BRIDGETOWN, Barbados – The Caribbean Development Bank (CDB) has taken the case for its vulnerability and resilience measurement framework to the United Nations (UN), proposing that its system is the best option for determining access to affordable finance for small states where sustainable development efforts continue to be derailed by exogenous shocks including volatility in international markets, natural hazards, health crises and geopolitical disturbances.

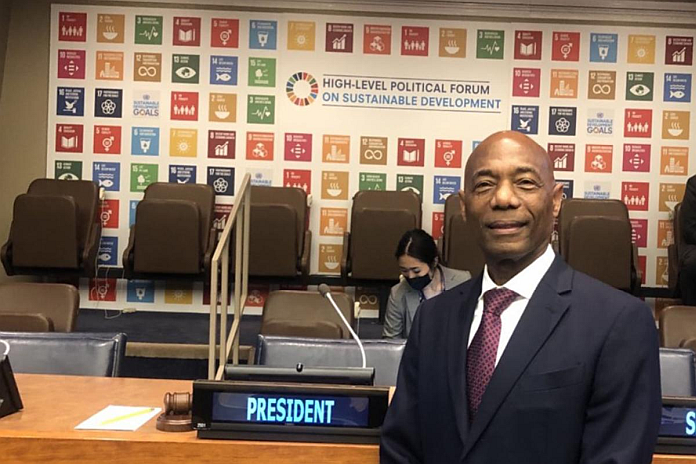

The bank’s president, Dr Hyginus “Gene” Leon, addressed the UN High-Level Political Forum on Sustainable Development at the UN Headquarters in New York on July 11, 2022, where he proposed the adoption of a framework currently being developed by CDB, which utilises the measurement of a country’s Internal Resilience Capacity (IRC) combined with the Bank’s Recovery Duration Adjuster (RDA) tool, to underpin access to affordable finance. The framework would provide a more equitable system for vulnerable small states currently disadvantaged by existing metrics which use Gross National Income (GNI) to determine access to concessional support.

In outlining the need for CDB’s framework, Dr Leon, said:

“Many developing countries, especially Small Island Developing States (SIDS), continue to struggle with the increasing frequency of economic, environmental, and socio-political shocks. In the Caribbean, for instance, we face significant legacy structural weaknesses that have been amplified by the ongoing COVID-19 pandemic, the impact of climate change, and the fallout from the Russia-Ukraine war. These challenges have ruined productive activities, disrupted educational services, widened income and gender inequalities, and heightened food and energy insecurity as supply chains faced major disruptions.”

“Further, our countries remain among the most vulnerable and least resilient in the world, making the recovery from shocks of long duration. This combined cocktail, resulting in low competitiveness and productivity, has reduced the scope for the region to realistically achieve many of the sustainable development goals by 203,” he added.

The IRC metric, Dr Leon explained, captures the structural and vulnerability factors constraining growth and development in a country pre-shock, and then the RDA evaluates the magnitude, impact, and persistence of effects once a shock occurs. The framework then calculates the nature and level of finance required to recover from the shock and put the country on a growth path.

“This framework can provide an easily understood dashboard for gauging the resilience capacity of countries (low, medium, and high), and thereby eligibility to development or concessional finance that will depend on need and resilience capacity and less on past income levels,” the CDB president said. “The challenge before us is how best to navigate a safe path from legacy structural weaknesses to transformative development, while maintaining debt sustainability, enhancing macroeconomic and financial stability, and building resilience against shocks.

This requires a holistic approach to development, creating a bridge between stabilisation and long-term transformation – in essence, integrating the debt sustainability framework of the International Monetary Fund, the investment-growth framework of the World Bank, and the resilience-building framework of the United Nations. Let me add that the coherence among these frameworks has to be underpinned by access to adequate and affordable finance. Let’s take this framework forward so that we could guarantee the sustainable livelihoods of the peoples of our respective regions,” Dr Leon advised the Forum.