how much further the bank will go.

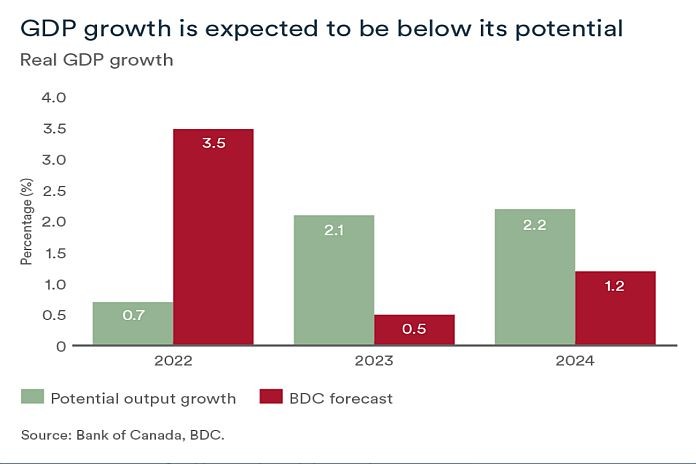

The recipe for bringing inflation back to the bank’s 1-3 percent target appears simple on paper—tamp down demand enough to allow for supply to catch up. This implies engineering below-potential GDP growth, estimated by the Bank of Canada to be about 2.0 percent in 2023 and 2024. In practice, it gets more complicated.

Households and businesses will be cautious

Household spending is the main engine of economic growth. While consumption typically accounts for about 60 percent of GDP growth, we estimate it accounted for nearly 80 percent in 2022.

During an economic downturn, employed individuals tend to spend less and save more for fear of layoffs. Indeed, even though household savings have slowed from their peak in 2020, they are still significantly higher than before the pandemic.

Rising interest rates have pushed down the stock market and home prices and these downturns are making people feel less wealthy and weakening their enthusiasm for spending that came with the reopening of the economy.

The slowdown will therefore hurt business sales. While most businesses are well-positioned financially and consider themselves prepared for a potential recession, the first quarter of the year will be critical for testing their resilience. A more pronounced decline than expected could lead them to cut their investment plans for the year.

Policy rate to reach 4.5 percent

While Canadians will be happy to see the progress made in the fight against inflation so far, there’s still a long way to go. The Bank of Canada raised its policy rate by 350 basis points in 2022 and inflation has been slowing since June.

We expect the policy rate could go as high as 4.5 percent next year before the central bank takes a break and allows time for past hikes to work their way through the economy. However, a change in the central bank’s course could come earlier than expected in the new year.

As demand slows and core inflation stabilizes, Canada could benefit from lower interest rates before the end of 2023. However, we believe it will take another 18 months before the Bank of Canada’s policy rate return to the neutral level of 2.5 percent.

Towards a rebalancing of the labour market

Typically, an economic downturn is accompanied by an increase in the unemployment rate. Layoffs increase as companies cut back on production. However, Canada still had around one million job openings in September. Thus, a contraction in the labour market is more likely to translate into fewer hours worked and less demand for staff.

Since there are continuing issues of matching the skills of the available workforce with the needs of businesses, a downturn in the labour market will be less pronounced than during similar periods of economic contraction in the past.

No recession, but low growth

At BDC, we expect economic growth to stagnate, but not contract thanks to the economy’s still solid fundamentals. Therefore, our most plausible scenario for Canada is for annual GDP growth of 0.5 percent in 2023, including one or two negative quarters.

The slowdown will be most pronounced in residential investment and goods consumption. Energy and food prices will also continue to eat into household incomes and the pent-up demand for services left over from the pandemic will fade as the year progresses. The Canadian dollar will remain relatively weak against the US dollar, which will favour exports at the expense of imports.

Since the downturn is being driven by tightening monetary policy, Canada has more control over its economic performance than in recent downturns, which were generated by external shocks such as the 2008-09 financial crisis and the pandemic.