By Tanja Goodwin, Maciej Drozd and Dennis Sanchez Navarro

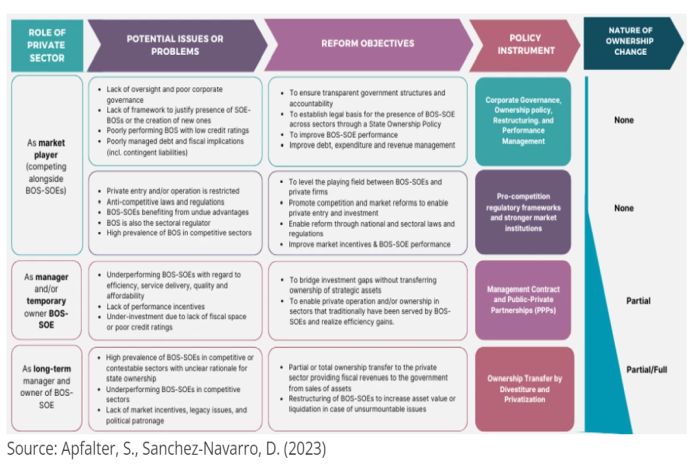

Reforms to State-Owned Enterprises (SOEs) are ‘usual suspects’ in strategies to boost growth and productivity, to mobilize private investment, and to address fiscal imbalances. Multiple instruments can be deployed to improve market performance and outcomes in sectors with SOE presence, and privatization is only one of them. Other policy options to reform SOEs include restructuring, improving corporate governance, opening markets to competition, adopting enabling regulations, or partnering with the private sector through PPPs and joint ventures.

Despite the potential benefits, a history of mixed outcomes from SOE reforms and privatizations has led to a cautious attitude among public officials to proceed with vigorous implementation. To support governments in navigating the complexities of SOE reform, the World Bank has introduced two innovative tools:

- A new taxonomy to distinguish the type of sectors and rationale for state ownership.

Did you know that in over 30 countries the state holds stakes in travel agencies? There are even nine countries in which potato processors are state-owned. Countries differ in their views on which economic activities merit state ownership. Some worry about market failures such as monopoly power and prioritize provision of goods and services by the state. But state ownership is not the only solution to address market failures. Other countries prioritize provision by the private sector and revert to alternative policy instruments such as market rules and enforcement of complementary price, quality, or antitrust regulation to ensure provision and discipline markets.

One critical starting point for reform is to understand where market failures arise more often, and state ownership can be a response. In other words, policy makers can look at the type of economic activities where competition among several private providers typically yields good market outcomes and differentiating them from those where there is an economic rationale for state ownership.

The World Bank has done just that: It has classified the type of markets in which the state operates. This innovative sector taxonomy (Dall’Olio et al, 2022) classifies more than 560 economic activities into three types of sectors: competitive, partially contestable, and natural monopolies.

Through the economic lens of market failures and intrinsic sector characteristics, this taxonomy enables governments to now distinguish sectors with stronger economic rationale for state ownership (e.g., electricity transmission) from sectors in which economic rationale is less clear (e.g., food manufacturing). It’s the latter type of activities that the private sector is particularly well-suited to carry out on its own. In a third set of sectors, other actions are necessary to achieve efficient market outcomes such as sectoral regulation on prices or access to essential facilities.

Once governments have distinguished competitive markets from natural monopolies, they can choose among multiple reform options to improve market outcomes. Privatization is only one of them. Just as state ownership does not solve market failures per se, changes in ownership are neither a necessary nor a sufficient condition for enhancing performance, improving market functioning, or enable private sector-led growth.

Therefore, it is critical to ensure that market incentives and institutions are in place to carry out reforms. Pro-competitive rules and strong market institutions such as competition agencies and independent regulators will be even more critical after the reform to ensure competition and a level playing field. But if not done correctly, SOE reforms can unintentionally promote higher concentration and lock in market power, limiting growth and job creation.

The WB Private Sector toolkit presents a full spectrum of policy options. It explores how the private sector can play a stronger role in sectors with state participation, ranging from corporate governance reforms, restructuring, regulatory reforms, management contracts up to full or partial privatization. Depending on the government priorities and the type of sector, the private sector can play a role as a market player or competitor alongside SOEs, for which enabling regulation and a level playing field are critical. The private sector can also operate as a temporary manager or owner of SOEs through temporary concession contracts or PPPs that enable private operation while bridging investment gaps without transferring strategic assets.

Finally, the private sector can become a permanent and full owner of SOEs through privatization that transfers the management and ownership of the assets to private firms. Yet, key pre-conditions are needed to enable private entry under a competitive environment to prevent privatization events from unintentionally creating private monopolies, favor incumbents, or facilitate cartel formation.

Evidence suggests that a smaller state footprint is associated with more dynamic markets and more competitive market structure (World Bank, 2023). Therefore, it is worthwhile embarking on well-informed and well-sequenced SOE reform. The new World Bank’s toolkit serves as a roadmap to determine the priorities and sequence of reform and is serving to inform reforms in developing countries such as Cabo Verde, Rwanda, Kenya, among others.

Resources – (SOEs) sector taxonomy (x.lsx)

– This blog builds on recent World Bank publications co-authored by Ana Cristina Alonso Soria, Stefan Apfalter, Andrea Dall’Olio, Maciej Drozd, Tanja Goodwin, Martha Martinez Licetti, Jan Orlowski, Fausto Patiño Peña, and Dennis Sanchez-Navarro.

![]()