By Caribbean News Global ![]()

ENGLAND / UAE – Perhaps, quotations by CIP/CBI authorised agents, as recent as October 2025, for Caribbean CBI/CIP programmes by way of single applicant quotation for infrastructure projects and the Economic Development Fund are insufficient evidence to satisfy legislators and leading authorities in the Caribbean, that their CIP/CBI continues to trade at a discount in the Middle East, Europe and Asia. In addition, it is likewise reasonable to contradict, wittingly or unwillingly, that due diligence is unquestionable, cheating the system.

Discounting continues unabated

The jury may be out on the practice of discounting and due diligence; however, agents’ quotations for One CARICOM passport in the Caribbean CIP/CBI itemised on applicants’ single application ranges from USD 89K; 106K and 122K. Donation USD 88K; Economic Development Fund Contribution USD 65K; Investment (non-refundable) USD 97K. Due diligence: USD 7,500 and 11,500 (dependent spouse as itemised on quotation) for Iranian applicants, instead of USD 25K for principal applicant.

The minimum affordable option in the Caribbean CIP/CBI is listed at USD 200K.

The above figures are from three separate quotations seen by Caribbean News Global (CNG) this month, reportedly sent to Caribbean CIP/CBI applicants, valid for seven days only.

Accelerating transformation

Very little has seemingly changed for the better, following the CBIP-MOA: Memorandum-of-Agreement-CBIP-20-March-2024 by Caribbean CBC/CIP leaders and the advancement to governance and regional coherence.

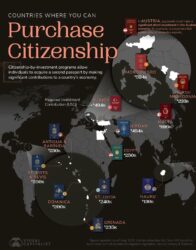

The practice of discounting, admittedly, appears to be a slap in the face of recent developments to establish a Regional Regulator for CBI programs among the five OECS member states. The expectation is to supervise, regulate and license the five CIP/CBI countries – Antigua and Barbuda, St Kitts and Nevis, Dominica, Saint Lucia, and Grenada.

Promoting fair pricing structures, expansion in competitive markets and unparalleled confidence in due diligence seems a cruel insult to Caribbean CIP/CBI value propositions, versus marketing operations.

Due diligence questionable

Laudably, certain CIP/CBI authorised agents operating in the Middle East, Europe and the UK are likewise inquiring about who’s paying due diligence fees.

Is it the applicant? The CIP/CBI agent? Or is it absorbed by the CIP/CBI unit of the applicant’s country?

Then there is the realisation that certain files are being processed much faster than others, without explanation.

The question is why? Is there a practice of favouritism? Are there territorial due diligence and processing advantages?

Related: Five visa-free Eastern Caribbean countries operating investor citizenship schemes

Several matters come to the forefront:

- Are Caribbean CIP/CBI instructions in line with CARICOM passport compliance?

- What has happened to the Caribbean CIP/CBI common standards and uniformity agreed by the respective countries?

- Who is policing Caribbean CIP/CBI marketing?

- What is the standard fee for due diligence?

- Who is monitoring and enforcing compliance, closing loopholes with the standards set for CARICOM passports?

- How much is received by the respective Caribbean CIP/CBI participating countries for one CARICOM passport?

Related: Is there Justice and Comradery among Caribbean CBI programmes?

Common sense needs to prevail

Legitimate and conscientious agents in Dubai and Europe are quite surprised. This comes against the backdrop of many openly disclosed nefarious activities within the mobility industry. These matters were discussed among Caribbean CIP/CBI leaders and with international partners, in particular, the United States, the United Kingdom, and the European Union, as well as with leading attorneys.

In the interim, policy issues and risk assessment are pending, while repercussions from the European Union, the United Kingdom, and the United States of America, hang over Caribbean CIP/CBI countries, heavily dependent on these programmes for economic development.

EU parliament introduces more flexible visa suspension mechanism

To the surprise of legitimate and leading licensed agents in the CIP/CBI industry, the recurring circumstances are being described as “unfair competition” with orientations to “A deer caught in the headlights!”

The increasing difficulty in this punishing environment is for uncorruptible authorised entities to safeguard their integrity, and that of the CIP/CBI industry. Their ability to rely on legitimate compliance has become increasingly difficult. The formal structure and enforcement of a governing body seem unpredictable and difficult to construct.

For many authorised entities with a global presence, the challenge is moving beyond the loss of business. The cost is becoming unbearable to write off.

To capture the scope and gravity attributed to Caribbean CIP/CBI discounting and due diligence, an attorney at law and a leading industry insider in Dubai, queried:

“ What am I supposed to do to effect change and turn this unfair advantage around?” he continued. “I cannot offer discounting, nor can I participate with the unknown in the apparent anomalies associated with due diligence and bizarre fee structures.”

A flagship source, with ties to global migration in the UK, commented:

“The situation is of grave concern, and if it is not amelioration and the Regional Regulator for CBI programs among the five OECS member states are not up to speed, there will be a cavity, and conceivably, an exodus from the industry.”

Inflection point

In June, the Governor of the Eastern Caribbean Central Bank (ECCB), Timothy N. J. Antoine, serving as chairman for the Interim Regulatory Commission (IRC), identified “political support” as being critically important for the successful establishment of a regional regulator for the five countries that offer Citizenship by Investment Programmes (CIP/CBI) in the Eastern Caribbean Currency Union (ECCU).

Caribbean CIP/CBI countries and the IRC have their challenges, evolving with the investment migration industry. It is equally important that scrutiny surrounding programs and marketing misrepresentations that undermine the Caribbean region, is closely monitored, and brought into legal bounds.

But how far will a value proposition, unified policies and reform customise an integral measure to restore confidence? Clearly, demonstrating the foundation upon which to operate is unclear. Is the prognosis to cash in and make a fast exit, and weaken the Caribbean region’s competitiveness globally?

“The underlying issue of Caribbean CIP/CBI countries’ citizenship schemes and discounting is not new, but more rampant than before; while certain agents are openly providing written itemised quotations on company letterheads. Nothing seems to have changed, to nullify the race to the end,” an EU mobility expert added.

“Evidence suggests that certain licensed agents are committing fraud willingly, and/or unwittingly, and circumventing risk to acquire a CARICOM passport, citizenship and to facilitate investments, where applicable, with cleavoirer in foreign applicants. Upon review, they hardly know anything about the novel purchase programmes to acquire a second and/or third passport.”

The transformative impact

Recognition software is revolutionising identity verification for travel, immigration and migration, capable of verifying identity at ports of entry, at electronic kiosks, and screening for fraudulent visa applicants.

“Biometrics, especially face recognition, enhances security and fraud prevention. It’s a game changer for border control,” said a global mobility expert.

Over time, recognition technology has become acceptable and advantageous in border security, to capture Digital Travel Credentials (DTCs) and personal details.

In the case of Caribbean CIP/CBI countries, the European Union, the United Kingdom, the United States of America, DTCs follow individuals in real time, without bias and favouritism. Among other data points, it provides relocation data of unscrupulous undesirables, attracted to certain CIP/CBI countries, where governments are apprehensive about migration policy, regulations with unembellished penalties.

Shaping the future of migration and the global mobility industry

Structural reform and policy settings in Caribbean CIP/CBI countries must form part of a continuous process. Adapting to future challenges will require modernised laws, digital transformation, talent development and comparative infrastructure.

On the way forward, strengthening fair-minded operations in competitive markets is a responsibility that must be fulfilled to ensure the sustainability of Caribbean CIP/CBI countries.

Defining the region’s economic narrative and ensuring growth benefits shape the next generation. This will determine how migration opportunities and the global mobility industry evolve.

Caribbean CIP/CBI countries need a balance between economic sustainability via legitimate migration programmes and a clear framework in jurisprudence.