Vulnerable populations in poor states have historically been excluded from access to financial instruments, which are considered a key tool in escaping poverty. In Africa, the limited digital financial inclusion of women causes multiple social problems and economic disadvantages for over 400 million people. However, expanding mobile networks, and the digitalization of the financial sector together with continuing efforts to increase financial literacy on the continent through aid initiatives are contributing to women empowerment and increased gender equality.

In this article, we explore the key definitions of microfinancing and its growing accessibility in Africa, the financial inclusion of vulnerable population groups and the digital technologies this relies on, as well as the relationship between the increasing access to finance and gender equality, and women empowerment.

For years, women in the developing world, particularly in Africa, were mostly isolated from digital financial inclusion, with just one in four women having a bank account some 15 years ago. However, the rapid expansion of mobile technology, financial services, and financial literacy has facilitated great change.

In 2019, according to a G7 Partnership for Women’s Digital Financial Inclusion in Africa report, nations on this continent were amongst the pioneers of digital finance but the report concluded that 400 million people on the continent, mostly women, still struggled to access financial services.

Five years later, Global Findex data showed that the percentage of women in sub-Saharan Africa who had a financial account had doubled over the decade leading up to 2021, reaching 49 percent due to increasing digital money technology. The evolution of digital microfinancing continues to reduce the gender gap in financial inclusion by increasing accessibility to savings and loans, supporting entrepreneurial ventures, and improving financial literacy among sub-Saharan African women.

Digital microfinancing and financial inclusion

Digital microfinancing is the use of specialized digital platforms in combination with mobile technology to provide small loans and financial services to vulnerable populations. Digital microfinance walks hand in hand with financial inclusion as both aim to extend the access of the underserved populations to financial services. For the poor, the digitalization of financial services and access to savings, credit, and other financial services is vital to gain entry to the formal economy and serves as a pathway to economic security and empowerment.

See also: The effectiveness of microfinance programs in poverty reduction and economic development

The pillars of digital microfinancing in Africa

The growing access to digital microfinancing is due to the evolution of several specific tools and reforms within the African financial landscape.

- Expansion of mobile money: The growing popularity of electronic money, which can be transferred through mobile networks via SIM-enabled devices, mostly mobile phones, is evidenced by the fact that between 2014 and 2017, the number of sub-Saharan African adults with mobile money accounts nearly doubled, reaching 21 percent. Users use this tool mainly to pay bills and purchase goods.

- Growing number of female banking agents: Agent banking is an alternative to traditional brick-and-mortar bank branches. The agents act as physical contact points to enable customers to access banking services. As clients prefer to transact with agents of their own gender, the growing number of female agents motivates women to access and use financial services. The World Bank estimated an almost 400% growth of female agents to 1,200 physical contact points in 2018.

- Mobile wallet: This is an account that is accessed through a mobile phone, usually provided by a non-bank, which is linked to a pooled bank account that holds the user’s funds.

- Gender-based research: Microfinance institutions aim to confirm that their digital initiatives do not exclude the poorest women. According to 2019 data by the International Monetary Fund, the proportion of female borrowers was 31%, with significant diversity in the region.

The evolution of digital microfinance in Africa

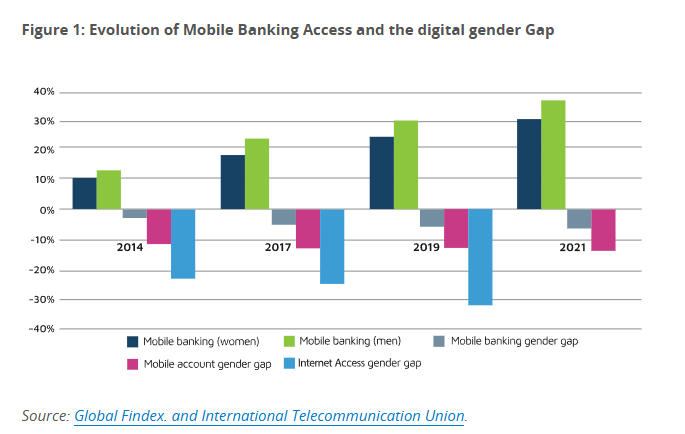

Between 2011 and 2017, the number of adults with banking accounts and those using digital financial services in Africa increased from 23% to 43%, driven largely by the expansion of mobile money. Some countries in Africa have also witnessed a sharp growth in financial inclusion levels with the number of women having bank accounts doubling in Kenya and increasing seven-fold in Ghana. More recently, between 2017 and 2022, nine out of 36 economies in sub-Saharan Africa experienced double-digit increases growth in account ownership which was driven by the adoption of digital mobile money. As per a 2023 World Bank study, women were overrepresented in the portfolios of microfinance institutions (64% in sub-Saharan Africa) and informal savings and credit clubs, showing the evolution of mobile banking and the inclusion of women as in Figure 1.

Individual African economies are making great strides in driving equitable gender access to digital financial access. In Mali, for instance, the digital finance gender gap decreased from 20 percent points in 2017 to 5 percent points in 2021 whereas the same indicator in South Africa has been constant since 2014. In Kenya, where the gender gap has been constant since 2011, the use of the mobile money instrument by women exceeds the use of traditional banking with the rate of mobile money account ownership, such as M-PESA among women, reaching 66% compared to bank account ownership which 45% in 2021.

The evolution of mobile money services such as SAFARICOM M-PESA in Kenya and M-Pawa and MoKash in Tanzania, Uganda, and Rwanda, enabled more than 2.5 million clients from underserved population groups to gain access to mobile financial platforms.

The impact of the digital microfinance sector evolution on gender equality and financial literacy

The growing number of digital microfinance infrastructure users, especially women, has several consequences from the perspectives of gender equality and financial literacy.

- Reduced gender inequality: In sub-Saharan Africa countries, such as Kenya, the gender gap in financial accessibility has narrowed from almost a 13% point difference in 2006 to approximately a 4% point difference in 2021, despite a 13.3 % point disparity between urban and rural women. The narrowing gender gap is attributed to the increasing number of mobile money and bank accounts. Increased savings: Mobile money services contribute to increased savings among women by providing a convenient platform that can be accessed directly from their mobile phones. According to a 2018 World Bank study, in Tanzania, women utilizing M-Pawa as a mobile savings initiative saved twice as much. At the same time, they were 14 percent more likely to obtain mobile loans, 4 percent more likely to expand their enterprises by starting a second one, and gained more influence in family decision-making.

- More initiatives to promote female entrepreneurship: The Bill & Melinda Gates Foundation and the European Investment Bank launched a €30 million microfinance initiative to grow women’s entrepreneurship. This microfinance program is empowering female entrepreneurship by ensuring that 80 percent of the beneficiaries are women. The program provides financial accessibility to women without the need for collateral security or credit history and adopts digital financial services to align with female borrowers’ needs.

- Promoted financial literacy: Digital microfinance tools are by default a promotion mechanism of the concept of financial literacy. When using digital tools, users also gain access to digital resources that offer information on savings’ management, investments, and loans.

Final word

The development of the digital microfinance sector stimulates women empowerment in Africa’s emerging economies by reducing gender equality, boosting women’s entrepreneurship, increasing savings, and promoting financial literacy. The digital tools allow vulnerable groups, including women, to manage their savings, arrange microloans, and have access to educational materials to boost their financial knowledge. The evolution of traditional microfinance with the integration of digital financial services is therefore bridging the gender gap and contributing to the sustainable development of vulnerable populations in Africa.

![]()