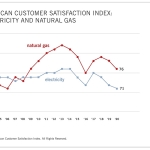

ANN ARBOR, Mich.–(BUSINESS WIRE)–Bad news once again for the energy utilities sector. For the second straight year, customer satisfaction takes a hit, dropping 1.5% to a score of 72.1 (on a scale of 0 to 100), according to the American Customer Satisfaction Index Energy Utilities Report 2019-2020.

“If there was ever a sign that the energy utilities sector needed to modernize the grids, 2019 was it,” says David VanAmburg, Managing Director at the American Customer Satisfaction Index. “This past year was marked by one natural disaster after another, and grids remain under constant pressure from cyberattacks. At the same time, consumers want cleaner energy, smarter technology, and energy-saving practices. While utility companies have a long way to go to, there’s at least a path forward to meet customer needs and deliver the experience customers want and expect.”

Natural gas, which remains the consumer preference, falters once again, down 3% to an Index score of 76, while electric service also dips, dropping 1% to a score of 71. The trend toward renewables, buoyed by strong consumer interest, is expected to continue into the coming decades, with coal’s share in electricity generation diminishing.

Residential customers aren’t happy with the current state of their service. Similar to a year ago, the decline in satisfaction is widespread, with most individual utility companies experiencing flat or lower customer satisfaction scores.

The Index results comprise three categories of energy utilities: investor-owned, municipal, and cooperative. Cooperative utilities hold the highest customer satisfaction among the three groups despite plunging 2.7% to 73. Investor-owned utilities and municipal utilities also fall, each dipping 1.4% to tie at 72. These scores place all three industries among the bottom 11 measured by the Index.

Atmos Energy holds steady, tops other investor-owned utility companies

For just the second time in a decade, no investor-owned utility scores 80 or above.

Natural gas providers dominate the top of the industry, with gas-only provider Atmos Energy as the new category leader, unchanged at 78. Meanwhile, last year’s frontrunner, CenterPoint Energy, continues its recent slide, tumbling 4% into second place with a score of 77.

NextEra Energy, which slips 1%, sits in third place at 76. Four companies tie with a score of 75: Sempra Energy (unchanged), NiSource (down 1%), Southern Company (down 3% to an all-time company low), and Consolidated Edison (down 4%).

On the industry’s low end, Duke Energy, one of only two investor-owned energy utilities to show a slight gain, up 1% to 71, is driven by some improvement in customer perceptions of value. Eversource Energy also ticks up 1% to 69.

PG&E is alone at the bottom of the category, plummeting 10% to 63 after another tumultuous year – starting with its bankruptcy protection filing in January 2019. The utility’s track record includes equipment failures linked to deadly wildfires in 2018 and criticism for widespread preemptive blackouts during periods of high risk for wildfires in 2019. Per customers, PG&E is worse across all aspects of the customer experience, most notably its ability to provide reliable electric service and restore power.

Salt River Project maintains stronghold on municipal energy utilities

For the second straight year, customers are less happy with their municipal energy utility services, but unlike last year, there are no major drops among the energy providers.

Despite slipping 1%, Salt River Project stays firmly atop the category at 77. The Arizona-based utility excels in terms of electric service reliability, and according to its customers, outperforms companies across all three energy utility categories.

The rest of the municipal category ties at the industry average of 72. The group of smaller municipal utilities inches back 1%, while CPS Energy is steady. Meanwhile, the Los Angeles Department of Water & Power (LADWP) rises 4% to a record high thanks to improved customer perceptions of value.

Smaller cooperatives plummet, tying record low

Member-owned cooperatives serving small rural communities once outperformed investor-owned and municipal energy utilities by 8 to 9 points on the Index. That lead is down to 1 point.

The largest cooperative energy utility, Touchstone Energy, tops the category despite dropping 1% to a customer satisfaction score of 74.

Last year’s leader, the group of smaller cooperatives, plunges 6% to 72, tying the record low from 2016.

The American Customer Satisfaction Index Energy Utilities Report 2019-2020 is based on interviews with 26,901 residential customers. Download the full report, and follow the American Customer Satisfaction Index on LinkedIn and Twitter at @theACSI.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About the American Customer Satisfaction Index

The American Customer Satisfaction Index has been a national economic indicator for 25 years. It measures and analyzes customer satisfaction with more than 400 companies in 46 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, scores are based on data from interviews with roughly 500,000 customers annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of the University of Michigan, licensed worldwide exclusively to American Customer Satisfaction Index LLC with the right to sublicense.

Contacts

Denise DiMeglio 610-228-2102

denise@gregoryfca.com