CASTRIES, St Lucia – The Eastern Caribbean Central Bank (ECCB) released their 2020 Annual Economic and Financial Review for various islands in the Eastern Caribbean. This report paints a difficult economic recovery road ahead for Saint Lucia. The subsequent material will summarize some of the data presented by the ECCB especially in comparison to other OECS islands. The facts presented is further evidence of the economic mismanagement by the current administration.

GDP decline

The ECCB report said: “Preliminary data indicate that the economy of Saint Lucia contracted by 23.8 percent in 2020 in contrast to growth of 1.7 percent in the previous year. Projections for 2021 point to a modest recovery, although uncertainties persist with respect to the evolution of the COVID-19 pandemic and the distribution and uptake of vaccines, both locally and internationally.”

Saint Lucia’s economy contracted significantly as it had the worst decline among all six independent Eastern Caribbean Currency Union (ECCU) countries. In addition, a combination of the current administration’s poor economic management and COVID-19 pandemic resulted in Saint Lucia’s GDP at the 2020’s end being less than the GDP in 2016’s end.

Furthermore, Saint Lucia is projected to only achieve its 2019’s GDP figure again in 2023, with its recovery taking longer than many other countries. This slow recovery is as a direct result of the current’s administration heavy focus on tourism centric projects and having little to do with the country’s economic diversification.

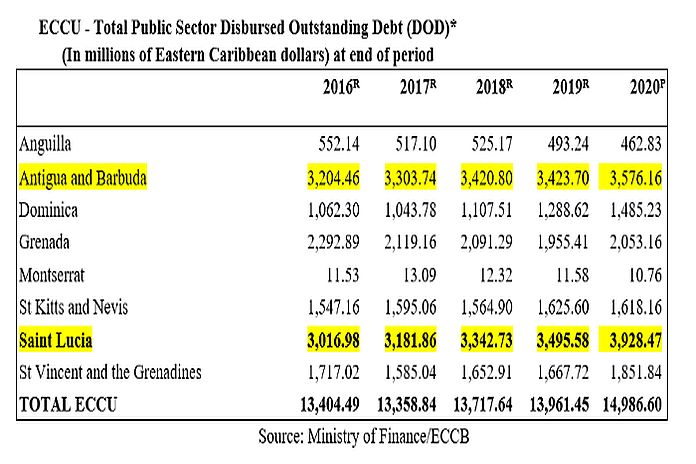

Debt updates

The ECCB report continued: “The total disbursed outstanding public sector debt increased by 12.4 percent to $3,928.5 million at the end of 2020. The increase in debt, coupled with a 23.8 percent contraction in economic output, resulted in a spike in the debt to GDP ratio to 89.8 percent, from 61.0 percent one year earlier. The higher debt stock was driven by the central government, whose balances rose by $414.0 million while public corporation debt grew by $18.9 million.”

Saint Lucia’s public sector debt has increased by more than $900 million (30%) from 2016 to 2020. When the current administration took office in 2016, Saint Lucia had the second-highest debt level of the ECCU and was $200 million below Antigua and Barbuda. At the end of 2020, Saint Lucia’s debt is $350 million greater than Antigua and Barbuda, and now Saint Lucia has the highest debt among the entire ECCU.

Saint Lucia’s debt increase accounts for more than 40 percent of the total debt increase in ECCU countries. This dramatic increase in debt from Saint Lucia has single-handedly brought up the average ECCU debt increase. The current administration has accrued significant debt that future Saint Lucian generations will be burdened with repaying.

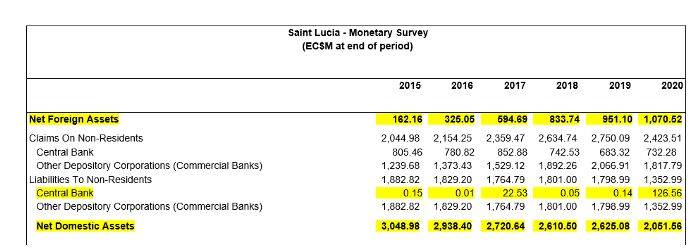

Asset quality of commercial banks and net foreign assets

The report also indicated some troubling information regarding the issue of non-performing loans which could limit any recovery in the upcoming years. “However, the asset quality of commercial banks deteriorated, with the ratio of nonperforming loans to gross loans increasing by 3.1 percentage points to 11.3 percent, moving further away from the ECCB’s 5.0 percent tolerable limit.”

Does the current government have any initiatives that would help mitigate non-performing loans? Saint Lucia’s ratio of non-performing loans to gross loans is now significantly greater than several of the ECCU islands such as Antigua (6.3%), Grenada (2.2%) or St Vincent (7.4%). Why is the economic management of the Saint Lucian economy grossly inadequate compared to other Caribbean islands?

Some other questions and observations include the following:

- Why has Net Foreign assets increased by $700 million (329%) from 2016 to 2020?

- Why has Net Domestic Assets fallen by almost $900 million (30%) from 2016 to 2020?

- Liabilities to Central Bank jumped to $126 million in 2020 from 0.14 million in 2019 which was also the most significant increase in the ECCU.

Saint Lucia appears to be the only ECCU country with such a major change in the asset profile in their monetary survey over the past five years. Was this the planned strategy of the current administration and if so, why?

As the performance of Saint Lucia seems to fare a lot worst than other Eastern Caribbean states, one ponders whether we are being led down a fiscal cliff. The picture painted by the ECCB is a grim one and begs the question, how will the current economy be managed to crawl out of such a debt hole. The urgency of this economic matter cannot be ignored and swept under the rug.

Saint Lucian’s will look to its leaders to implement a meticulously calculated approach for economic recovery, and this may require tougher decisions to limit the burden on our future generations.

Source: The St Lucian Analyzer

Wonder if some hacks will dare says that’s not true and these numbers are fabricated.

This is madness …