By David Jordan

Caribbean News Global (CNG) is pleased with the publication privileged of the three-part series conducted with David Jordan. We recognize the pertinent information afforded our readers. In this final series, Jordan examines Financial Management on the economic paralysis that confronts Saint Lucia, in the era of COVID-19, the International Monetary Fund (IMF) and Saint Lucia’s 2020/2021 estimates of revenue and expenditure for 2020/2021.

Q: What are the risk (factor) concerns in the management of public funds and debt in the era of COVID-19?

A: I believe when a country [Saint Lucia] experiences a “ cash flow problem” it is not only an issue of a fiscal deficit but [more] importantly is the issue of overall financial mismanagement. This is a major factor given the engagement and intervention of the International Monetary Fund (IMF) with the expectation to “rescue and/or restore” fiscal prudence.

The question is often asked rather disparagingly: Could they have done better? Ex-ante and / or ex-poste? However, COVID-19 is an unprecedented crisis since World War II, noting historical factors and management of our national economy, is now being managed on a “health-wise” basis with all of its challenges.

COVID-19 has exposed economic vulnerabilities that Saint Lucia and many other developing countries that continue to focus on the tourism sector for economic growth strategies will have to address with immediacy. In the case of Saint Lucia where in 3.5 weeks of a shut-down had to grasp with balance of payment issues (cash and bonds) the World Bank and IMF emergency Rapid Credit Facility.

Q: What is your recommendation for economic management in this new era?

A: The universal approaches and measures are Budget Deficit Financing or Balanced Budget methodologies and approaches. Invariably, countries like ours, are always subjected to situations where expenditure outstrips revenue. More often than not, we rely on revenue from import duties, tax, and non-tax revenue through grants and loans. However, unwise practices come back to haunt us, as displayed by successive political administrations.

There are major concerns about the low rates of project implementation in the region (as low as 20 percent) and allotments by international institutions for development projects are sometimes not realized during the said financial year. In many instances these capital projects are poorly selected and pursued at tremendous costs. They are also subject to mismanagement, common corrupt practices, and adverse economic consequences to the country and economy. I am aware there was a practice of Public Finance Management but this has been discarded.

Pubic Sector Saving is not facilitated as it ought to and has thus embraced current facilitation with the IMF. These small IMF SR loans fit the narrative above and increasingly, countries with constraints of size, economies of scale and scope, vagaries of the weather, hurricane, earthquake, and the effects of climate change are always found unprepared for catastrophes and now the unprecedented occurrence of COVID-19.

Thus ex-ante, and in large measure, I would advocate and agree to the adoption of measures with safeguards against risk; critically issues of diversification and movement away from mono sector development approaches must be addressed. The other consideration deals with obligations and the administrative positions of politicians and technocrats.

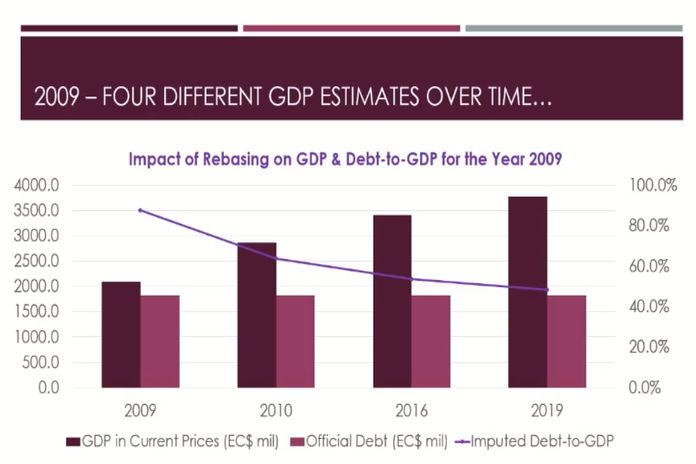

Q: The minister of finance celebrates rebasing, improved GDP, and reasonable low debt levels; What’s your economic assessment?

A: This is just the start. It is like playing with the same team with different colour uniforms – a new team but with the same coach, with a heavy pep talk and the many issues associated therefrom. Budgetary approaches remain the same. In this new era, it is not business as usual and will not be relevant in the 2020/21 estimates of revenue and expenditure.

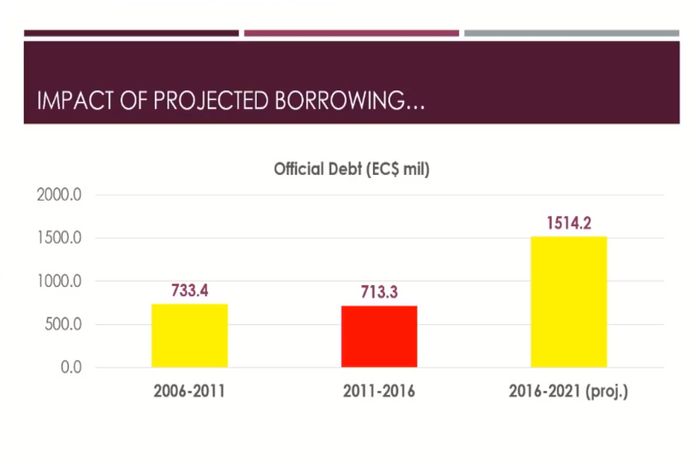

The IMF has its hands and claws over Saint Lucia and will be supervising the economy. The rebased 59.3 percent Debt to GDP ratio ( the new uniform ) which had nothing to do with its management but by the adoption of the new mechanism and the modalities of the conditions of the IMF Rapid Credit Facility has implications for the economy as mention earlier; a short window of (0.7) for economic movement or further borrowing. The RCF conditions extend until 2030.

Q: What are the options to manage this crisis?

A: The government needs to carve out a strategy to emerge out of this crisis. However, how soon will depend on innovative management, prudent and disciplined based on Public Financial Management together with Investment and Savings policies.

Primarily through innovation (technology, research, and development) there is a need to attract revenue not just through additional taxes but new investments that spur economic growth, development and growth of local entrepreneurs and their enterprises, and by generating greater national cooperation. I don’t want to sound … crying wolf … or fire, but there is smoke.

Saint Lucia is at a point where it needs to adopt austerity measures while engaging compatible fiscal expansionary policies and I emphasize not contractionary policies. There are numerous lessons to be learned from neighbor islands that have become delinquent and graduated from IMF measures.

Q: Are you implying that Saint Lucia has succumbed to austerity measures as a pre-condition for various loan facilities?

A: Yes, as referenced earlier. This seems and smells IMF austerity governed measures for Saint Lucia inclusive of drastic policy, administrative and structural changes. This will impact all sectors of the economy and will require the involvement of, all the brains in the public and private sectors. Moreover, science and technology, the youth economy ‘Zen-generation’, a modern agri-business, a focus on emerging industry, and eGovernment.

Public sector support will be critical for improved targeted sectors and areas of economic activity. The engagement has to be both quantifiable and qualitative support in the context of productivity, absorption, and concrete programs to generate jobs while paying particular attention to socially and economically vulnerabilities.

Q: In what capacity would you help Saint Lucia in this time of crisis?

A: I have heard the phrase “crisis lends to the exploitation of opportunities”, while some in public office state, “don’t let a crisis go to waste.” I guess those who used the phrase consciously know what they were saying.

However, I will state within the context of economics, that the theory of Rational Expectations ought to prevail and should be the preferred maxim – the creation of economic modelling, assumptions, and knowledge of the model must be practical.

Extraordinary governance and leadership must emerge at this critical time. Leadership must be prepared to listen and apply lessons learned. Politicians, and policymakers need to work hand in hand with technical experts to adopt the correct policy prescriptions. This is not a time to pretend you are open to ideas and suggestions but you are bullet-headed in one direction.

Q: Do you care to elaborate?

A: I am speaking to a specific focus on Rational Expectations within the adoption of economic theory,“ if you have full access to all information and data you can have better rational expectations and outcomes. In economics, “rational expectations” are model-driven and consistent. The focus is consistency for example with model’s predictions which ought to be valid. One needs to stay attuned with the predictions of future values, social and economic relevant variables from the model of rational expectations.

However, it is better said by a statement attributed to Abraham Lincoln “ You can fool all the people some of the time and some of the people all the time, but you cannot fool all the people all the time”.

Thus, rational expectations assumption is used especially in many contemporary macroeconomic models and applicable in this case. Among other hallmarks of his economic theories, economists John Maynard Keynes believed that governments should increase spending and lower taxes in order to stimulate demand in the face of recession.

Simply put, if you examine the circular theory of money – then why should a ‘finance minister’ attempt to stifle the economy that is already suffering COVID-19 unprecedented shocks and effects? Therefore, is there consistency unfolding before our very eyes in Saint Lucia?

The answer is no. Current policy decisions are void of socio-economic ethics and sound economic theory.

Q: Given your background would you help if called upon?

A: I have contributed to the public sector of Saint Lucia, trained in economics, public finance, economic policy and connected with several issues of policy. The list is not exhaustive and would include policy areas such as SEDU, Standards, Consumer Affairs, Services, Pubic Finance Management, Manufacturing, International Trade and Corporate strategies.

I recognize Saint Lucia is experiencing a national crisis, but as of now, I am associated with a team of like-minded experts and can very well mobilise appropriately, locally and within the Organisation of the Eastern Caribbean States (OECS) to guide us pass this crisis.

While I and others remain optimistic that the government of Saint Lucia should rise to the challenge it is a daunting task – we all have a responsibility to do what is right and just.

From the office of FRIEETAD in the OECS Inc.

Great piece hope our leaders get this message across.