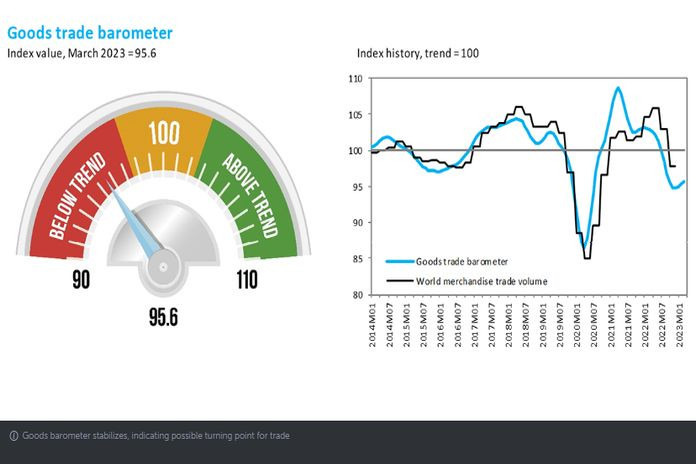

GENEVA, Switzerland, (WTO) – Global goods trade remained depressed in the first quarter of 2023, but forward-looking indicators point to a possible turnaround in the second quarter according to the latest WTO Goods Trade Barometer issued on 31 May.

The value of the barometer index rose to 95.6 in the latest reading – up from 92.2 in March – but remained well below the baseline value of 100, suggesting a below-trend stabilization and the beginnings of an upturn in merchandise trade volumes. Mixed signals in the barometer’s component indices nevertheless suggest that the road to trade recovery may be bumpy.

The Goods Trade Barometer is a composite leading indicator for world trade, providing real-time information on the trajectory of merchandise trade relative to recent trends. Barometer values greater than 100 are associated with above-trend trade volumes while barometer values less than 100 suggest that goods trade has either fallen below trend or will do so in the near future

The volume of merchandise trade in the fourth quarter of 2022 was down 2.4 percent compared to the previous quarter and 0.8 percent compared to the same period in the previous year. The Q4 slump was driven by several related factors, including the ongoing war in Ukraine, stubbornly high inflation in advanced economies, and tighter monetary policy globally.

The easing of pandemic controls in China starting in December 2022 appears to have boosted port traffic in the country, but this was outweighed by reduced vessel traffic in Europe. Preliminary data suggest that trade remained depressed in Q1 of 2023, but the recent pickup in export orders points to an increase in demand for traded goods in the second quarter. These results are broadly consistent with the WTO’s most recent trade forecast issued on 5 April, which projects 1.7 percent growth in world merchandise trade in 2023.

The barometer’s component indices are currently mixed. The automotive products index (110.8) has risen firmly above trend on the back of strong sales in the United States and Europe. The highly predictive export orders index (102.7) has also returned above trend after a dip following the outbreak of war in Ukraine. In contrast, the indices representing container shipping (89.4), air freight (93.5) and electronic components trade (85.2) all continue to signal weakness. The index of raw materials trade (99.0), meanwhile, finished just below trend. The combination of strong positive and negative indicators makes the short-term outlook less certain than usual.

The full Goods Trade Barometer is available here. Further details on the methodology are contained in the technical note here.