By Alejandro Werner

COVID-19 is spreading very quickly. This is no longer a regional issue—it is a challenge calling for a global response. Countries in Latin America and the Caribbean have been hit later than other regions from the pandemic and therefore have a chance to flatten the curve of contagion.

Efforts on multiple fronts to achieve this goal are underway. In addition to strengthening health policy responses, many countries in the region are taking measures of containment, including border closures, school closings, and other social distancing measures.

These measures, together with the world economic slowdown and disruption in supply chains, the decline in commodity prices, the contraction in tourism, and the sharp tightening of global financial conditions are bringing activity to a halt in many Latin American countries—severely damaging economic prospects. For the region, the recovery we were expecting a few months ago will not happen and 2020 with negative growth is not an unlikely scenario.

The resulting increase in borrowing costs will expose financial vulnerabilities that have accumulated over years of low-interest rates. While the sharp fall in the oil price is expected to benefit the oil-importing countries in the region, it will dampen investment and economic activity in countries that are heavily dependent on oil exports.

In the event of a local outbreak, service sector activity will likely be hit the hardest as a result of containment efforts and social distancing, with sectors such as tourism and hospitality, and transportation particularly affected.

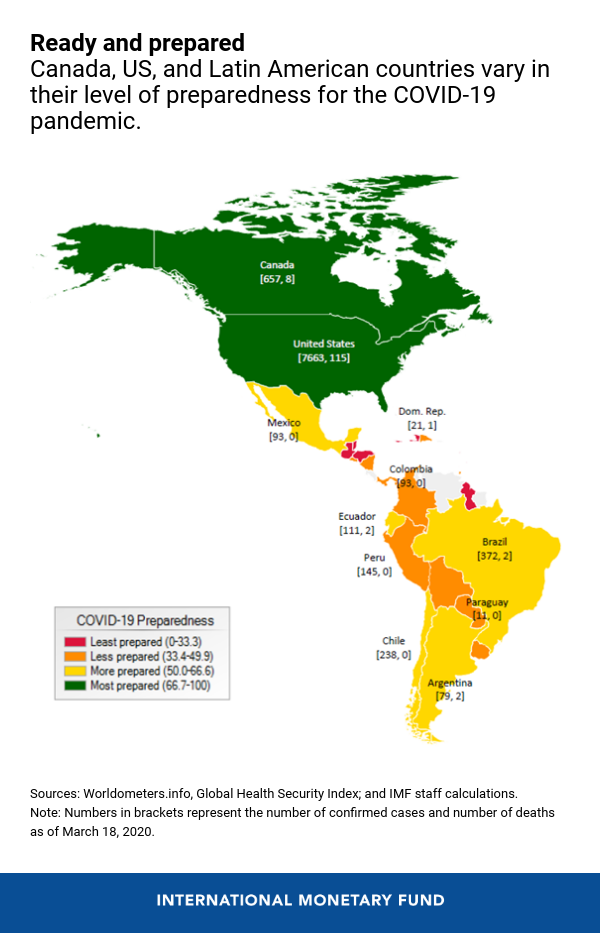

Moreover, countries with weak public health infrastructures and limited fiscal space to ramp up public health services and support affected sectors and households would come under significant pressure.

The economic impact of the pandemic is likely to vary due to regional and country-specific characteristics.

South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe and the United States which are important trade partners. The sharp decline in oil prices will hit the oil exporters especially. The tightening of financial conditions will affect negatively the large and financially integrated economies and those with underlying vulnerabilities. Containment measures in several countries will reduce economic activity in service and manufacturing sectors for at least the next quarter, with a rebound once the epidemic is contained.

In Central America and Mexico, a slowdown in the United States will lead to a reduction in trade, foreign direct investment, tourism flows, and remittances. Key agricultural exports (coffee, sugar, banana), as well as trade, flows through the Panama Canal could also be adversely affected by lower global demand. Local outbreaks will strain economic activity in the next quarter and aggravate already uncertain business conditions (especially in Mexico).

In the Caribbean, lower tourism demand due to travel restrictions and “the fear factor”—even after the outbreak recedes—will weigh heavily on economic activity. Commodity exporters will also be strongly impacted and a reduction in remittances is likely to add to the economic strain.

Policy priorities

The top priority is ensuring that front-line health-related spending is available to protect people’s wellbeing, take care of the sick, and slow the spread of the virus. In countries where there are limitations in health care systems, the international community must step in to help them avert a humanitarian crisis.

In addition, targeted fiscal, monetary, and financial market measures will be key to mitigate the economic impact of the virus. Governments should use cash transfers, wage subsidies and tax relief to help affected households and businesses to confront this temporary and sudden stop in production.

Central banks should increase monitoring, develop contingency plans, and be ready to provide ample liquidity to financial institutions, particularly those lending to small and medium-sized enterprises, which may be less prepared to withstand prolonged disruptions. Temporary regulatory forbearance may also be appropriate in some cases.

Where policy space exists, broader monetary and fiscal stimulus can lift confidence and aggregate demand but would most likely be more effective when business operations begin to normalize. Given the extensive cross-border economic linkages, the argument for a coordinated, global response to the epidemic is clear.

Countries are starting to take policy initiatives in this direction. For example, additional funds are being secured for health spending in many countries including Argentina, Brazil, Colombia, and Peru. Moreover, Brazil announced an emergency economic package on March 17 that is targeted for supporting the socially vulnerable, maintenance of employment, and combatting the pandemic.

For our part, the International Monetary Fund (IMF) stands ready to help mitigate the economic fallout from the coronavirus and we have several facilities and instruments at our disposal.

In closing, I would like to iterate the importance of decisive actions by all of us to limit the economic fallout from the coronavirus and avert a humanitarian crisis. The Fund stands ready to assist and work with member countries in these difficult times.

![]()