By Tobias Adrian and Fabio Natalucci

During the pandemic, central banks in both advanced and emerging market economies took unprecedented measures to ease financial conditions and support the economic recovery, including interest-rate cuts and asset purchases.

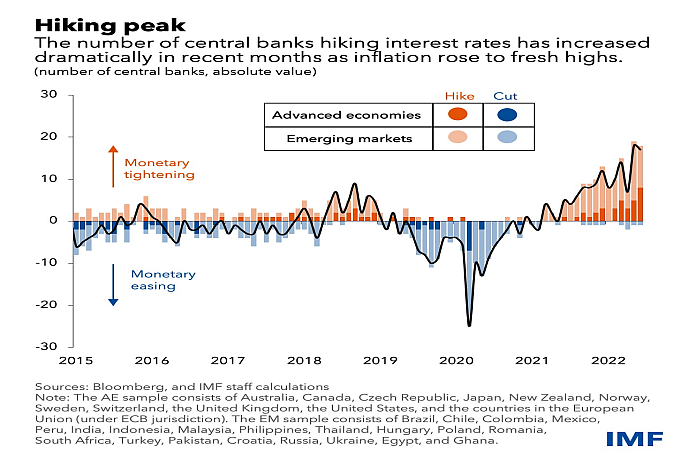

With inflation at multi-decade highs in many countries and pressures broadening beyond food and energy prices, policymakers have pivoted toward tighter policy. As our Chart of the Week shows, central banks in many emerging markets proactively started to hike rates earlier last year, followed by their counterparts in advanced economies in the final months of 2021.

The monetary policy cycle is now increasingly synchronized around the world. Importantly, the pace of tightening is accelerating in several countries, particularly in advanced economies, in terms of both frequency and magnitude of rate hikes. Some central banks have begun to reduce the size of their balance sheets, moving further toward normalization of policy.

Stable prices are a crucial prerequisite for sustained economic growth. With risks to the inflation outlook tilted to the upside, central banks must continue normalizing to prevent inflationary pressures from becoming entrenched. They need to act resolutely to bring inflation back to their target, avoiding a de-anchoring of inflation expectations that would damage credibility built over the past decades.

Monetary policy can’t resolve remaining pandemic-related bottlenecks in global supply chains and disruptions in commodities markets due to the war in Ukraine. It can however slow overall demand to address demand-related inflationary pressures, so a tightening of financial conditions is the goal.

The high uncertainty clouding the economic and inflation outlook hampers the ability of central banks to provide simple guidance about the future path of policy. But clear communication by central banks about the need to further tighten policy and steps required to control inflation is crucial to preserve credibility.

Clear communication is also critical to avoid a sharp, disorderly tightening of financial conditions that could interact with, and amplify, existing financial vulnerabilities, putting economic growth and financial stability at risk down the road.