By FocusEconomics Insights

ASIA – Over the past month, the Euro area has faced a severe outbreak of new Covid-19 cases. Regional heavyweight Germany logged a record 68,049 new cases on 23 November, while the Netherlands has also seen a record number of new cases in recent weeks. Central and Eastern Europe has been hit especially hard, with the region’s low vaccination rate placing significant pressure on local health systems.

The spread of the virus across the continent is likely linked to colder weather forcing more individuals to stay inside, where it can spread more easily. Moreover, looser restrictions, increased travel, significant pockets of vaccine hesitancy and weakening immunity are all helping to accelerate the transmissibility of Covid-19. The rise in cases has put considerable pressure on authorities to take action, which raises the possibility of fresh lockdown restrictions before a busy holiday season. In Austria, authorities have already decided to reintroduce a nationwide lockdown, despite public protests and nearly 65% of the population being fully vaccinated. Meanwhile, Germany has introduced restrictions on unvaccinated residents, similar to a host of other countries in the region that have decided to keep unvaccinated individuals out of certain public venues such as restaurants and bars.

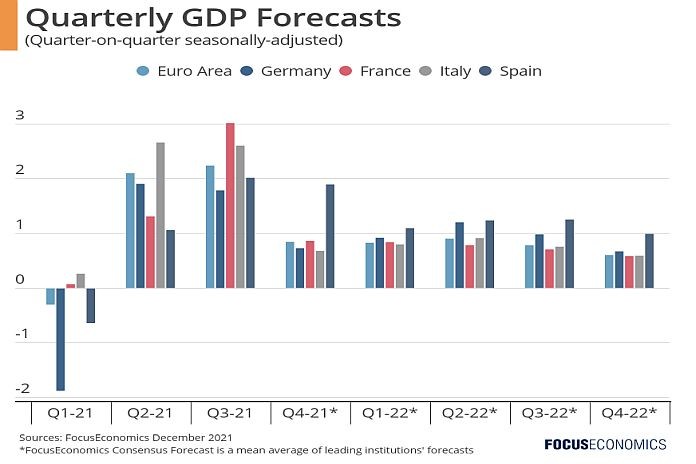

The risk to the economic outlook for the Euro area has risen due to the spike in cases. Renewed lockdowns will take a bite out of household spending. Meanwhile, souring business sentiment will likely weigh on investment decisions ahead. Nevertheless, economies should be more resilient to Covid-19 restrictions this time around, and fiscal policies remain supportive. Thus, risks to the outlook are likely to remain centered around continued supply chain disruptions, rising price pressures, particularly energy prices and elevated public debt levels. That said, all these risks will be exacerbated by any further tightening of measures.

Insights from Our Analyst Network

Commenting on the outlook for the Euro area, analysts at JPMorgan noted:

“It remains hard to predict how the new wave will evolve this winter, but the German drag now seems much larger than previously assumed. We are cutting our GDP forecasts for Germany and taking Euro area growth from around 4 percent (SAAR) to 2.0 percent for this quarter and next. If, as we expect, mounting pressures raise vaccination rates materially, most of this shortfall is likely to be recovered around the middle of next year.”

Furthermore, commenting on the outlook for the German economy, Carsten Brzeski, Global Head of Macro at ING, noted:

“The combination of supply chain frictions, higher energy prices and higher inflation in general already argued in favor of a significant slowdown of economic activity in the final quarter of the year. The fourth wave of the pandemic could now actually push the economy to the brink of stagnation, or even technical recession. Admittedly, the adaptability of the economy to lockdowns, supported by government and central bank measures, has clearly increased since March 2020.”