By the UK Team

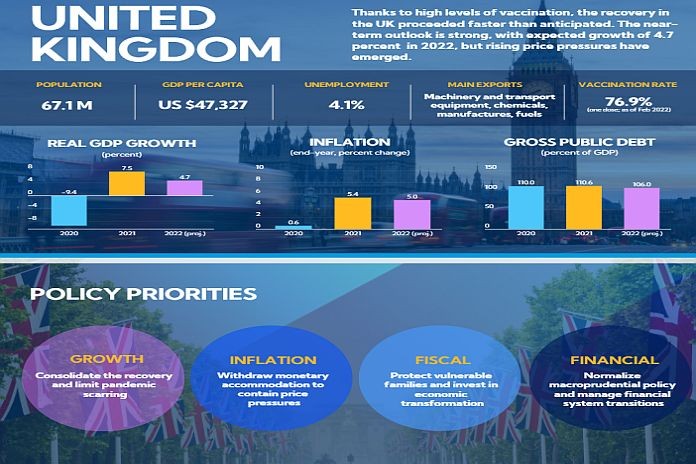

IMF European Department – Thanks to a rapid vaccination campaign and highly accommodative policies, the United Kingdom’s economic recovery has proceeded faster than expected. The near-term growth outlook remains strong – but so too are inflationary pressures.

Monetary policy will need to tighten steadily to anchor inflation expectations and bring inflation back to target. Careful communication to counter expectations of a long cycle of rate hikes and high borrowing costs would help reduce the drag on growth in 2023. Fiscal policy could support this tightening cycle if planned consolidation was brought forward slightly.

Despite the recovery, the pandemic and Brexit have magnified structural challenges and will leave some scars. The government has made significant progress in spelling out a comprehensive Plan for Growth, but structural issues such as regional inequality will require additional investment in transport infrastructure and digital connectivity.

Meanwhile, enhanced retraining policies would support labor market transitions by helping workers find employment in expanding industries.

In terms of climate, the Net Zero Strategy is a major step forward. The key to success lies in setting clearer and earlier incentives for the private sector to reduce emissions and removing barriers to greater green investment by the private and public sectors. Packages to compensate consumers for more expensive energy bills should focus on lower-income households; after these packages are phased out, they could be redesigned to support climate objectives.

The financial system has been resilient. Corporate and household balance sheets have held up well, but the resilience of non-bank financial institutions and core financial markets could be better underpinned. Financial innovation such as fintech and green finance must be managed carefully. The primacy of financial stability should be maintained when pursuing post-Brexit regulatory reforms.