By Chris Patterson

KINGSTON, Jamaica (JIS) – The Bank of Jamaica (BOJ) has continued to use a three-pronged approach to address high domestic inflation, since October 2021.

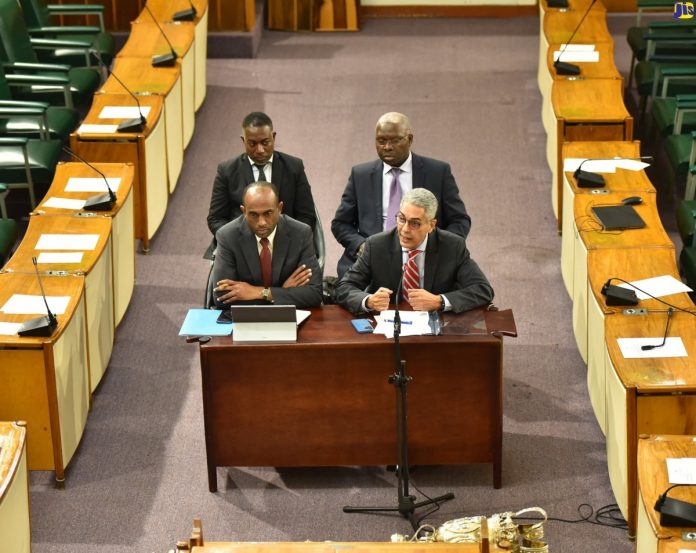

This was disclosed by Governor, Richard Byles, while delivering a monetary policy statement during a recent meeting of the Standing Finance Committee of the House of Representatives, at Gordon House.

These include gradual increases in the bank’s policy interest rate by 650 basis points, the provision of US dollar liquidity support to the foreign exchange market to foster stability, and ensuring the maintenance of tight Jamaica dollar liquidity conditions in the money market.

Byles said the package of mutually reinforcing policy measures is meant to achieve several outcomes.

These include a rise in interest rates on deposits and loans in the financial system to encourage savings in Jamaican dollars by making this undertaking more attractive relative to foreign currency assets, and hence help to manage aggregate spending in the economy. In so doing, this would help to maintain the stability of the foreign exchange rate.

Byles further said the timely sale of foreign currency by the BOJ during periods of temporary gaps between supply and demand is also aimed at stabilising the market while preserving the government’s flexible exchange rate system.

“Selling US dollars also removes Jamaican dollars from the financial system, which causes a premium to be placed on Jamaican dollar liquidity by the participants in the system and reducing demand-induced inflationary pressures,” he said.

The governor also highlighted the use of open market operations, which involves the BOJ issuing certificates of deposit to banks, removing liquidity from the system and causing money market interest rates to rise, thereby forcing the rate of inflation down.

Byles said these interventions are intended to cushion the impact on consumers of the large changes in global prices for oil, grains and other imported commodities, through the exchange rate channel.

“They are also meant to reduce demand in the economy and, consequently, the ability of businesses to pass on price increases to consumers. Finally, they are meant to assure people that inflation in the future will not continue to rise unpredictably and so allow for them to act today in ways that are consistent with the maintenance of low, stable and predictable inflation in the future,” he said.

Byles stated that the foreign exchange market has remained relatively stable, reflecting, in part, the actions taken by the bank in response to the higher-than-targeted inflation.

“This stability in the exchange rate continues to play a role in moderating the cost of imported goods and tempering inflation expectations,” he added.