CAIRO, Egypt – African Export-Import Bank (“Afreximbank” or the “Group”) has released the consolidated financial statements of the bank and its subsidiaries for the year ended 31 December 2023.

Largely propelled by the bank’s and its subsidiaries’ growth, the Group’s results for the financial year ended 31 December 2023 demonstrate a strong and resilient performance, surpassing prior year results and well ahead of expectations. The bank remained steadfast in implementing its 6th Strategic Plan and delivering value to stakeholders, and this resulted in the Group ending the year, once again, achieving a solid performance and attaining an exceptional financial position.

It is noteworthy that this performance has been enhanced by the Group’s ability to successfully execute its four strategic pillars focused on “Promoting Intra-African Trade,” “Facilitating Industrialization and Export Development,” “Strengthening Trade Finance Leadership” and “Improving Financial Performance and Soundness”.

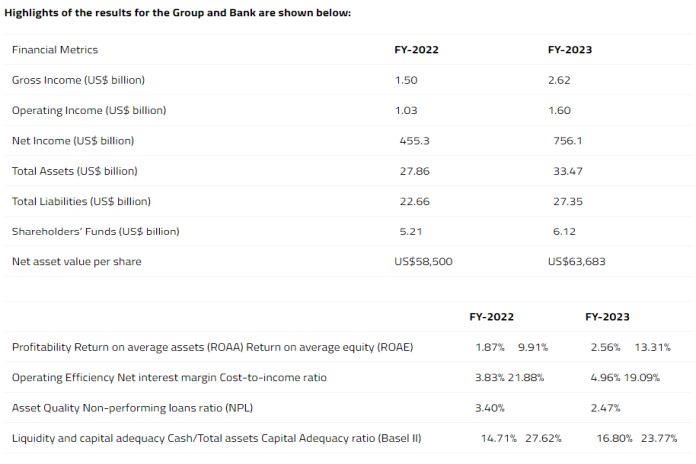

Net interest income reached US$1.4 billion at the end of the 2023 financial year, compared to US$910.3 million in 2022. The 58.67 percent increase was driven by the growth in interest income, which in turn was driven primarily by the growth in the bank’s portfolio of loans and advances. Net Interest Margin grew to 4.96 percent compared to the prior year’s level of 3.83 percent.

Due to global inflationary pressures and investment in human capital to support increased business activities, the Group’s total operating expenses were US$304.5 million, 34.93 percent higher than in 2022. The capacity expansion and rise in expenditures were envisaged in the five-year Sixth Strategic Plan, which is currently under implementation until December 2026.

The Group’s Total assets grew by 20.12 percent to US$33.5 billion (FY2022: US$27.9 billion), largely on account of increases in net loans and advances to customers and cash and cash equivalents.

The Group Shareholders’ funds, which largely mirrored the Bank’s Shareholders’ funds, recorded a solid growth of 17.55 percent to reach US$6.1 billion as of December 31, 2023, compared to the FY’2022 position of US$5.2 billion. Accounting for this growth were the US$546.8 million retained income (which is net of appropriated 2022 dividends) and the US$349.8 million fresh equity raised during the year as shareholders supported the GCI II programme, which aims to raise US$2.6 billion paid-in-capital (US$3.9 billion callable capital) by 2026.

Denys Denya, Afreximbank’s senior executive vice president, commented:

“During the 2023 financial year, the Afreximbank Group exceeded the budget and significantly surpassed its 2022 performance. This outcome was mainly driven by the bank’s and its subsidiaries’ achievements. Our focus is steadfast on fueling industrial growth, boosting trade within Africa, and promoting exports with added value, which are crucial for the continent’s prosperity. We will continue to maintain a cautious balance between profitability, liquidity, and safety to ensure a decent net interest margin and deliver profitable and sustainable growth and quality assets. We are delighted to report results well above forecasts for the financial year ended 31 December 2023, and look forward to delivering stronger financial outcomes in 2024.”

In 2023, the bank was ranked number one in all three categories in the Bloomberg Capital Markets League Tables Report for African Capital Markets – number one Mandated Lead Arranger, Bookrunner and Administrative Agent for Sub-Saharan Borrower Loans. This is a testament to the Bank’s leadership role in facilitating capital from within and outside the continent.

Additionally, its subsidiary, the Fund for Export Development in Africa (FEDA), received multilateral support from Zimbabwe, Kenya, Congo, Chad, Gabon, Sierra Leone, and São Tomé and Príncipe, who officially signed the FEDA Establishment Agreement. This collective support is pivotal in the Bank’s mission to provide lasting financial support to African economies.

The bank also celebrated a key milestone – its 30th anniversary, marking three decades of financing and supporting trade in Africa and highlighting the need for Africa to enhance intra-African trade and integration amidst the challenges stemming from the global shocks caused by the COVID-19 pandemic, the adverse economic ramifications of the Ukraine crisis, and other global conflicts.

Moreover, the bank inaugurated its Afreximbank Caribbean Office, a pivotal step in supporting the implementation of the Partnership Agreement between Afreximbank and the Caribbean Community (CARICOM) member states. This expansion solidifies Afreximbank’s commitment to promote and develop trade between Africa and the Caribbean, aligning with its Diaspora Strategy and the African Union’s designation of the African Diaspora as Africa’s sixth region.

Despite Africa’s economic challenges and constraints, Afreximbank’s management and team demonstrated a focus on supporting member countries by offering customized programmes and facilities designed to address the continent’s distinctive needs. These efforts and interventions assisted member countries in meeting trade finance commitments, assessing crucial imports, boosting food security and commodity production, alleviating supply chain bottlenecks, and adjusting to challenges arising from climate change.

Forward-looking statements

The bank makes written and/or oral forward-looking statements, as shown in this presentation and other communications, from time to time. Likewise, officers of the Bank may make forward-looking statements either in writing or during verbal conversations with investors, analysts, the media, and other key members of the investment community. Statements regarding the bank’s strategies, objectives, priorities, and anticipated financial performance for the year constitute forward-looking statements. They are often described with words like “should”, “would”, “may”, “could”, “expect”, “anticipate”, “estimate”, “project”, “intend”, and “believe”.

By their very nature, these statements require the bank to make assumptions subject to risks and uncertainties, especially uncertainties related to the financial, economic, regulatory, and social environment within which the bank operates. Some of these risks are beyond the control of the bank and may result in materially different results from the expectations inferred from the forward-looking statements. Risk factors that could cause such differences include regulatory pronouncements, credit, market (including equity, commodity, foreign exchange, and interest rate), liquidity, operational, reputational, insurance, strategic, legal, environmental, and other known and unknown risks. As a result, when making decisions with respect to the bank, we recommend that readers apply further assessment and should not unduly rely on the Bank’s forward-looking statements.

Any forward-looking statement contained in this presentation represents the views of management only as of the date hereof. They are presented to assist the Bank’s investors and analysts to understand the bank’s financial position, strategies, objectives, priorities, and anticipated financial performance in relation to the current period, and, as such, may not be appropriate for other purposes. The bank does not undertake to update any forward-looking statement, whether written or verbal, that may be made from time to time by it or on its behalf, except as required under applicable relevant regulatory provisions or requirements.