By ECCB

BASSETERRE, St Kitts – The Eastern Caribbean Central Bank (ECCB) published its annual report and financial statements for the financial year ended 31 March 2023, recorded a net loss of $54.5 million for the 2022-2023 financial year, a $5.4 million increase over the previous financial year.

The deteriorated performance was largely driven by significant losses on foreign investment securities as interest rates in the United States rose dramatically from near zero over the financial year.

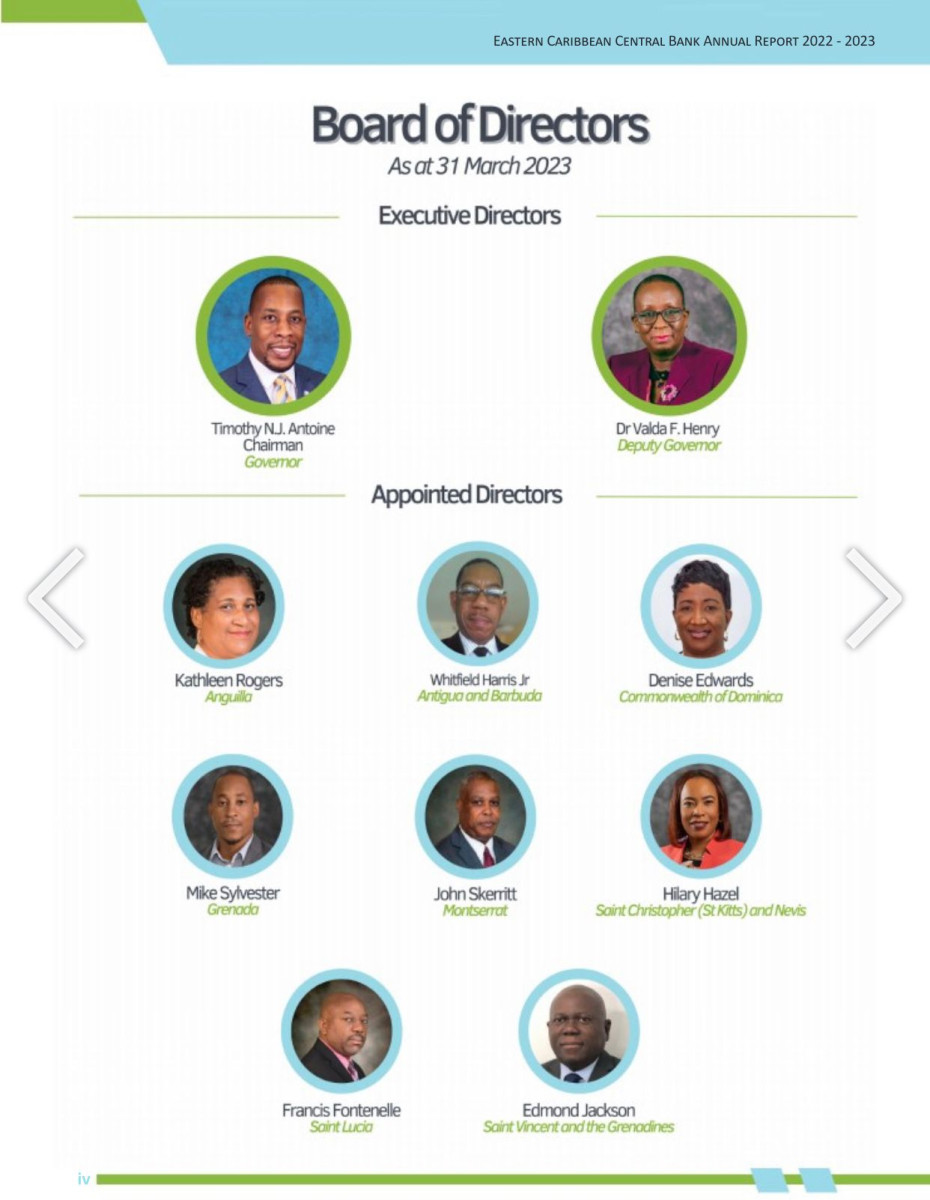

The Governor of the ECCB, Timothy N. J. Antoine says the 2023-2024 financial year will be a ‘bounce back’ year for the bank due to the projected slowdown or cessation of interest rate hikes by the US Federal Reserve, and elevated interest rates.

Governor Antoine confirms that the bank remains ever more committed to advancing its strategic goals in support of its member countries, which continue to face an extremely challenging economic and policy environment.

During the 2022-2023 financial year, the ECCB advanced a number of key initiatives, guided by it 2022-2026 strategic plan. Those included the development of a Payment System Vision and Strategy for the Eastern Caribbean Currency Union (ECCU); laying the groundwork for the establishment of an Office of Financial Market Conduct; and continued strong surveillance and vigilance, which has resulted in the maintenance of resilience and stability of the ECCU financial sector.

The bank also captured two prestigious international central banking awards; The Green Initiative Award for its Greening of the ECCB Campus Initiative, and the Communication Initiative of the Year Award for the production of its public education programme – ECCB Connects.

Looking ahead, Governor Antoine calls for a ‘Big Push’ across the region.

This ‘Big Push’ he says is a call to implement innovative and transformative policies and initiatives to double the size of the ECCU economy for the benefit of the people of the region.

The elements of the ‘Big Push’ are wealth creation; food and nutrition security; energy security; and digital transformation.

The ECCB’s 2022-2023 annual report and financial statements can be accessed here.