- 56% of German-based businesses cite rising inflation concerning their organization.

- 41% of cross-border B2B organizations believe business expansion is essential to offset the challenges of inflation, high interest rates and market volatility.

- 76% of businesses pay $10+ transaction fees on cross-border payments and 38% of businesses experience 5+ day B2B payment delays.

- In Germany, digitizing payments (44%) and improved payment terms (40%) are ranked as the top ways to combat these negative effects.

LONDON–(BUSINESS WIRE)–41% of global organizations believe that international business expansion is imperative to ease their current trading concerns. That’s according to a new study released by global fintech-as-a-service partner Rapyd, which shows that a sizeable contingent of cross-border businesses are looking to double down on their growth ambitions as the best remedy for the economic headwinds facing them, despite mixed levels of business optimism.

Rapyd’s 2023 State of B2B Cross-Border Payments report shows that businesses are divided on how they view the year ahead. 43% expressed concern about the current state of business versus 57% that claimed not to be concerned. In Germany, the top concerns are inflation (56%) and market volatility (44%).

Half of global businesses cited inflation as their biggest worry, followed by increasing interest rates (46%) and market volatility (35%). Cross-border trading issues such as currency fluctuations (32%) and import/export challenges (30%) are also featured prominently in the list of key business concerns, with 35% of businesses calling for better fintech solutions to improve the transparency, speed and cost of payments.

Familiar payments challenges curb growth aspirations

Rapyd surveyed financial decision-makers in 715 medium-to-large cross-border businesses across seven global markets: Brazil, Canada, Germany, Mexico, Singapore, UK and US. According to respondents, speed, cost and efficiency continue to be the backbone of cross-border operations and expansion. Current cross-border payment shortcomings – specifically high transaction fees and payment delays – inhibit growth by eating into revenues, harming cash flow and making it harder for businesses to plan their finances.

The study found that 76% of businesses are burdened by excessive transaction fees of $10 or more on cross-border payments to suppliers, partners, distributors, employees and contractors, including 25% of businesses which reported typical cross-border transaction fees of $25-50, and 15% which claimed to be paying fees of $50+ dollars.

Similarly, more than two in five (42%) cross-border businesses paid between 0.25% to 1% in foreign exchange (FX) fees when carrying out cross-border transactions, with a further quarter of the businesses paying even higher FX fees of between 1%-3% or more.

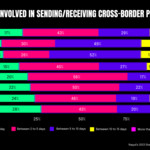

And businesses aren’t faring any better when it comes to payments speed. 38% of respondents experienced delays of five days or more when sending or receiving cross-border payments to other businesses, with businesses in Germany and Singapore reporting the longest delays. 52% of German businesses report payment delays between 5 to 10 days; with 12% having to wait between 10 to 15 days.

Globally, businesses recognize the need to overhaul legacy cross-border payment processes and see technology as essential to this transition. 35% of financial decision-makers believe that better fintech solutions will ease their current concerns, and more than 6 in 10 businesses (61%) have made payments systems digitization a top priority, while another third have already automated their payments systems.

Garðar Stefánsson, CEO of Rapyd Europe, said:

“Our report shows businesses all over the world battling hard against adversity. They are doing everything in their power to reach new markets and open up new revenue streams, but they’re constantly set back by the complexity and cost of trading in other countries – losing huge sums and vast amounts of time on cross-border transactions. The bigger their operations get, the more these costs rise. It’s an unacceptable situation at a time when so many advanced economies are struggling to grow.

“Fintechs have a tremendous opportunity to help cross-border businesses with their expansion ambitions by providing faster and more cost-effective payment solutions, as well as creating innovative new approaches that simplify the way these systems operate. Ultimately, no business should have to take on the complexity of B2B payments by themselves when they’re going for growth – that’s why trusted fintech partners are critical. It’s time for fintech to step up to the plate and build bolder, better payments solutions that make cross-border trading seamless and straightforward.”

Key Germany highlights:

- When asked what is specifically concerning their organization, the top concerns for German businesses are inflation (56%) and market volatility (44%).

- When asked what would ease their concerns, German businesses cited that digitizing payments (44%), improved payment terms (40%) and better fintech solutions (32%) of three of the top solutions to combat negative effects of inflation, growing interest rates and increased volatility.

- 52% of German businesses report payment delays of 5 to 10 days. 12% report delays between 10 to 15 days.

- 53% of German businesses cite digitizing payments as a main priority, with 42% of businesses having already automated their payments systems.

Rapyd’s State of B2B Cross-Border Payments 2023 report is available here.

Notes to Editors:

Survey Methodology

Rapyd surveyed financial decision-makers across 715 businesses in Brazil, Canada, Germany, Mexico, Singapore, the UK and US online in February 2023. The survey was conducted among medium-sized (50-499 employees) and large (500 and over) companies operating in the B2B goods or services industries.

About Rapyd

Rapyd lets you build bold. Liberate global commerce with all the tools your business needs to create payment, payout and fintech experiences everywhere. From Fortune 500s to ambitious business and technology upstarts, our payments network and powerful fintech platform make it easy to pay suppliers and get paid by customers—locally or internationally.

With offices worldwide, including Tel Aviv, Dubai, London, Iceland, San Francisco, Miami and Singapore, we know what it takes to make cross-border commerce as easy as being next door. Rapyd simplifies payments so you can focus on building your business.

Get the tools to grow globally at www.rapyd.net. Follow: Blog, Insta, LinkedIn, Twitter.

Contacts

Global media

Lizzie Ryan

Rapyd Global Communications Manager

press@rapyd.net