- Global growth is expected to be lower than earlier projected, signalling a potential economic downturn.

- Developing countries face mounting debt and insufficient international support, risking another lost decade.

- The banking crisis highlights long-neglected financial fragilities and regulatory weaknesses.

- Declining energy costs lead to lower inflation, but elevated food prices maintain a high cost of living in many developing countries.

- Growing global asymmetries threaten developing countries’ resilience, requiring stronger multilateral action and an urgent focus on sovereign debt architecture.

– Developing countries are facing a projected foregone income of $800 billion and battling unprecedented levels of debt distress.

GENEVA, Switzerland – UNCTAD in its latest Trade and Development Report Update released on 12 April warns that developing countries are facing years of difficulty as the global economy slows down amid heightened financial turbulence.

Annual growth across large parts of the global economy will fall below the performance registered before the pandemic and well below the decade of strong growth before the global financial crisis.

The UN trade and development body estimates that interest rates hikes will cost developing countries more than $800 billion in foregone income over the coming years. UNCTAD expects global growth in 2023 to drop to 2.1 percent, compared to the 2.2 percent projected in September 2022, assuming the financial fallout from higher interest rates is contained to the bank runs and bailouts of the first quarter.

Developing countries face the crushing effect of soaring debt, interest rate hikes, high food prices and insufficient liquidity

Many developing countries face a deepening development crisis as soaring debt levels and higher servicing costs squeeze productive investment in both the public and private sectors. A shortfall of international liquidity has already turned unforeseen shocks into a vicious financial cycle in some countries.

UNCTAD finds that 81 developing countries (excluding China) lost $241 billion in international reserves in 2022, an average decline of 7 percent, with over 20 countries experiencing a drop of over 10 percent and in many cases exhausting their recent addition of Special Drawing Rights (SDRs). Meanwhile, borrowing costs, measured through sovereign bond yields, increased from 5.3 to 8.5 percent for 68 emerging markets. Overall, external creditors’ pressure on developing countries to reduce fiscal deficits is expected to increase.

UNCTAD highlights that debt distress will result in a development crisis and wider inequalities, with 39 countries paying more to their external public creditors than what they received in new loans, causing an adverse impact on public investments and social protection.

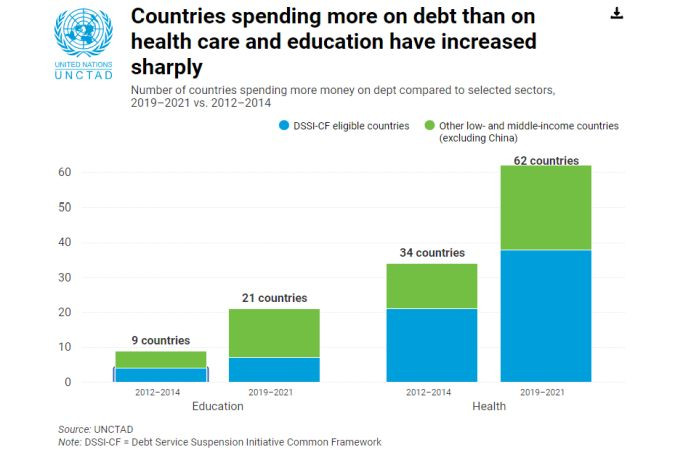

Over the last decade, debt servicing costs have consistently increased relative to public expenditure on essential services. The number of countries spending more on external public debt service than healthcare increased from 34 to 62 during this period.

High food prices hurt developing countries

Record profits for agricultural commodity traders have been driven by economic uncertainty and market volatility over the past four years, according to the report.

Exceptionally large profit margins have driven higher prices, which highlights the concentration of market power in key industries. In developing countries, food inflation remains high, while the impact of energy costs varies depending on local regulations.

The financialization of commodity trading has made financial markets the dominant influence on food traders’ profitability. The report emphasizes that in early 2023, food inflation remains elevated, despite a decrease in overall inflation, with 25 percent to 62 percent of the headline figure driven by food inflation.

UNCTAD calls for a bold agenda to support developing countries: global debt architecture overhaul, greater liquidity and more robust financial regulations

Both the banking crisis and the cost-of-living crisis have shed light on the opacity and increased concentration of market power in key industries. UNCTAD calls for the closing of the loopholes in financial reform launched in the wake of the 2007-09 crisis, for the widening of the scope of systemic oversight and for closer regulation of shadow banking institutions.

To adequately address developing countries’ needs, the financial multilateral agenda requires strengthening, with an urgent focus on the reform of the debt architecture. UNCTAD calls for the establishment of a multilateral debt workout mechanism, a registry of validated data on debt transactions from both lenders and borrowers, and improved debt sustainability analyses that incorporate development and climate finance needs.

The ongoing IMF-World Bank meetings provide a valuable opportunity to strengthen development finance and address constraints facing countries that need greater liquidity. Issuing new SDRs worth at least $650 billion would be a positive first step in helping to alleviate the heavy debt burdens that hinder development prospects. Additionally, G20 nations have pledged to recycle at least $100 billion of their unused SDRs, a commitment that should be fulfilled to further support global economic recovery.

The combined impact of higher interest rates and elevated energy and food prices in the context of receding fiscal support is expected to further weaken household spending, including on housing. Business investment, buffeted by financial turbulence, is also expected to slow down further or contract.

Annual growth across large parts of the global economy will fall below the performance registered before the pandemic and well below the decade of strong growth before the global financial crisis – with a potentially devastating effect on the economies of developing countries. This will further deepen the cost-of-living crisis that their citizens are currently facing and magnify inequalities worldwide.